All the soft footsteps of the ECB

ECB: moderate adjustment of the pace of the Pepp, the important decisions in December. The comment by Antonio Cesarano, Intermonte's chief global strategist

The following are the main points of yesterday 's ECB meeting:

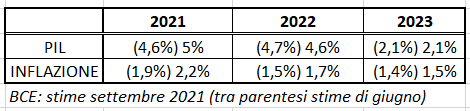

- Upward revision of growth and inflation estimates, especially 2021 and 2022

- "Moderate" reduction in the pace of Pepp purchases (for the fourth quarter) compared to the second and third quarters, when the ECB had instead accelerated

- Unanimous decision on the Pepp issue

- Decision to be understood as a recalibration and not as a tapering. Lagarde literally declared "The lady is not tapering", paraphrasing Thatcher's famous 1980 phrase "The lady's not for turning" (I'm not reversing the course)

- No discussion on how to change the monetary policy toolset, postponing everything to the December 16 meeting

- Inflation still defined as transitory.

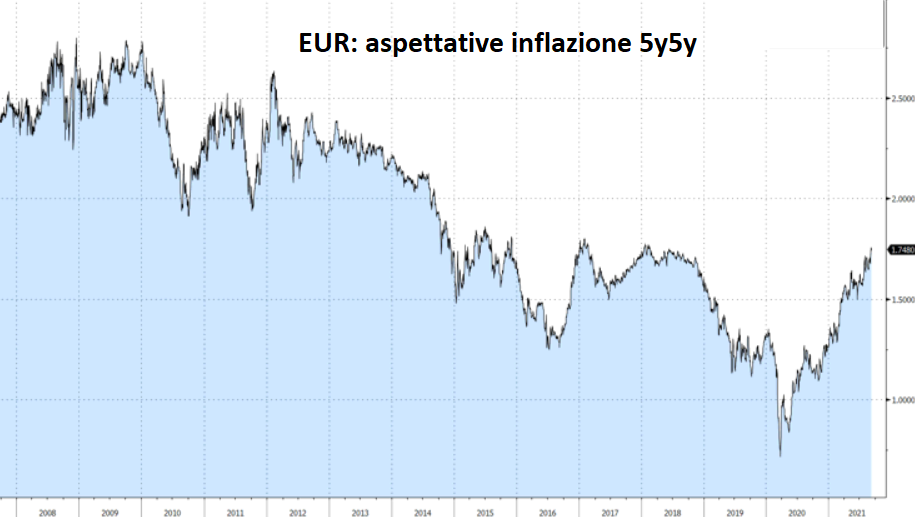

On this point, when asked whether the ECB was observing the marked rise in market inflation expectations (5y5y drawn from the prices of inflation swaps) Lagarde replied that they are monitored together with a vast set of data that at the moment does not arouse concern on inflation, albeit with attention to risks, in particular those of translating the rise in consumer prices into a marked rise in wages.

In this regard, Lagarde recalled the focus on the outcome of the related negotiations during the autumn

IN SUMMARY

Yesterday the ECB only made a small adjustment to the pace of the Pepp, without upsetting the purchase plan for now until the end of the year, postponing the most important decisions to the meeting of 16 December, continuing to consider the inflation phase transitory, attributing it to four main factors :

- Rise in the price of oil

- German VAT restored to ordinary level

- Comparison effect due to the postponement of summer sales in 2020

- Bottlenecks in the supply chain

The feared abrupt decline in the pace of reduction in Pepp purchases (by a minority of the consensus) was therefore averted and consequently the Italian spread takes breath, returning closer to the low end of the 100 / 110bps range.

The focus, therefore, gradually shifts to the forthcoming data on Eur inflation (1 October) as well as to the progress of wage negotiations in the autumn, before the aforementioned ECB meeting in December.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/che-cosa-non-ha-deciso-la-bce/ on Fri, 10 Sep 2021 05:24:09 +0000.