Bloomberg discovers the virtues of the Italian economy after so much nonsense and interested hoaxes

Bloomberg praises Italy which, from the pre-pandemic GDP level, has grown significantly more than France, Germany and Spain. But he is careful not to remember a few things… Giuseppe Liturri's analysis

“ Italy is not in the desperate economic situation that you believed ”. This is the title of a thoughtful editorial that appeared today on Bloomberg signed by Lionel Laurent.

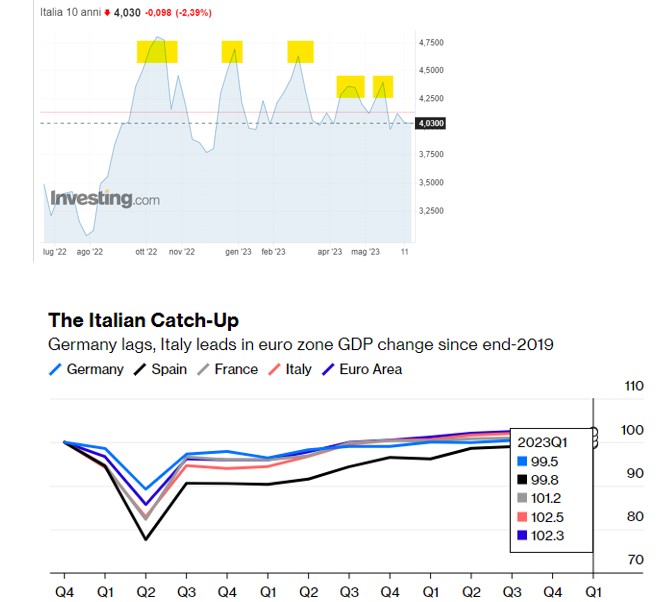

Starting from a brilliant and innovative medium-sized Lombard company supplier of essential components for electric cars, listed on the Stock Exchange for a few months, the author praises a country which, from the pre-pandemic GDP level, has grown significantly more than France, Germany and Spain, reaching even slightly above the Eurozone average.

We were a basket case (according to him) because our country's reputation has long been undermined by short-lived governments, huge public debt and a disastrous banking sector, compounded by the two decades in which Silvio Berlusconi dominated the scene, characterized by corruption and broken economic promises. He has only forgotten Ruby and the Olgettines.

BLOOMBERG AND THE NOTHING OF NEXTGENERATIONEU

Then he observes almost amazed that today it is political stability that appeals to investors and the Btp/Bund spread which has dropped to around 150 points is the measure of this approval. And he attributes these results to “economic reforms” and NextGenerationEU funds. That is, zero, from a macroeconomic point of view, we add, because the 67 billion euro collected so far have mainly served to replace public bond issues, as they are intended to finance investments already planned or even executed starting from February 2020 (see the works by fry).

Instead, he grasps the point when he notes that the giants from beyond the Alps have feet of clay and Italian companies have been quicker to adapt and react to rapid changes (lockdown from Covid, energy crisis aggravated by the war). On this point we observe that those enormous discontinuities in the placid routine (with asphyxiated growth) of the economy until 2019 have exposed the level of risk of the German-centric economic model. All based on low-cost raw materials (energy in the lead), wage moderation and consequent low inflation. Suddenly the bank broke, with the cost of labor per unit of German product that began to run, without corresponding increases in productivity, undermining the competitiveness of German industry. We hadn't put both feet in the sole Russian supplier's shoe and have retained important sources of supply via pipelines from Algeria, Libya and Azerbaijan, while feeling the full impact of spiraling prices.

PUBLIC DEFICIT AND GDP

The author is careful not to recall that, compared to the recent past, a significant public deficit has contributed to the growth of GDP, reducing and stabilizing the debt/GDP ratio. Not to mention the previous lost decade, when the country was ballasted with primary surpluses wanted by Brussels. The decision to put significant figures in the construction sector (also via superbonus %), despite all the criticisms on how and when and on the comparison with alternative choices , is textbook when you want to relaunch the growth of a country. And the multiplier of that expense was around unity, in line with the provisions of economic doctrine .

But the displeasure at not being able to put Italy in the dock again and perhaps be able to make a lot of money by selling the BTP short is evident. Also because, if we look at the ten-year BTP graph, it seems that someone has really hurt himself betting against the BTP since last October. Three times, in the wake of the ECB's rate hikes, the market tried to break through the yield threshold around 4.70%, and was rejected with losses and hasty cover-ups. Lastly, it also held the ceiling of 4.30%.

So ours – speaking to his readers who are evidently licking their wounds and are regretting not having invested in BTPs – warns that something could still go wrong. There is the relatively low level of education, the "perceived" corruption (by whom?) at the level of Georgia (!), the slowness of the judicial system and, above all, the spending times of the PNRR , on which a large part of the growth.

A warning that resembles the famous "remember that you must die!". To which we reply "I'll sign it now". In the meantime, let them worry about the German and French economies whose toy has broken and remember that trying to sell BTPs seriously damages your wallet.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/bloomberg-virtu-economia-italia/ on Wed, 21 Jun 2023 06:19:41 +0000.