Bank loans and public guarantees, all the EU-US differences. Fabi report

Loans and public aid, the answer in Europe and the USA. Data and comparisons on the measures taken by governments to deal with the economic emergency. The Fabi report

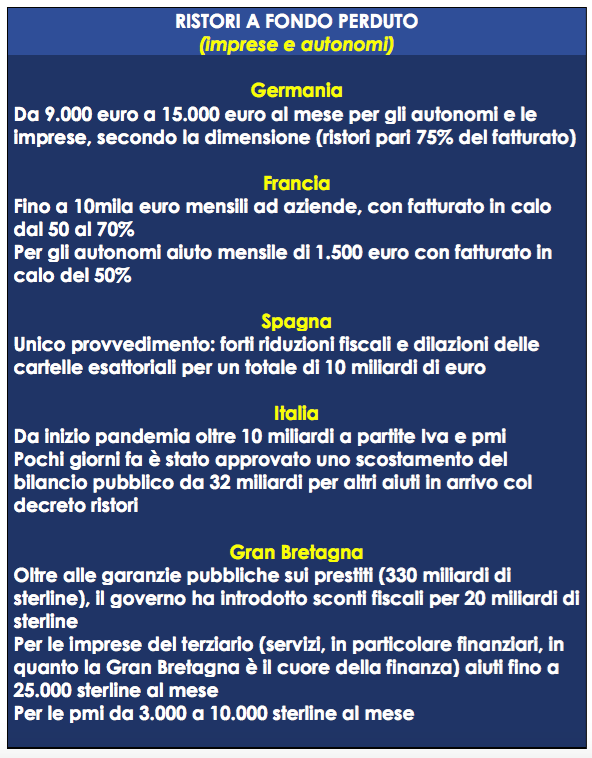

“The new non-repayable refreshments arriving should be channeled with respect to the individual specificities of the sectors. An example: at the beginning of the first lockdown, at the beginning of the first lockdown, the shops in the clothing and footwear sector, including the large, small and medium distribution of fashion, had already received at least 80% of the spring-summer goods and had already purchase contracts for autumn and winter 2020-2021 clothing ".

This is what the secretary general of Fabi, Lando Maria Sileoni said, commenting, during the Coffee Break broadcast on La7, the dossier of the banking federation "Loans and public aid, the response in Europe and the USA".

According to the secretary general of Fabi, “the purchasing campaign for the winter of 2021-2022 is already underway for the large-scale distribution of fashion, for small and medium-sized retailers. For the entire fashion sector, the planning of purchases takes place a year in advance and, consequently, the goods, with the current situation of the pandemic, can only be sold below cost. It is enormous damage. Trade in general must therefore be supported with non-repayable loans regardless of the red, orange or yellow color of the region to which it belongs. All have suffered significant losses and significant drops in purchases and the suspension of the IMU on capital goods, as already rightly done for hotels, should also be extended to these shopkeepers ”.

“With the measures and aid for the economy, in Italy it went quite well with the bank loans guaranteed by the state, but there have been few both tax incentives and non-repayable repayments to date. And the planning of public investments is insufficient to date ”, added the secretary general of Fabi, commenting on the dossier during the Coffee Break broadcast on La7. According to Sileoni, "the response of the banks with respect to the loans was there, even if initially there was a delay due to disorganization both of the State with the guarantees and of the banks themselves in the initial phase".

+++

"Loans and public aid, the answer in Europe and the USA". Here is the complete dossier of Fabi

Exceptional crises require equally surprising responses, and the one caused by the pandemic is not even comparable to the world's greatest economic crisis. We are not in the distant 2009 but even today, after more than a decade, no country and no economy – whether emerging or developed – has been spared from the crisis and the "minus" sign in the growth of gross domestic product has already touched everyone at the end of last year. The Great Lockdown Crisis will cost around 8 trillion euros globally and its devastating effects on production, income, wages, consumption and employment have not relieved any state – from Europe to America – from adopting massive budget policies. to contain an unexpected and unprecedented economic disaster.

The commitment of each state has mainly gone through tax savings, public investments, state aid to businesses and guaranteed bank loans and some measures have already produced positive effects, containing the most immediate damage of the lockdown such as unemployment and insolvencies of businesses and households. However, this did not happen in a homogeneous way and runs the risk of not producing the same effects even in the immediate future. Comparing the aid plans of the big Europeans and those overseas, it is clear that the national economic systems have also traveled at two speeds because the responses of central governments have not been of the same magnitude and, even more so, not all prompt and immediate as it was hoped.

