When the Governor of the Dutch Central Bank tells you that you were a fool to join the Euro …. Hey, Prodi, where are you?

Friends recognize each other just when they tell you the truth, even if it is inconvenient, and the Dutch are, after all, friends, even if maybe you don't have to follow their advice. The governor of the Dutch Central Bank, Klaas Knot, gave a public lecture on the need to get out of the Covid-19 crisis all together. Within this lectio, in addition to continuous praise for the economy of the Netherlands, there were some observations and some very interesting data.

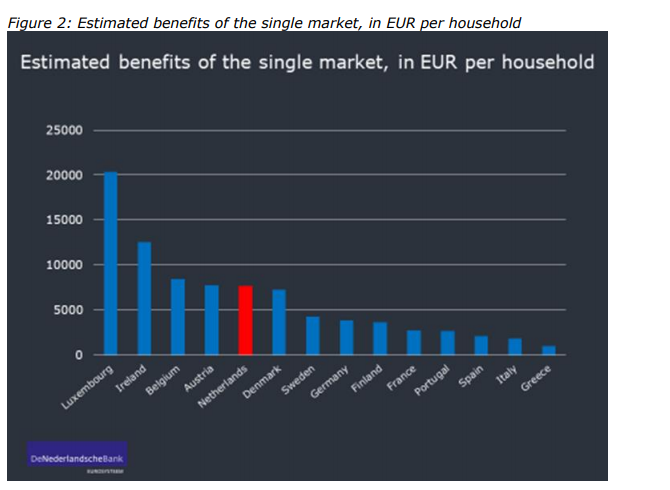

First of all, our governor gives us, in black and white, in a beautiful graph the earnings that every European family would have had from accessing the euro. The graph below leaves no room for many doubts:

Each family in Luxembourg earned € 20,000 from accessing the euro. A Dutch about 7,500, a German 4,000 an Italian not even a thousand. And we must consider that these are calculations made by a central bank that is part of the board of the ECB. Basically we are asking the innkeeper how good the wine is, and despite this, the innkeeper tells us that it is mediocre….

After all, the Dutch friend also explains the fact: but, unfortunately, a single currency also brings disadvantages. Certainly for a group of countries that differ a lot from each other economically. For example, a common currency means a common interest rate, and that rate is not always suitable for each country. This can contribute to the build-up of debt, or to skyrocketing home prices. Irreversibly fixed exchange rates not only offer stability, but also imply that countries can no longer use their exchange rate as a way to restore their competitiveness.

Partly because of this, not all euro area countries have benefited equally from the euro. To put it bluntly: countries with stronger economies, such as the Netherlands, benefited more than countries with weaker economies.

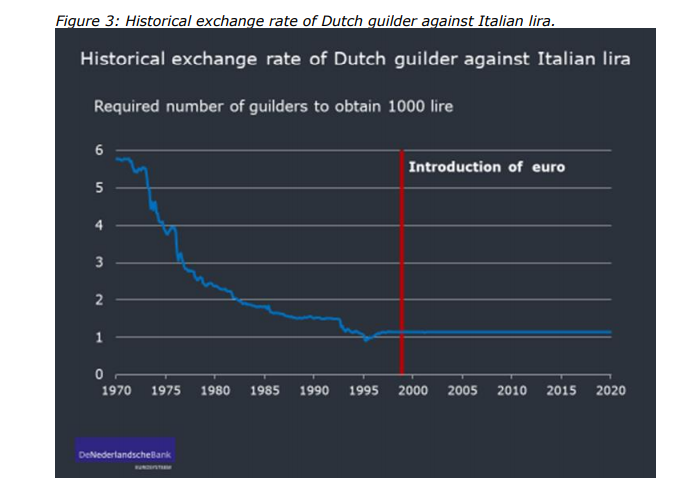

So why does a common currency work in favor of stronger economies? Let me explain. To do this, I will use the Netherlands and Italy as examples. Exchange rates between euro countries were frozen, so to speak, when the euro was introduced in 1999. Since then, productivity growth has been greater in the Netherlands than in Italy. This is what economists refer to when they talk about "stronger" and "weaker" economies. Productivity growth means you can make more or better products with the same means of production and thus offer better value in terms of price to quality. To keep Italian products competitive with Dutch products, the Italian currency would have had to depreciate against our currency. As a result, Italian products would become cheaper. Before the florin and the lira became irreversibly linked, we regularly witnessed this type of depreciation of the lira. But this is obviously no longer possible now. You can see it very well

In reality, the Dutch friend forgets that, according to Kaldor's second law of growth, this also depends on the growth of production, so when the Dutch production started to displace the Italian ones, their productivity grew by more than how much ours has grown. In practice, cause and effect are exchanged.

The speech then lets us predict what will happen for the future, and therefore what we can do: for the governor of the Dutch central bank, strong growth is debt-free growth, so his invitation is to return to strict austerity that allows him to return to the debt ratio. / GDP of 60%, less than half of what is currently the Italian one. A nice way to give us two alternatives: either you go hungry or you know where the exit door from the euro is. In your interest ……… ..

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article When the Governor of the Dutch Central Bank tells you that you were a fool to enter the Euro…. Hey, Prodi, where are you? comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/quando-il-governatore-della-banca-centrale-olandese-ti-dice-che-sei-stato-un-fesso-ad-entrare-nelleuro-ehi-prodi-dove-sei/ on Thu, 10 Sep 2020 15:15:07 +0000.