All the striking economic similarities of the US and China

US and China: equal in inequality? The analysis by Andrea Delitala, Head of Euro Multi Asset, and Marco Piersimoni, Senior Investment Manager of Pictet Asset Management

SOCIAL INEQUALITY

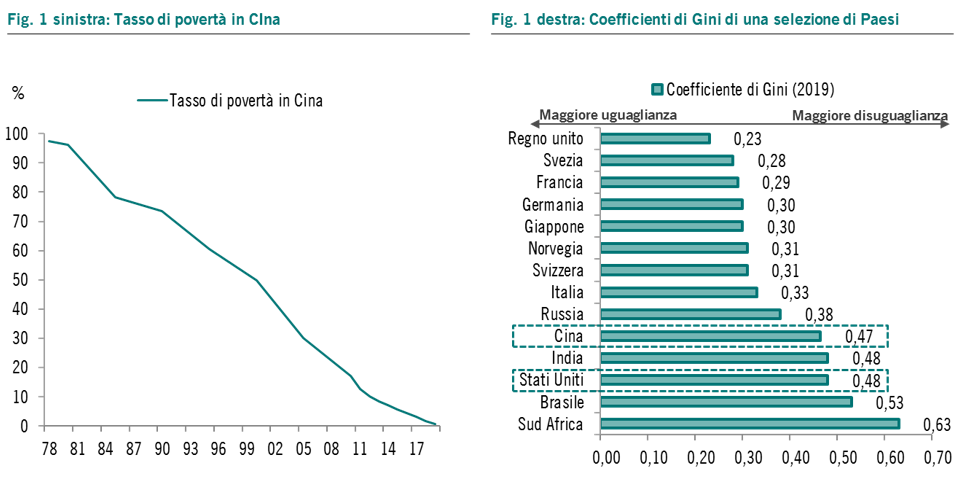

Looking at the Gini coefficient (indicator of inequality in the distribution of income) of China and the US, some might have to smile: the two countries, poles apart in political and economic systems and opposed in the struggle for world leadership, present a level of extremely similar inequality and, moreover, close to that of many developing countries despite being the first two economies in the world (see Fig. 1 right). The different forms of capitalism of the two giants have therefore produced comparable results from the point of view of the (poor) distribution of wealth.

But if a swallow does not make a spring, a common element does not imply equality across the board, as evidenced by the different reaction of the governments of the two countries to this very similar starting situation: China has in fact opted for a decisive intervention, of empire which in the United States would be impracticable due to the different political structure (and perhaps will).

CHINA

Going in order, in Beijing the new direction to go was indicated with the term "common prosperity", which does not mean egalitarianism, but a shared wealth among all citizens, both economically and culturally. After emerging from poverty (see Fig. 1 left), therefore, China now aims to achieve widespread material and cultural well-being. First of all, through a rigid anti-monopoly supervision that prevents an excessive concentration of economic-financial power in the hands of a few companies and their managers, then with a fight without borders against illegal forms of income and, finally, by encouraging donations charity (emblematic, from this point of view, was the donation of over 15 billion dollars made by the tech giant Alibaba in favor of the government's common prosperity project). The new line is not surprising given the hints in Xi Jinping's speeches in the previous months. If anything, the (intentional?) Inability to dialogue with the financial markets is surprising.

