Because despite Omicron, global growth will not derail

What will happen to the global economy and commodity prices. The analysis by Ole Hansen, head of commodity strategy BG SAXO

Commitments of Traders reports published by the US CFTC highlight futures positions and changes made by hedge funds in commodities, forex and financial stocks. What has happened in the last few days confirms that, despite the advent of the Omicron variant, global growth will not derail.

Treasury yields and the dollar rose and the commodities sector recovered after the worst slump in a year. With the end of the year and the low liquidity season approaching, some speculators have gone against the direction of the markets and have preferred to reduce exposure to commodities and the dollar anyway.

Looking at all the asset classes covered in this update, we see that squaring of positions is becoming an important theme. December is normally a time of year when traders reduce exposure as liquidity begins to dry up and order books are reduced ahead of the holidays and the end of the year. With this scenario in mind, the particularly hectic trading days may not give much indication of the short-term direction of the market. An example of this are the reductions in long positions on the dollar and commodities, which occurred in a week in which both increased.

Raw material

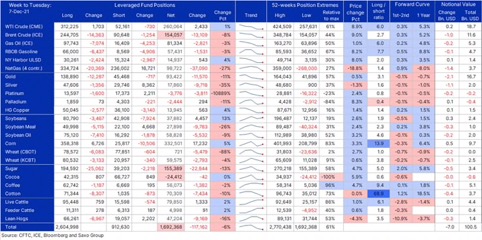

The sale of commodities continued for the second week in a row, but slowed from that, when it recorded the highest number of sales since Covid-19 hit the market in February 2020. Despite strong gains with 20 of the 24 futures contracts trading higher, the overall theme, as mentioned, was risk reduction with gross longs having seen a reduction of 124k lots while gross short was reduced by 8k lots.

Only a handful of contracts saw net purchases, led by corn (17.2k lots), soy (4.5k) and WTI (2.4k) while the sale was led by natural gas (-37k), sugar (-22.8k) , Brent (-13k) and gold (-11.6k).

Power

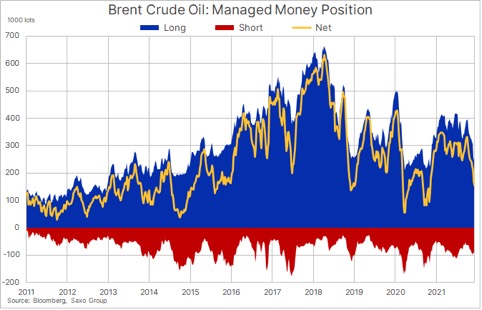

The most interesting of last week's changes was the reduction of 13.1k lots in Brent crude oil long to a new 13-month low at 154k lots. There has been a steady sell-off in the past nine weeks, and despite last week's 9% rally, recovery due to the advent of the Covid Omicron variant and the break above the 200-day moving average, speculators have not changed the trend. their defensive position. This behavior is in stark contrast to the general market belief of a price increase in 2022.

Crude oil (OILUKFEB22 & OILUSJAN22) is trading close to a three-week high with markets considering current Omicron concerns as passing as there is a belief that China, the world's largest crude oil buyer, will begin to deliver fiscal stimuli in early 2022 to stabilize the economy.

Both Brent and WTI are challenging their 21-day moving averages, with a break that could add further technical momentum. Meanwhile, speculators cut their long Brent crude positions for the ninth time, and nine weeks of uninterrupted reductions saw net long positions drop to a 13-month low. This behavior is in stark contrast to the general market belief of a price increase until 2022. The focus is on the monthly oil market reports from OPEC today and IEA tomorrow.

Gold

Gold (XAUUSD) remains stuck below its 200-day moving average at $ 1794 with attention to market reaction after FOMC decisions and assessments to be made regarding inflation rising at the fastest pace in years' 80. The market is currently considering three rate hikes next year, with the first expected in June. Against the negative price impact of a potential more aggressive US central bank, the rapid spread of the Omicron virus also deserves some attention given its potential negative impact on growth.

Industrial metals started the week on a firmer footing, with iron climbing 6% on expectations that China will increase stimulus to support the economy. Following the end of an annual three-day conference on central economic work, with the Communist Party signaling a clear shift in focus from growth to stability. They also promised to anticipate policies to stop the recent crisis.

Gas

Gas prices on the rise in the EU where, in addition to having to deal with Covid-19 and the Russian threat, the European Council is evaluating whether investments in gas and nuclear energy can be labeled as green. The EU's green investment ranking system is closely observed by investors around the world and could potentially attract billions of euros in private funding to aid the green transition, especially given the strong need to reduce the use of coal, the greatest pollutant to the world.

Forex

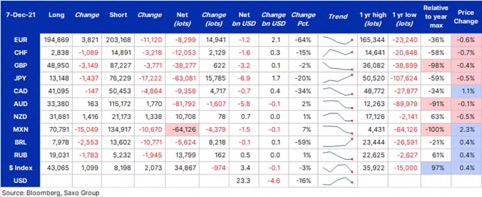

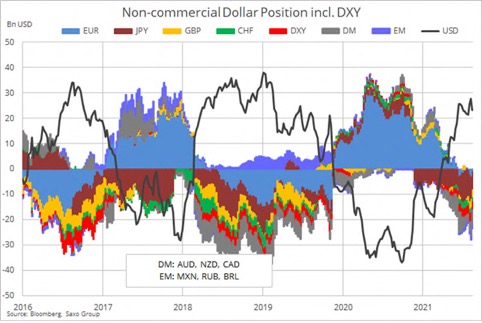

In forex the speculative flow was skewed towards dollar sales, mainly driven by the short hedging of EUR, JPY and CAD. Just a week after hitting an 18-month high due to usual Omicron concerns as well as increased focus on Fed squeeze, the overall length of the dollar against ten IMM currency futures and the dollar index was reduced by a bit. 16% to $ 23.3 billion.

As can be seen in the table below, general attention has mostly focused on reducing exposure, which helps explain why the dollar's length was shortened in a week when the green bill went up. The decrease of $ 4.6 billion was driven primarily by a large decline of $ 5.1 billion equivalent to gross short positions, led by JPY ($ 1.9 billion) and EUR. Other notable changes were the net short on the MXN which hit a four-year high at 64k lots or the equivalent of $ 1.5 billion.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/perche-nonostante-omicron-la-crescita-globale-non-deragliera/ on Sun, 19 Dec 2021 06:31:07 +0000.