All PagoPa accounts: Antitrust stop to the pro-Postal government plan

PagoPa at Zecca and Poste? Facts, numbers, controversies and insights. With the Guarantor saying: a tender is needed to sell a share of the PagoPa company

The political, banking and regulatory world is in turmoil over the government's project to transition PagoPa, the digital platform for payments to the Public Administration controlled by the Mef.

With the decree law on the Pnrr, in force from 2 March 2024, the government intended to sell the ownership of PagoPA Spa: 51% would pass to the State Mint, while the remaining share would go to Poste Italiane.

But the Market and Competition Guarantor says no to the operation. The rule contained in the Pnrr decree which concerns PagoPA presents "some competitive issues". This was highlighted by the Antitrust Authority which, in its memorandum on the provision, anticipated this morning by the newspaper La Repubblica . The law provides for the entry of the Printing Institute (up to 51%) and Poste Italiane (for the remaining share) into the capital of PagoPA.

According to the Authority, «with a view to guaranteeing the market and the rights of potentially interested operators, the identification of the transferee of the 49% share should take place following a competitive auction or in any case a procedure that evaluates and puts comparison of multiple expressions of interest".

All the details on the government project, on PagoPa's accounts and on the no from the Agcm (which is calling for a tender).

THE GOVERNMENT PROJECT

The government has established, in article 20, paragraph 3, of the legislative decree of 2 March 2024, n.19, containing "further urgent provisions for the implementation of the national recovery and resilience plan", which, "for the purposes of strengthening the interoperability between public databases and valorization of the national digital data platform, as well as rationalization and industrial reorganization within the shareholdings held by the State, are attributed respectively to the Printing Institute and the State Mint in an amount of no less than 51% and for the remaining shareholding (49%) in Poste Italiane, the option rights for the purchase of the entire shareholding held by the State in the PagoPA company".

WHAT IS PAGOPA?

As stated on the official website , PagoPa "is the digital platform that allows you to make payments to the Public Administration and beyond, in a transparent and intuitive way".

Payments such as taxes, fees, utilities, fees, membership fees and stamp duty can be made via the App (developed by PagoPa) or through both the physical and online channels of banks and other Payment Service Providers (PSPs), such as for example bank branches, home banking, ATMs and post offices.

THE INTRODUCTION OF PAGOPA AND THE INSTITUTIONAL FRAMEWORK

As Startmag explained in 2020, “the pagoPA system was created by the Agency for Digital Italy (AgID) in implementation of the art. 5 of the Digital Administration Code and Legislative Decree 179/2012. The subsequent Legislative Decree 135/2018 transferred the management of pagoPA to the Presidency of the Council which avails itself of the Extraordinary Commissioner for the implementation of the digital agenda and also provided for the establishment of a joint stock company owned by the State which will operate under the address of the Prime Minister."