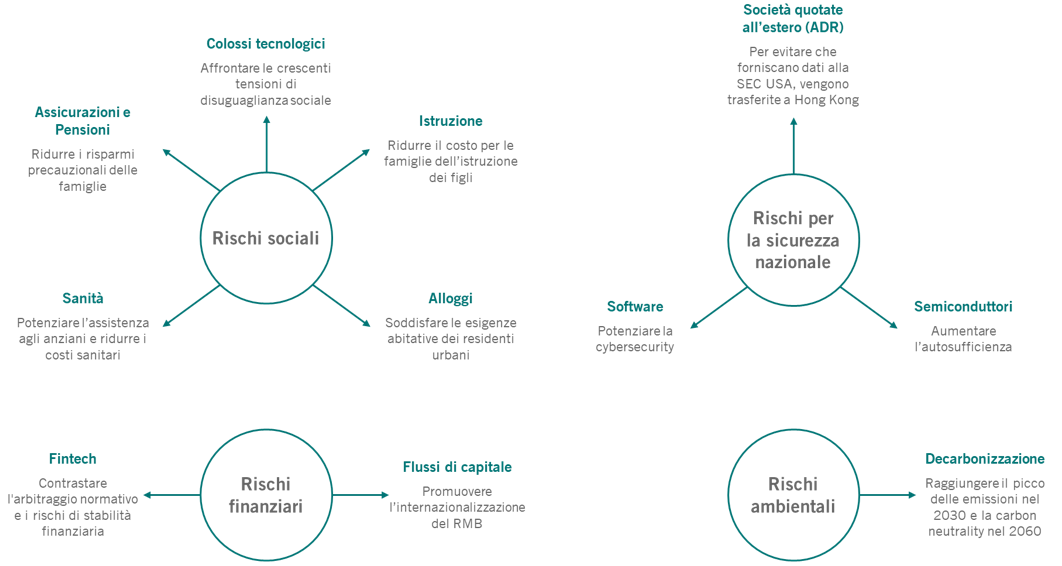

The brutality with which the Party made and communicated decisions has scared the markets, which have seen, for example, forcedly transform profitable after-school tutoring companies into non-profit companies, a move aimed at reducing the cost of education. for families, but with which in fact an entire sector has been swept away by the investable universe of international investors. Once again, therefore, the Chinese government has demonstrated the inability – and probably the lack of interest – to interact softly with the financial markets. Also because the Beijing intervention is destined to be very broad: in an attempt to balance economic growth with greater social equality, security and sustainability, the regulatory incursions will impact both on the technological giants and on sectors such as real estate, health care and financial system (for more details, see Fig. 2).

Fig. 2: Four key areas of policy objectives in China

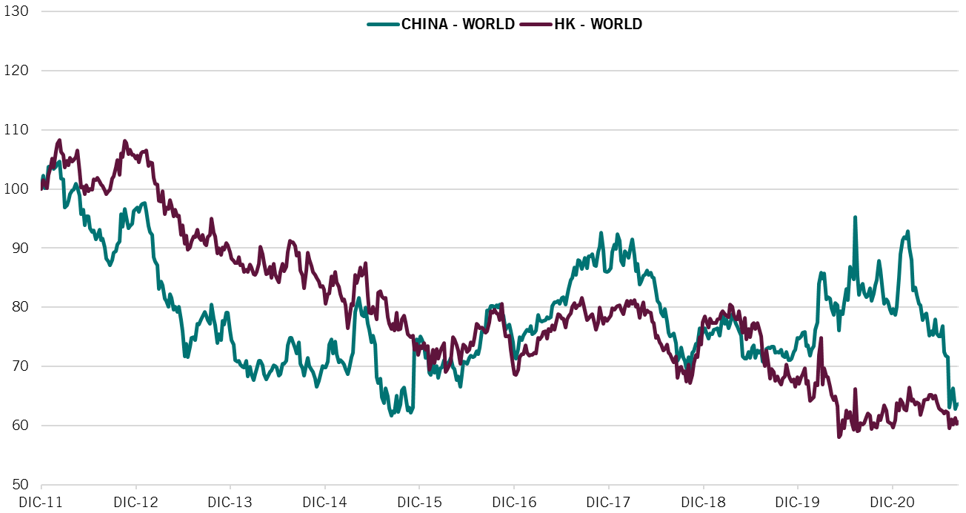

Fortunately, after the initial shock, it was specified that the measures adopted do not manifest the intention of targeting private capital, but serve as a warning against unfair business practices, a specification that has partly calmed the minds of market operators. Thanks also to a more accommodative attitude on the part of the People's Bank of China, this easing of tensions makes Chinese equities interesting again, especially considering that they are currently trading at heavily discounted valuations compared to global lists (see Fig. 3).

