Oil, what will happen in the United States

The EIA expects US oil demand to reach 19.51 million this year versus the 19.79 million barrels per day previously forecast.

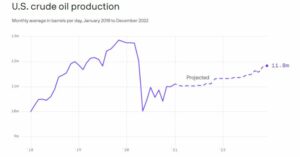

The US government expects US oil production to increase by about 3.5% next year, spurred by rising crude oil prices and a rebound in shale drilling. In 2022, oil production will average 11.49 million barrels per day, according to forecasts provided by the Energy Information Administration .

PRODUCTION ESTIMATES UNCHANGED

The US agency, which left its production estimate for this year unchanged at 11.1 million, said recent increases in the price of crude oil and the addition of rigs will help production increase especially in the second. quarter of this year.

The US agency, which left its production estimate for this year unchanged at 11.1 million, said recent increases in the price of crude oil and the addition of rigs will help production increase especially in the second. quarter of this year.

RISING PRICES

The EIA also revised its 2021 price forecast for West Texas Intermediate (WTI) upwards to $ 49.70 a barrel, nearly $ 4 more than its previous December estimate of $ 45.78 a barrel. estimated the 2022 price at $ 49.81 per barrel.

US AND WORLD DEMAND

The EIA expects US oil demand to reach 19.51 million this year versus the 19.79 million barrels per day previously forecast.

The global supply for 2021 will, on the other hand, average 97.13 million barrels per day compared to the previous 97.42 million. World demand should instead amount to 97.8 million, down from the old forecast of 98.2 million.

IN 2022 MORE RECOVERY BUT EVER AT THE LEVELS OF 2020

Estimates from the Energy Information Administration provide the first glimpse of what US production will look like in 2022 with a substantial but by no means complete recovery. Suffice it to say that in 2020, US production reached almost 13 million barrels per day.

“It is unclear whether production will ever return to 2020 levels, in part due to uncertainties about future global demand and prices. Furthermore, investors seem to have no patience to wait for years of high growth investments at the expense of returns, ” Axios points out.

SHALE PRODUCERS CONCENTRATED ON DEBTS

"Most shale producers are now more focused on debt cancellation and meeting promises made to investors than maintaining fiscal discipline," Bloomberg notes.

THE ALCOVID-19 UNCERTAINTY PERFORMS

In any case, observes the EIA itself, the analysis "remains subject to high levels of uncertainty because the responses to COVID-19 continue to evolve".

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/energia/petrolio-che-cosa-succedera-negli-stati-uniti/ on Sat, 23 Jan 2021 06:37:29 +0000.