Because the chip crisis is hitting the auto sector again

The war in Ukraine has once again put the chip supply chain in crisis, frightening the car manufacturers. The impact will mainly affect the United States, but the European Union is not safe. Here are facts, risks and scenarios

The chip shortage scares the automotive industry. In recent months, the chip crisis seemed to have loosened its grip, after the spike following the outbreak of conflict in Ukraine. However, the same war today risks aggravating the situation again. In fact, sending new aid could make components scarcer and more expensive. The first to be hit by the new chip and semiconductor crisis would be the United States, but the European Union would certainly not be immune. Is a new tile for cars on the way, after the fuss raised by the EU Regulation?

THE CHIP CRISIS BOOMS AGAIN ON CARS

Chip shortages are once again looming over European and US automakers following the recent approval of new military aid to Ukraine. The European Union, which has allocated two billion euros for the purchase and delivery of ammunition. Although these do not contain chips, the intensification of the war effort could lead to the construction of new machines.

Rising demand is bad news for automakers. Indeed, the components are present in the electronic systems of all vehicles, in different quantities. The number grows with each innovative technology. On average, an internal combustion engine machine contains several hundred, but in EVs the number increases significantly.

US FIRST

In America the problem is already taking on worrying dimensions. The straw that broke the camel's back is the Biden administration's approval of a substantial new military aid package for Ukraine. The companies that produce weapons are only waiting for the go-ahead from the federal government to give the green light to construction. The new US military support is estimated at 400 million dollars, which will mainly go to munitions and missiles.

The intensification of aid risks having important repercussions on various sectors, which compete with the defense for microchips. In pole position we find automotive, followed by machinery and non-residential construction.

Supply chains that would have to deal with increasingly scarce and expensive raw materials , due to greater competition from defence. Only the retail trade seems to be able to withstand the impact.

“One of the big problems, now that we're trying to increase the military industrial base, is having enough electronics. For industries where demand is still strong, we are still seeing material shortage issues, and these issues will take longer to resolve,” said Jason Miller, associate professor of logistics at Michigan State University business school, interviewed from Reuters .

FACTORIES AT RISK

Factories are not immune from the chip and semiconductor crisis, as General Motors well knows. In fact, the American plant located in Silao, Mexico, has reopened after more than a week of hiatus due to the shortage of semiconductors.

“Over the past year, we have seen a gradual improvement in our supply chain, including semiconductors. Short-term disruptions will continue to happen,” GM spokesman Dan Flores wrote in an email sent to Reuters.

There is also concern about the availability of cement, another material that could experience demand stress due to the intensification of European and US aid to Ukraine. If it were to become scarce, strategic infrastructures and factories for the production of semiconductors and EVs would be at risk.

“Cement is probably one of the most resilient manufacturing sectors at the moment. Demand has shown no signs of cooling off,” said Michigan State University professor Miller.

THE ORIGIN OF THE CRISIS

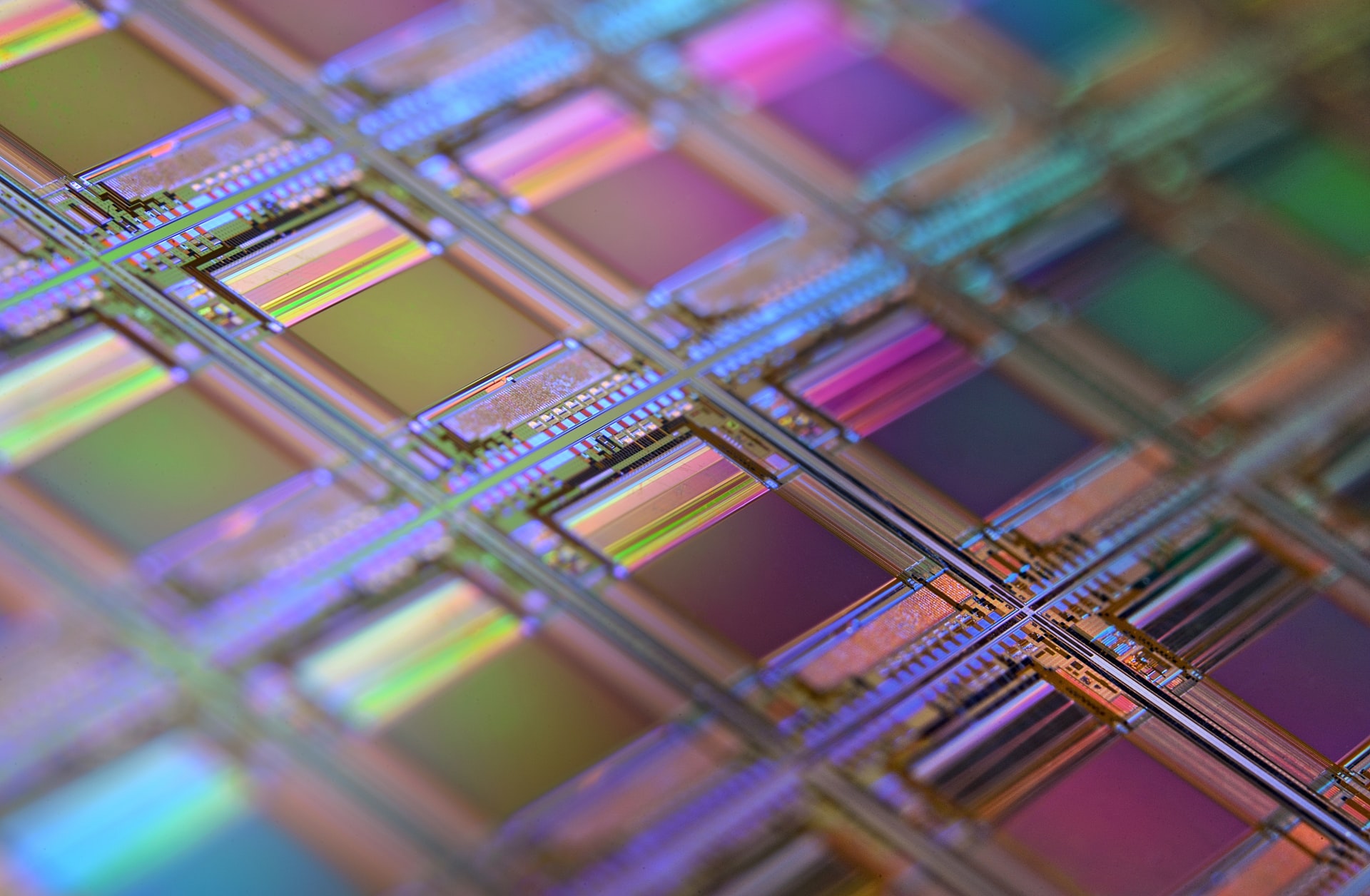

The chip shortage problem is not easy to solve as it has deep roots, extending beyond the Covid-19 pandemic. At the heart of the matter is the chip manufacturing process, which is expensive and not very scalable. The same raw materials that compose them come from a few geographical areas, resulting in a sort of oligopoly of critical minerals. The high costs push various manufacturers to prefer low-cost chips, which give way to high-quality ones in case of emergency, such as pandemics and wars. Furthermore,

The spread of the virus was the perfect storm, causing demand to grow while crippling the global supply chain. Furthermore, producers found themselves unprepared to cope with the growth in demand, lacking sufficient stocks. At the same time, the costs of germanium and silicon have soared.

A situation that risks recurring in the not too distant future.

(Article published in Energia Oltre )

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/carenza-chip-settore-auto-problemi/ on Sun, 02 Apr 2023 05:10:48 +0000.