Fig. 3: Relative valuations of the PB (Price to Book) of China and Hong Kong compared to the rest of the world

USA

On the other side of the Pacific Ocean, in the United States, the problem of inequalities, exacerbated by the pandemic also due to the lack of adequate social safety nets, has been repeatedly emphasized by both the top management of the Federal Reserve and by representatives of the Biden administration.

To date, however, the main measures aimed at reducing the gap between the different income classes seem to have been delegated to part of the tax plan to be launched in the autumn. As mentioned, however, the objective of supporting the less well-off sections of the population is also shared by monetary institutions, which carefully watch the evolution of the labor market. On this front, the commitment of the Fed and the government is paying off, with the unemployment rate now close to 5% after the peak of 20% reached last year at the worst moment of the crisis. In order for the goal of full employment (coupled with that of expanding the participation rate and regaining the workforce) to be achieved, at least 2/3 of the 10 million jobs lost since the outbreak of the pandemic still need to be recovered.

In this sense, it will be essential to favor the intersection between demand (employers) and supply (workers) which at the moment are struggling to meet: in the United States, in fact, more than one free job is available for each unemployed worker, a misalignment probably the result of the fear that many people have of contracting Covid and the difficulty of finding the new skills required by an economy that has undergone a rapid and abrupt transformation. This unusual circumstance is, however, contributing to the recovery of purchasing power by workers (who have kept their jobs), given that for some months the growth of wages has been higher than that of prices, a dynamic that is certainly virtuous for American consumption. . The risk in this case is that, once the basic effect that led US headline inflation to exceed the level of 5% on an annual basis is exhausted, we could see a new rise in prices instead dictated by wage inflation, certainly capable of triggering a more persistent trend. It must therefore be assessed whether the Fed will maintain its wait-and-see and tolerant attitude towards inflation, continuing to judge it as a transitory phenomenon.

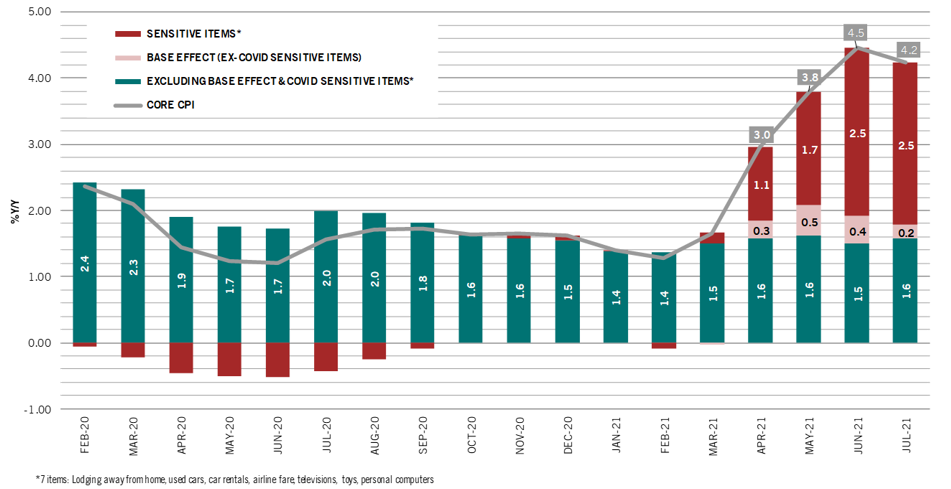

To date, in support of the central bank's soft line, we must also ascribe the fact that, if eliminated from the most sensitive component to Covid (such as spending on computers, televisions or car rentals) and from the base effect, US core inflation it seems to be true at sustainable levels, less than 2% (see Fig. 4). Likely, when the services sector, hit hardest by the pandemic, will drive inflation with the final reboot of the economy, inflation on goods will already be in a downward phase. In any case, the Fed seems inclined to accept a temporary overheating of prices as it is necessary to achieve the objectives on the labor market.

