Why energy costs so much, and why it will cost even more

Energy bills cost a fortune, and will cost even more in the future. For the current cost we will give you an explanation in the article, for the future cost we can anticipate that the Commission, as announced for some time, will issue a directive in which it plans to tax the CO2 emissions of energy producers and to reduce their emissions by 5 % per year. The result will be a sharp increase in bills for all European citizens, as well as a shift in the energy mix that will have to include more and more nuclear power.

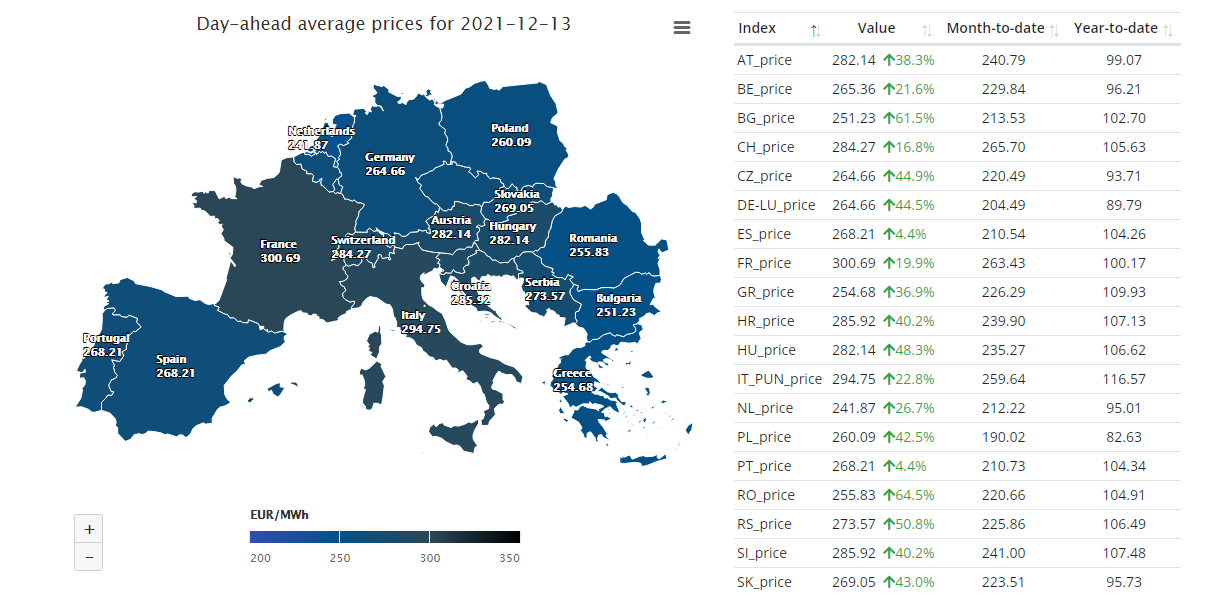

For the current cost instead let's start by showing you the “Spot” cost of energy in Europe in the past week. This is the cost without surcharges and ancillary charges:

What you see is the spot price, but it is interesting to see the price that was paid last year: in Italy it went from 116 to mw / ha to 294 to Mw / h. A huge increase, of 153%, which has major repercussions on families.

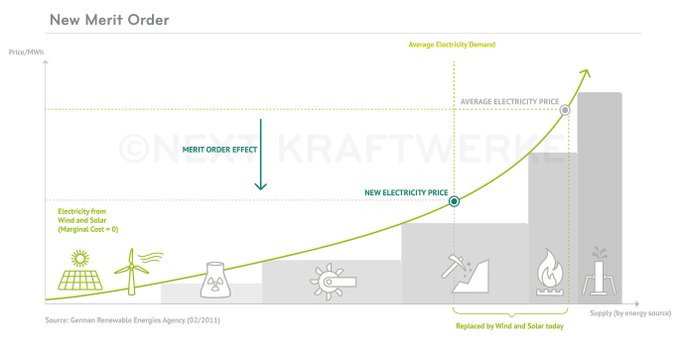

Yet we cannot think that sources such as hydroelectric, geothermal or wind have increased their cost so much in the last year. A dam does not cost more in 2021 than it did in 2020 or 2019. So why this increase so strong?

Ladurezzadelvivere explains it to us very well. Its synthesis is almost perfect and therefore … we take it back to him.

1) The SPOT energy price is a wholesale price (ie without charges, taxes, transport and distribution costs) that is formed day by day and concerns the energy delivered the next day. It is NOT the price that end consumers pay, because on the one hand this also depends on ancillary costs, taxes, etc., and because there are also longer-term contracts

