All the bank accounts and the leavening effect of the ECB. Fabi Report

Bank accounts: numbers, comparisons and scenarios in an analysis by Fabi, the banking federation led by general secretary Lando Maria Sileoni

Italian banks (and not only Italian ones) must thank the ECB in particular for the excellent performance of their balance sheets.

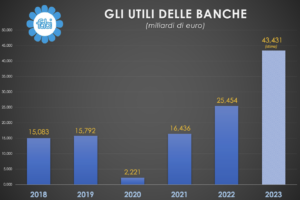

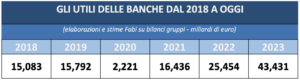

The increase in rates by the ECB pushes the results of Italian banks which, at the end of the year, could grow by 70% compared to the 25 billion in 2022, reaching, according to a Fabi projection based on the comparison with last year, at 43 billion and 431 million. “Our forecasts confirm that the sector is going through an extraordinary phase: these results legitimize our economic requests for the new national contract, starting with the average monthly increase of 435 euros. The negotiation seems to have started on a positive path", comments the Fabi secretary, Lando Maria Sileoni.

HOW THE BALANCE SHEETS OF ITALIAN BANKS WILL CLOSE IN 2023 ACCORDING TO FABI. THE FULL REPORT

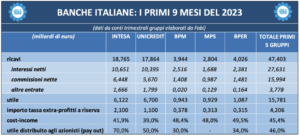

The increase in interest rates by the ECB pushes the results of the banking sector which, at the end of the year, could grow by 70% compared to the 25 billion in 2022. The primacy of loan revenues is consolidated (58%) compared to commissions (34%) and other activities (8%). With 15.7 billion in profits, the five groups, in the first nine months of this year, equaled the figure for the entire system in 2019 and exceeded 2018 (15.1 billion). Primary capital requirements improve: from 14% to 17%. Positive signs for the liquidity of the sector: average coverage at 128%, well above the regulatory minimum set at 100%. With the tax on extra profits as a reserve, you anticipate probable supervisory decisions.

The total profits that Italian banks will realize in 2023 are set to exceed 40 billion euros: the brilliant results achieved in the first three quarters of the year, compared with those of the previous 12 months, allow us to estimate, in projection, that the profits of the banking sector of our country will be, overall, around 43 billion and 431 million.

A result that would be 17.2 billion higher (+70%) compared to the 25.4 billion profits of 2022 and almost triple if compared with the previous five years: in 2021 profits stood at 16.4 billion, in 2019 at 15.7 billion and in 2018 at 15.1 billion; in 2020, due to the Covid pandemic, 11 November 2023 P. 2 the overall result was only 2 billion. 2023, therefore, will be remembered as a golden year for the profits of Italian banks and already in the first nine months of the year, which brought 15.7 billion in profits to the top five groups, precise indications emerge in fact and how much never positive about the ability to generate profits and be profitable.

The decisions of the European Central Bank are undoubtedly favoring the growth of profits. If in recent years the interest rate context had not supported the banks' numbers, especially with reference to traditional activities, in fact, the same cannot be said for the current year and, in part, for 2022. The effects produced on the income statement of the main Italian banks have been astonishing and significant and the season of quarterly accounts demonstrates this in practice. With just three months to go until the end of 2023, banks appear to be already well equipped to face the final phase of closing accounts and use the interest margin lever as a "buffer" for the possible slowdown in the economy expected for 2024.

In the first nine months of 2023, the top five groups in Italy totaled almost 16 billion euros in profits, up 70% compared to the same period of the previous year, but the effects induced by the European Central Bank's policy on profitability of the interest margin, not only has it rekindled interest in banking – digital or otherwise – but it more than gives hope for when the balance sheets close. If we add to this the improvement in capital ratios and liquidity levels, 2023 will be a year to remember and the next two years, also according to the indications contained in the documents of the main banks, will lead to similar if not better results. It must also be said that with 15.7 billion in profits, the top five groups, in the first nine months of this year, equaled the figure for the entire system in 2019 and exceeded that of 2018 (15.1 billion).