WHOSE PAY IS IT

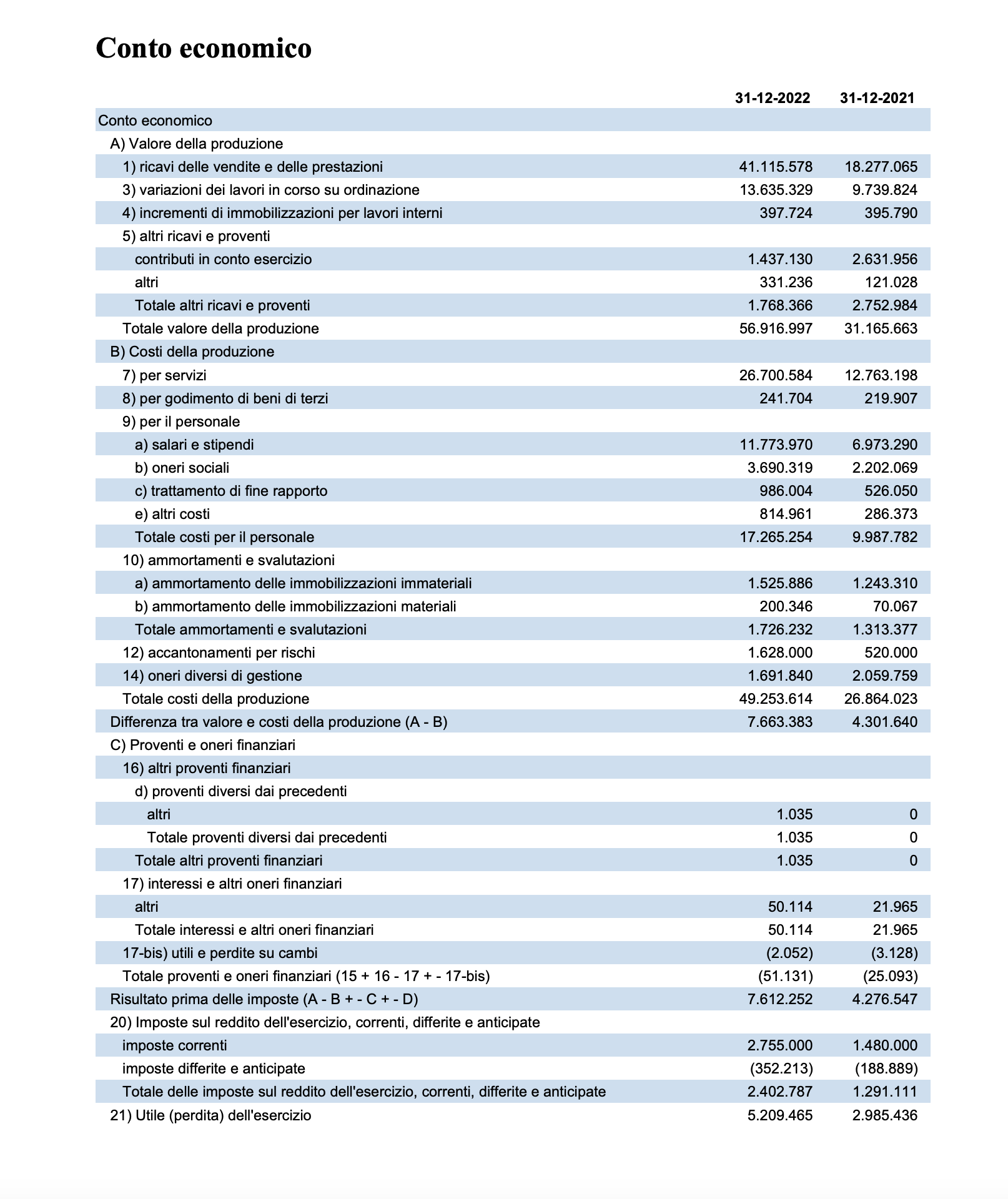

THE INCOME STATEMENT FOR THE TWO-YEAR PERIOD 2021-2022

In 2022 PagoPa recorded a turnover of 56.9 million euros, up 82.6% compared to 31 million euros in 2021. The profit also almost doubled, reaching 5.2 million euros with a increase of 74.5% compared to 2021 (2.9 million). And so the Ebitda which in 2022 was approximately 9.4 million euros, expanding by 67.2%. Production costs also almost double: from 26.8 million in 2021 to 49.2 million in 2022. Net assets exceed 9.2 million euros, rising by 128.9%.

The company boasts a total of tangible fixed assets worth 308 thousand euros and has total debts of 47.9 million euros (compared to 28.7 million the previous year).