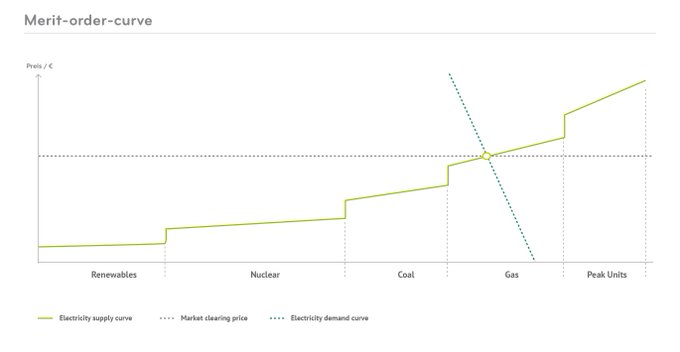

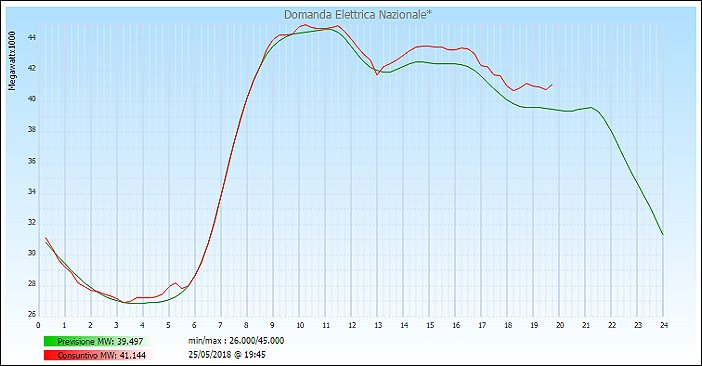

2) The spot price in Europe is formed according to the logic of the marginal price. How does the marginal price work? Manufacturers offer a quantity at a price (hourly, for all 24 hours of the next day), which is normally based on the production costs of each plant at that fixed time. The various market operators (the "power exchanges") stack the offers by quantity / price from least to most expensive, thus generating a cumulative supply curve quantity / price for sale (merit order).

3) Consumers (aggregated by operators who sell to customers) instead offer (for each hour) their price / quantity for the purchase of energy. Also in this case the market managers stack the offers by quantity / price, generating a demand curve. The demand for energy tends to be rigid (ie the quantities demanded remain unchanged even in the presence of high prices: for someone to decide not to consume it takes very, very high prices). Usually, buy offers do not even include a price indication. precisely because those who ask for energy cannot do without it, cannot leave industries and users in the dark. Usually the price is not even indicated

8) Even in France, therefore, the marginal price is often set by gas plants. For this reason, the French price is sometimes aligned with the Italian one, where always and in any case the marginal price is fixed by gas plants, due to the way the Italian plants are built and the market areas.

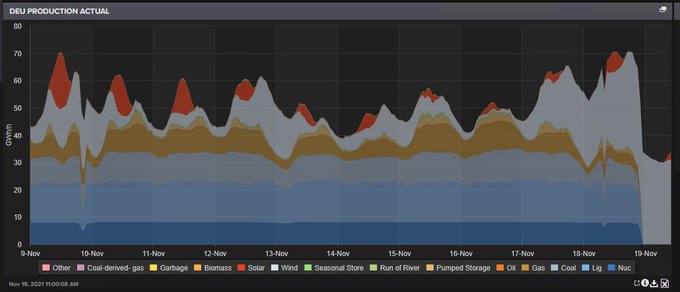

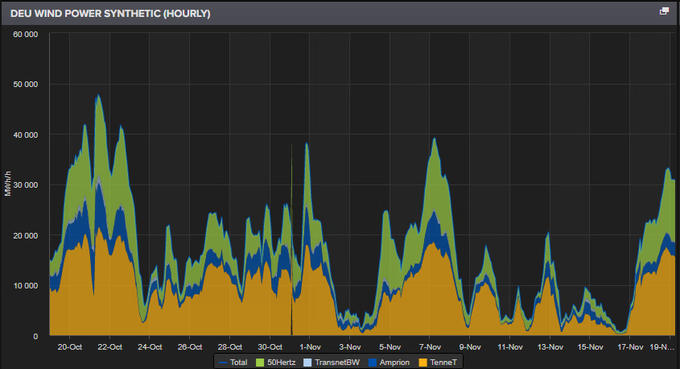

9) Germany, on the other hand, has a very large number of wind farms (over 30,000 MW): on very windy days and with low demand, it is possible that these are the ones to fix the marginal price. If so, the spot price is low, because producers will have offered a price that reflects their costs

of production, close to zero. If, on the other hand, there is little or no wind and / or high demand, even in Germany the marginal price is set by gas plants (while the baseload is still nuclear, lignite and coal). (Germany wind production profile last month)

10) In Poland, on the other hand, the marginal price is almost always made by coal and lignite power plants of national production, therefore with a very low cost. In the end:

- Not all of the market is supplied at spot prices: indeed, many usually try to establish fixed prices in advance for periods of at least one year (even non-solar). Therefore the spot price does not represent the real price of the wholesale market as a whole, but is only valid for those quantities that pass through the various national power exchanges. Sometimes, on the other hand, customers buy energy at prices indexed to the spot price but the energy does not physically pass through the power exchanges, which only make financial adjustments based on the commercial flows declared by the operators representing supply and demand. These flows are controlled and measured by the grid operator (in Italy Terna) so that every instant of the day must be closed with a net balance of the flows (production / consumption, or rather injection / withdrawal) equal to zero. Then the balancing game starts from here, but that's another story.

- European markets are interconnected, albeit not perfectly. There is a mechanism (market coupling) whereby market “zones” are created in which spot prices are generated taking into account the neighboring zone (for example, Northern Italy and Slovenia). These areas are created because there are grid constraints between production and consumption: the grid is not always able to transport all the energy everywhere. Cables are like pipes, they have a maximum energy carrying capacity. There are cross-border lines between countries, whereby supply and demand mutually influence each other with the transport constraint. Therefore, the prices of a single nation (i.e. of a single market) are linked, to a greater or lesser extent depending on the network constraints, to those of other nations.

So there is a complexity in the definition of the non-trivial price, with mechanisms created over the years, and important physical constraints. What could be done, in this phase, is to lower marginal costs, that is, to make the “Supply side economics” that tries to reduce the marginal cost. It is a question, for example, of intervening on gas costs, for example by temporarily intervening on transit costs, improper costs and even on CO2 offset costs. Will they do it? I do not think so.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Why energy costs so much, and why it will cost even more comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/perche-lenergia-costa-cosi-tanto-e-perche-costera-ancora-di-piu/ on Sun, 12 Dec 2021 16:20:52 +0000.