WELCOME BACK INTEREST MARGIN: 10 BILLION MORE REVENUES IN THE BANKS' CHESTS

After more than a decade of zero rates in which commission leverage was chased, the rapid and massive rise in interest rates ensures record numbers for banks and makes their revenues and profits soar. The quarterly accounts of the top five banking groups, which represent the financial thermometer of the entire system, photograph a sector that is "sailing" at full speed, beating all expectations. The 10 rate increases by the ECB were worth – for the top five banking groups – a "turnover" of 27.6 billion in interest margin, up 56% compared to the first 9 months of 2022. The almost 50 billion in total revenues were in fact mainly supported by revenues linked to interest on credit to businesses and families (27.6 billion), an area which corresponds to almost double what was collected, among other things, with commissions on services and managed savings activities (15.9 billion). Compared to the total revenue, the first five groups achieved 58.3% with interest margin and 33.7% with commissions, while 8% (3.7 billion) was represented by other revenues (trading and Other financial income). While interest rates have been a panacea for 2023 profits, it is also true that the September quarterly accounts could not only restore banks' appetite towards a traditional revenue channel such as credit – overshadowed by the easy November 11th 2023 P. 3 profits from financial activities in recent years – but create the conditions of resilience to manage major future risks. The last two years marks a discontinuity compared to the previous one. In 2020, revenues from commissions and other activities (39.4 billion) had exceeded for the first time those linked to lending activities (38.7 billion): in percentage terms, 50.4% against 49.6%, the overtaking was minimal, while the gap grew the following year when the two sources of revenue stood at 53.6% (44.1 billion) and 46.4% (38.1 billion) respectively. In 2022, thanks to the increase in rates, revenues from loans (45.5 billion, equal to 51.6% of the total) are back in the lead compared to commissions and other activities (42.6 billion, 48.4% of the total).

FULL MARKS PROMOTION ALSO FOR ASSETS AND LIQUIDITY

The season of quarterly accounts of the leading banking groups confirms the health conditions of the system, in terms of liquidity and capitalisation, which have improved compared to the previous year. As for capital solidity, all the banks in the sample have indicators well above the minimum requirements established by the supervisory authorities. The levels of risk coverage with own capital, in the first 9 months of 2023, confirm the capital strengthening action already started by the banks over the years and which today benefits from the solid budget results. For the sample of banks examined, primary capital requirements range from a minimum of 14% to a maximum of 17%. Equally positive signals arrive for the liquidity profile of the sector, with coverage requirements that on average stand at around 128%, compared to the regulatory minimum of 100%.

COST-INCOME AT 46% (IT WAS AT 62% IN 2018)

The result of the accounts ranging from January to September 2023 also reveals the clear improvement in credit quality for the entire sector which translated, for the first five groups, into lower risk provisions and lower write-downs. The increase in profits and profitability, also the result of careful management on the expense front, is also reflected on the cost/income side: the average result for the first five groups is equal to 46% (ranging from 39% to 49 .5%): this parameter, which indicates the efficiency of a bank (the lower it is, the more positive), has never been so low and only five years ago, in 2018, for the entire sector, it stood at 62% average.

THE TAX ON EXTRA-PROFITS BECOMES A NON-DISTRIBUTABLE RESERVE OF 4.2 BILLION

As regards the tax on extra profits recently introduced by the government, all banks, including the first five groups covered by the analysis, have opted for the non-distributable reserve provision equal to 2.5 times the theoretical amount of the levy tax: for the top five banks this is 4.2 billion for 2023. This is an option explicitly provided for by an amendment to Legislative Decree 104 of 2023 which pushed the country's credit institutions to strengthen their assets, avoiding , thus, the payment of the extraordinary tax. A path thanks to which the banks have probably anticipated capital strengthening which, in the future, in light of the probable deterioration of credit, could be suggested or imposed by the supervisory and supervisory authorities.

«Our forecasts confirm that the Italian banking sector is going through an extraordinary phase: profits are reaching record levels and these results are also the result of the daily commitment of those who work in the bank. The requests made by all the unions at unitary level at the table for the renewal of the national collective labor agreement are more than legitimate. In addition to the 435 euro average monthly salary increase including the arrears for 2023, we want the full restoration of the TFR calculation base and the increase in meal vouchers" comments the general secretary of Fabi, Lando Maria Sileoni. «The negotiation seems to have started on a positive path: in the next few days the discussion will continue with the aim of being able to close and sign a new contract as soon as possible which, as in the past, guarantees and protects the category, ensuring a positive and professionally important both to those who already work in the bank and to those who will be hired in the coming years" adds Sileoni.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/tutti-i-conti-delle-banche-e-leffetto-lievito-della-bce-report-fabi/ on Sat, 11 Nov 2023 09:26:09 +0000.