China, the debt trap for emerging countries

What emerges from a study conducted by the World Bank, the Harvard Kennedy School, AidData and the Kiel Institute for the World Economy, presenting data on the debt contracted by some developing and emerging countries after the bail out operations made from China

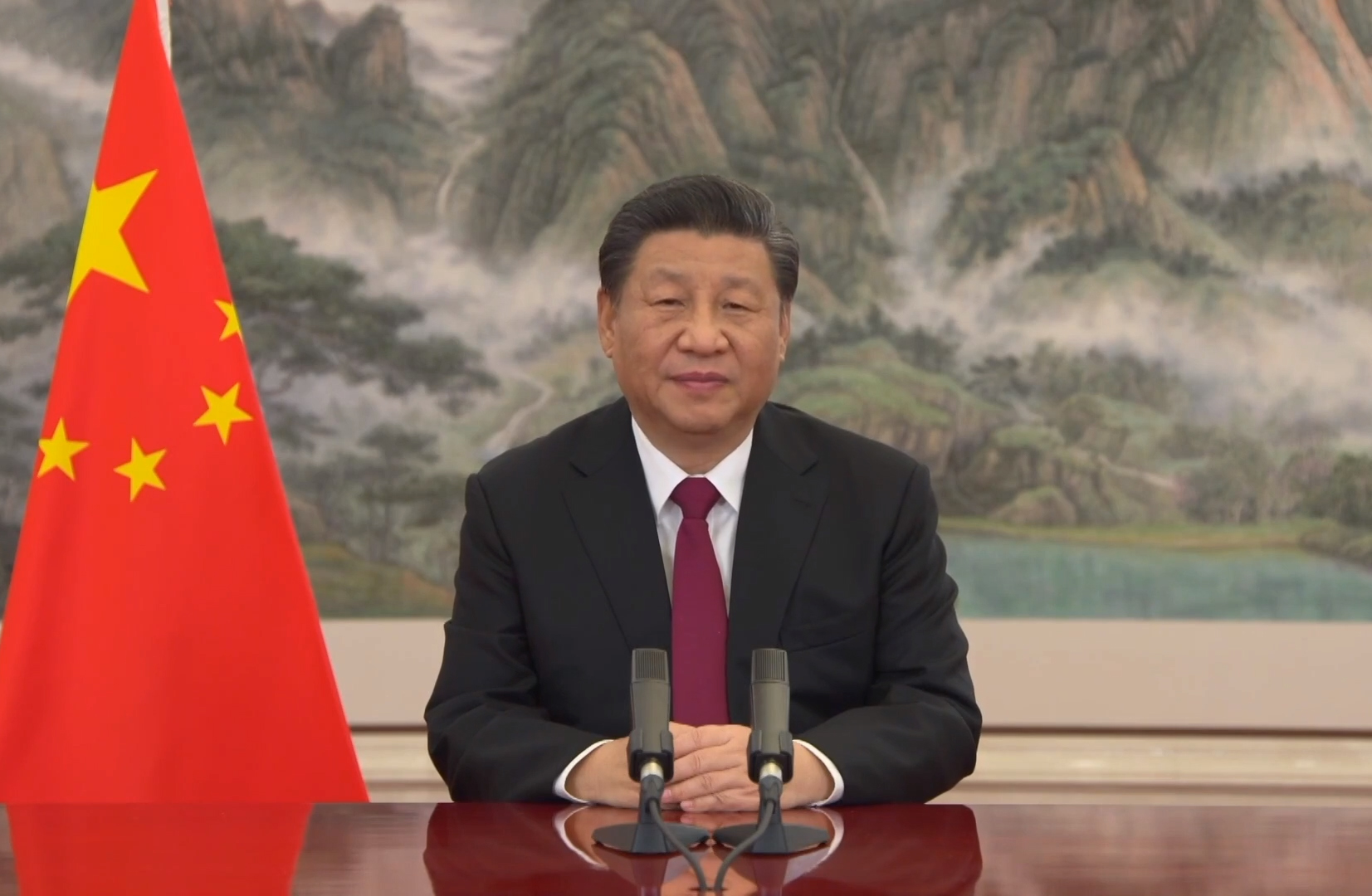

Beijing is burying emerging countries under mountains of debt through bailout operations and financing the works of the Belt and Road Initiative which a study conducted by four US institutions defines as "opaque". US Treasury Secretary Yellen goes on the attack accusing China of making those countries fall into the "debt trap". Beijing's reply: "irresponsible" statements.

I study.

It is a study conducted jointly by the World Bank, the Harvard Kennedy School, AidData and the Kiel Institute for the World Economy, which presents data on the debt contracted by some developing and emerging countries after the bail out operations carried out by the China and the huge financial flows injected to support the development of the Belt and Road maxi infrastructure project.

The monetary mass invested by Beijing between 2008 and 2021 in the bailout of 22 states involved in the construction of the infrastructures of the Belt and Road Initiative, which the finances of those countries are unable to cope with, amounts to 240 billion dollars. Among these we note the presence of Argentina, Pakistan and Mongolia in terms of debt volume.

According to the study, the contents of which were relaunched by Reuters , the loans granted by Beijing increased enormously between 2016 and 2021, even if the flows have recently experienced a setback linked to the impossibility of the beneficiary countries to repay the debt contracted with China itself to finance the Belt and Road works.

Argentina received the most, with 111.8 billion dollars, followed by Pakistan with 48.5 billion and Egypt with 15.6 billion. Nine other countries were beneficiaries of sums of less than one billion.

Swap lines from the Central Bank of China account for the bulk of this funding, amounting to $170 billion earmarked for countries such as Suriname, Sri Lanka and Egypt. The rest is represented by bridge loans or to support the balance of payments granted by Chinese state banks, for a sum equal to 70 billion dollars.

"Beijing is trying to save its own banks," is the consideration of one of the authors of the study, the former chief economist of the World Bank Carmen Reinhart. “That is why it entered the risky business of international bailout loans.”

The bailout loans made by China are called "opaque and uncoordinated" by another author, Brad Parks, director of AidData, a research facility at the College of William & Mary in the United States.

Beijing's piqued response.

It didn't take long after the study results were disclosed for Beijing to respond with its customary note of denial.

These loans, Foreign Ministry spokesman Mao Ning said, are granted on the basis of the "principles of openness and transparency".

"China operates", added Mao, "in accordance with market laws and international rules, respects the will of the countries involved, has never forced anyone to borrow money, has never forced any country to pay, it does not place political conditions on loans and does not pursue its own particular political interest”.

Yellen's lunge.

The study did not escape the watchful eyes of US Treasury Secretary Jennet Yellen, who made her comment during a congressional hearing.

“I am very, very concerned about some of China's activities globally, engaging in some countries in ways that leave them trapped in debt without promoting economic development,” Yellen said.

Yellen "irresponsible": China's poisonous reply.

For Beijing, those of the Treasury Secretary on emerging countries trapped by debt are "irresponsible" and "unreasonable" statements, retorted the Foreign spokesman Mao himself.

"We do not accept unreasonable accusations from the United States", were the words of Mao, who shifted the weight of the debt problem onto the shoulders of the United States, accused of having aggravated the financial conditions of those countries by raising interest rates by the Federal Reserve.

"The United States," Mao added, "should take practical steps to help emerging countries instead of pointing the finger at other countries and making irresponsible statements."

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/cina-debito-paesi-emergenti/ on Sun, 02 Apr 2023 07:10:10 +0000.