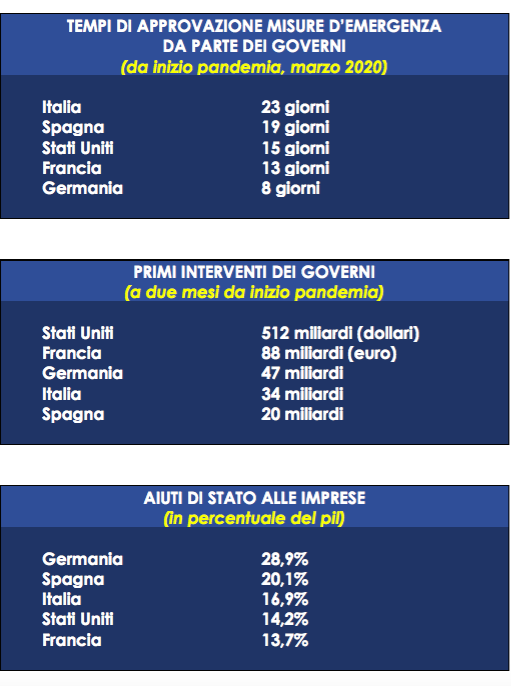

TIME FOR APPROVAL OF EMERGENCY MEASURES BY THE GOVERNMENTS

There are those – such as France, Germany and the United States – took between eight and 15 days for the approval of the first measures to support the local economy and those, like Spain, waited a full three weeks. Different ways of reacting also for Italy, which left families and businesses with bated breath for more than twenty days before giving a glimpse of hope. But if the premises and timing were not reassuring and Germany is excluded, for Italy the road of public guarantees on loans together with that of state aid to companies has ensured a little more oxygen than other European countries , albeit with the necessary obstacles and slowdowns.

STATE AID TO BUSINESSES

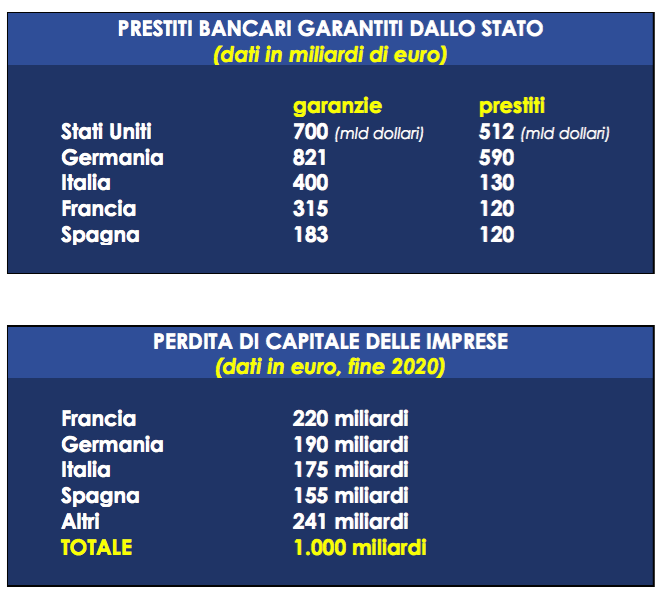

At the European level, the production system has accumulated losses of one thousand billion euros. In the European panorama, the most vulnerable companies were the German and French companies which set aside more than 400 billion euros in losses at the end of 2020. The economic backlash suffered by the Italian ones instead reached the sum of 175 billion euros, almost equal with Spain (155 billion euros in losses). Of all the state aid authorized in the European panorama (about 3 thousand billion euros), more than half were issued by the German government alone, while Italy, France and Spain follow at a safe distance. The smallest package of aid measures for companies is that of France, which, up to now, has allocated only 2 13.7% of its GDP, followed by Italy and Spain with percentages equal to 17% and 20% respectively. %. Germany seems to outclass the whole of Europe and remedies the damage to its national production system with an economic effort almost doubled compared to the average of other countries and equal to 28.9% of gross domestic product. However, it is a pity that German generosity has not been accompanied by the same timeliness, because only 8% of state funds have been made available to local businesses so far, confirming that Germany's model may not be so efficient as to be an example to be follow.