Fig. 4: US core CPI – contributions of the components conditioned by COVID and base effect

THE MONETARY POLICY

The different approach to monetary policy represents a further element of divergence between the United States and China. On the one hand, the North American central bank last year poured a real river of liquidity into the economic-financial system, amounting to about 17% of GDP, a record level even higher than the post-great financial crisis effort. . On the other hand, the PBoC is undoubtedly the most orthodox central bank in the world, having not considered extraordinary measures such as Quantitative Easing or negative rates even after the recent crisis and having even continued its commitment to reduce leverage. of the financial system, except for a brief setback in the months immediately following the outbreak of the pandemic. Now, however, if the Fed is gradually but steadily reducing stimulus, the PBoC's stance seems more accommodating, having recently announced a 50 basis point cut in the Reserve Requirement Ratio (RRR). This is a move made in an attempt to support the country's economic recovery, which has slowed down in recent months, this is a factor in common with the US. In fact, if economic surprises are worsening widely globally, US data in particular is coming out below expectations, so much so that we have revised down our expectations for GDP growth in 2021, now at 6, 5% (from 7%). However, we do not foresee a reversal of the structural trend, but a temporary air gap, a small drop in cyclical tension that will not impact on growth in 2022, still projected at a robust 5.3% in the US and 4.8% for the world economy.

THE THIRD INCONVENIENCE

In the context outlined, as often happens, between the two litigants the third enjoys. As mentioned, in fact, concerns at the moment are focused on the United States and China (or more broadly on the Asian region, where Japan is also showing signs of slowing), while European data is more robust. The Old Continent seems to have an advantage on a cyclical basis, also by virtue of a slight delay accumulated in the implementation of fiscal policies, which are only now starting to produce their first effects (the Recovery Plan is being substantiated in individual national reform programs in recent weeks).

The region also enjoys the continued support of the European Central Bank, which at its meeting on Thursday 9 September maintained an extremely cautious attitude. Interest rates at exceptionally low levels, also due to the fact that economic policies have so far convinced the markets and brought inflation expectations close to the 2% target, clashed with the cyclical recovery and led the ECB to reduce the amount of the monthly purchases foreseen within the PEPP emergency program (from the current 80 billion euros to a lower level not yet specified, more details will be provided at the December meeting). However, in doing so, the central institute made a point of clarifying that it is not a matter of "tapering" but of "recalibration" of monetary policy, once again sending out a conciliatory signal to the financial markets. The future European fate will also be determined by another event that will soon see the light, the German elections. In recent weeks, we've seen a turnaround in polls that the CDU has lost consensus to the SPD.

Fig. 5: Main coalitions and policies in Germany

The concrete possibility therefore emerges of a coalition without the CDU, formed by SPDs, Greens and Liberals, which would mark the end of an era of great political stability in the country. In addition, especially if the government ends up incorporating the left in the place of the Liberals, we could see greater fiscal spending in Germany, partly in the guise of environmental protection spending (see Fig. 5). Therefore, although the disciplined management of public finances is transversal to all political alignments of the country, the elections could give an outcome capable of slightly loosening the bridle of rigid spending control, in Germany but also within the European Union. A softer return to budgetary rules (Stability Pact) and a resumption of the integration path (banking union, capital market, etc.) would not in fact be excluded, with potentially favorable implications for the periphery of the region. The new fiscal rules, the effectiveness of the reforms in the beneficiary countries of the Next Generation EU (Italy and Spain) as well as the geopolitical structure of the EU / EMU will be the real stakes in the coming years; the results of the forthcoming German elections will have to be carefully evaluated with reference to these aspects.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/tutte-le-sorprendenti-somiglianze-fra-usa-e-cina/ on Sun, 26 Sep 2021 06:07:09 +0000.