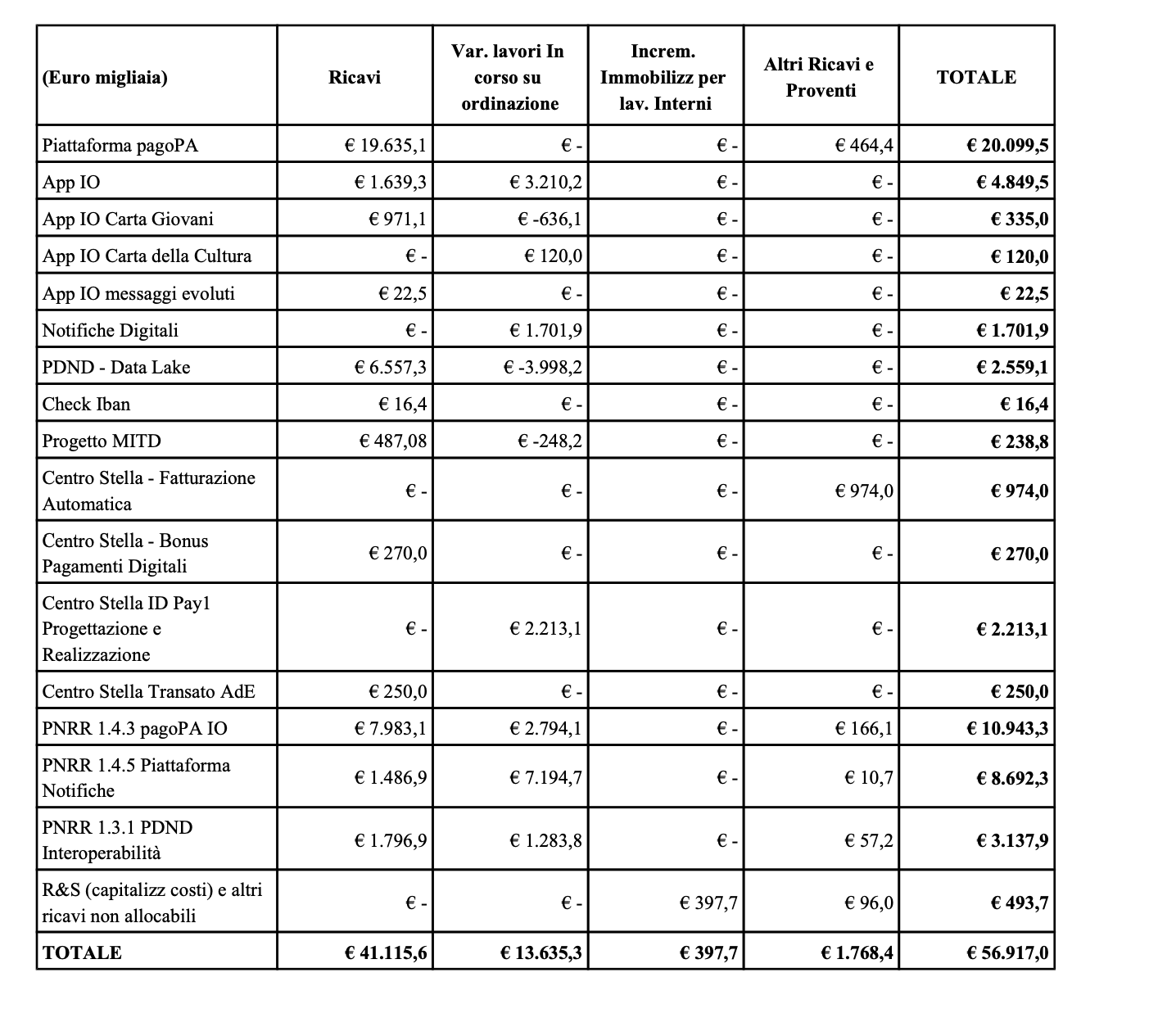

REVENUE SPLIT

The table below provides a vision of the composition of the value of production by reference product/service, highlighting the value of revenues, work in progress and contributions relating to the activities carried out by the company during the financial year, with specific indication of the relevant shares accrued on the 3 sub-investments of the Pnrr.

SOME NUMBERS FOR 2022

As can be seen from the financial statement report filed for the 2022 financial year, as of 31 December of the year the platform recorded approximately 332 million positive transactions (+103% compared to 2021, in which approximately 164 million were recorded) for an equivalent of over 61.1 billion (+80% compared to 33.9 billion in 2021). There are 20,891 entities participating in the platform, equal to 91.3% of the PAs, 83.4% for a total of 19,087 entities are active on the platform with at least one payment service.

During 2022, 41.9 million users (physical and legal) interacted with pagoPa, of which 39.6 million physical users and 2.3 million legal users (self-employed workers or businesses).

THE VALUE OF THE OPERATION

But how much will the State Mint and Poste Italiane pay for the control of PagoPa?

“The consideration for the transfer of the shares referred to in the first period – states the legislative decree of 2 March 2024, n. 19 – is determined on the basis of a sworn estimate report produced by one or more individuals with adequate experience and professional qualifications appointed by the Ministry of Economy and Finance, in agreement with the purchasing parties and with costs borne by them. All acts connected to the operations referred to in this paragraph are exempt from direct and indirect taxation and taxes".

THE PLAN WITH POSTS

Therefore the postal company led by Matteo Del Fante, which already manages digital payment services as well as banking activities, would be a partner together with the PagoPa State Mint. Or rather, even its private investors, who are within its capital and, therefore, "will benefit from the arrival of PagoPA among the properties of Poste", wrote Repubblica in recent days citing the legal opinion of one of the two banks .

THE GROUPS OF THE BANKS

Yes, because in the meantime, as reported in recent days in particular by Repubblica , the two banks named at the beginning have collected legal opinions on the transfer of the company for public payments to the Zecca and Poste Italiane, ready to call the Antitrust into question.

“An initial legal opinion explains that Poste Italiane – if it controls PagoPA – could “exclude its competitors” (including banks) from the same platform. In other words, “Poste would have both the possibility and the incentive to prevent third parties from accessing PagoPA”. In such a scenario, Poste would therefore use "its market power to the detriment of competitors in relations with billers and invoicers". And even if it left the doors open, it would certainly make it "more expensive to operate on PagoPA" for other companies that offer payment services, "now competitors of Poste" explains Repubblica .