PUBLIC GUARANTEES

In comparison with the United States and Europe, with its maxi plan, Germany confirms itself in first place in the ranking of support measures such as bank loans and guarantees, even exceeding the sum – albeit important – allocated by the American government. Compared to Germany's 821 billion euros, the United States is unable to surpass the figure of 700 billion dollars. Italy follows Germany closely, albeit with a halved figure for the guarantees made available to the country (400 billion euros), followed by France and Spain. Laggards Italy also for the share of loans already disbursed, with a percentage of 25% compared to 33% in Spain and 36% in France. The funds allocated by the government, in terms of guarantees, for Italian companies that have suffered a collapse in turnover during the pandemic, do not reach, in terms of bank loans granted, 100 billion euros (data updated to September 2020) , a value also lower than that of Spain and France.

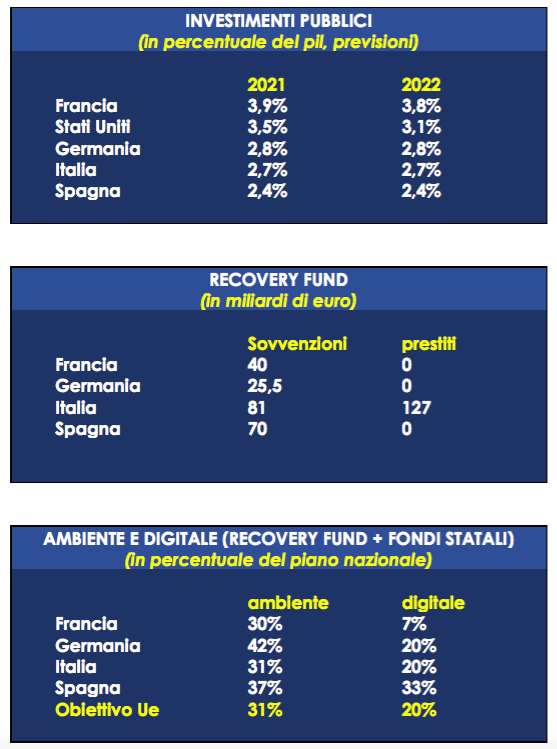

PUBLIC INVESTMENTS

There is no past or contemporary economic crisis in which public investments have not played a crucial role in stimulating growth, creating jobs and acting as a catalyst for private investment as well. History teaches us that spending around 1 million euros on infrastructure means creating two to eight new jobs, while between five and 15 if the same figure also focuses on spending on research and development. The governments of France and the United States are well aware of this and, on average, have planned to invest public resources equal to 3.8% and 3.3% of the GDP until 2022, followed by Germany alone which stands at 2, 8% of its gross domestic product. The trend in investments will be slower in Italy, where a modest 2.7% of pre-pandemic GDP is expected. It remains to be hoped that Italy, lagging behind along with Spain, will rethink its "fiscal multiplier" for the next two years and achieve the right balance between implementation times – always very long – and sectors of intervention. Maintaining the quality of investment projects will be essential, but even more to ensure their realization because, if new and challenging opportunities arise from crises, it is necessary to know how to grasp them.

RECOVERY FUND

From a comparison with France, Spain and Germany, the post-Covid “Marshall Plan” for Italy puts in place important resources which represent about 28% of the total expenditure financed by the European government. The relaunch operation for our country is worth around 210 billion euros, with a third of this figure provided for as a grant. Although lacking in all the details, the total budget will be allocated to the modernization of the country and the “green” transition, primarily through infrastructure. The goal is to align the country with the performance of the other member states of the European Union and, in line with the EU objective, the spotlight for Italy will be on digital and the environment. The ability to grasp change and invest in less developed sectors could pay a lot in the near future also for Italy and, if the same does not shine through the expenditure of European funds, the hope is that it will learn from what has not worked in past and do not waste a unique opportunity like the one just presented. The choice of contaminating Italian companies with technology and aiming for sustainability will commit half of the European funds to Italy. If 31% of total resources are destined for “green”, digital transformation will also absorb a large part of the total funds, equal to 20% of the total. The percentage is in line with Germany's forecasts for spending in the same sector and four times higher than in France. Only Spain, which so far has little attention to digital and the environment, will allocate more resources to the two sectors, with percentages of 37% and 33% respectively.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/prestiti-bancari-e-garanzie-pubbliche-tutte-le-differenze-ue-usa-report-fabi/ on Sat, 23 Jan 2021 14:38:56 +0000.