“What aggravates the position of Poste Italiane – according to the legal opinion – is the fact that this company “is one of the main operators” active on PagoPA. Not only. The opinion recalls that Poste has acquired Lis (in September 2022) with its 54 thousand affiliated points of sale, where it is also possible to pay bills" continues the newspaper.

“Another bank – Repubblica further noted – in one of its confidential documents, gives an account of other objections to the PagoPA operation which – based on the reconstructions of its expert lobbyists – also emerged in some ministerial bureaucracies even before the presentation of the decree law (in the Council of Ministers of 26 February 2024). The decree – we read in the confidential document – assigns Poste a significant share of PagoPA "in the absence of a competitive procedure". That is, we are faced with a direct assignment of a public good (PagoPA) to a company like Poste". of digital payment".

THE HEIGHT OF ANTITRUST

But the government's project is stopped by the Market and Competition Guarantor, who essentially requests that there be a tender to sell shares of PagoPa.

The Antitrust torpedoes the government's project that wants to assign PagoPA to the State Mint (for 51%) and then to Poste Italiane, for a very significant share (the remaining 49%), the newspaper Repubblica wrote today revealing the decision of the Agcm.

An idea – writes the Antitrust in one of its memos – which presents "competitive critical issues". The Guarantor focuses above all on how the transfer of 49% of PagoPA from the current owner (the Treasury) to the Post Office would take place. This is the most delicate aspect of the matter, as demonstrated by the Abi complaints. The government would like to assign 49% of PagoPA to the Post Office with a decree already approved by the Council of Ministers, now in Parliament for its conversion into law.

The procedure is not appreciated by the Antitrust which demands «minimal conditions of transparency and non-discrimination to guarantee the market. The use of a similar procedure is the only method", insists the Antitrust, which allows "the most qualified operator to be selected". Operator who could be Poste like any other, comments Repubblica .

ANTITRUST'S NO TO POSTE SU PAGOPA ANTICIPATED BY THE DAILY REPUBBLICA

The Antitrust therefore calls for "a competitive auction or in any case a procedure that compares multiple expressions of interest". Conversely, the government shortcut is "in conflict with rules" which "rise to real ordering principles of the system" also due to "their adherence to Euro-unitary and constitutional principles".

In its decree, the government wants the value of PagoPA to be ascertained through a sworn valuation. Here too, however, the Antitrust has something to object to. The sworn estimate is fine, as long as the value identified becomes the basis of an auction open to all operators interested in buying 49% of PagoPA (Poste, its competitors, the banks themselves). At this point, the Guarantor lingers on the decisive role of PagoPA. In practice, "private law entities that manage public services and publicly controlled companies" are obliged by law to use it for "digital payments to public administrations".

THE ROLE OF PAGOPA ACCORDING TO THE AGCM

PagoPA is «the public hub for digital payments enjoying a significant and non-replicable advantage compared to any other platform created by private individuals». Now, Poste's entry into 49% of PagoPA assigns the buyer (Poste, precisely) the "privilege recognized to the platform, with consequent participation of the same in the (relative) share of profits". The Antitrust adds that PagoPA was born neutral, "that is, as a mere intermediary" for payments. Instead, the "sale of 49% of the PagoPA platform lends itself to undermining this character of neutrality", because Poste "is also present in the downstream market". Market "where it operates in competition with other entities that use the platform".

THE POSITION OF POSTE IN THE WORDS OF DEL FANTE

But what is the position of Poste Italiane?

On 13 March, heard in the Chamber, the group's company head, Matteo Del Fante, spoke about the issue: «We guarantee the market – explained the CEO of Poste – the confidentiality of the data. We have recorded a billion transactions on Spid and no one has ever wondered about confidentiality. PagoPA is a payment circuit on which we are based in 409 different service providers. The supplier allows the citizen to use its own PagoPA as a payment circuit. There is no interest, whoever owns it, in minimizing the scope of the circuit. Indeed: it is in the interest of any shareholder to grow their assets in the utmost confidentiality."

Del Fante added: «We have been working with banks for more than 20 years. By law, we cannot provide credit or grant loans. But since 2002 we have been distributing loans from financial institutions. When one of our clients wants a consumer loan, we analyze the case and pass it on to the bank. We have carried out 48 billion operations and 4 million Italians have benefited from our territorial presence."

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/tutti-i-conti-di-pagopa-stop-antitrust-al-piano-del-governo-pro-poste/ on Tue, 19 Mar 2024 10:04:45 +0000.