Can falling energy prices help the recovery?

A comment on the 2023 outlook for European equities and the impact that a drop in energy prices could have in favoring an eventual economic recovery. The analysis of Martin Skanberg, Fund Manager, European Equities, Schroders

The question for 2023 is whether markets can weather the challenging macroeconomic backdrop. Hopes that inflation has already peaked, at least in the US, has buoyed equities recently. It is possible that this momentum will continue into the first part of 2023, only to fade later in the year.

Falling energy prices could offer some support

After the sharp increases in energy prices following Russia's invasion of Ukraine, the market has been waiting for a recession in the Eurozone, which has not yet materialized.

Energy prices are now moderating and year-over-year comparisons will become easier. Recession still looks like the most likely scenario, but moderating energy prices could cause the recession to be shorter and shallower than it otherwise would have been.

Just as the predicted recession hasn't arrived yet, neither has the expected sharp decline in corporate profits. Lower energy prices would be a boon to corporate profit margins. Another positive influence is the current resolution of the supply chain disruptions caused by the pandemic. Both factors could help profits remain solid, even if further cost pressures related to rising wage demands persist.

Momentum may fade as the year progresses

At the same time, there is no doubt that the economic environment will be challenging in 2023. Even if inflation were to ease from current levels (10% in November 2022), it is unlikely to return to the European Central Bank's target level of 2%.

The ECB is still in the process of starting Quantitative Tightening next year. This means, in practice, less liquidity which is generally not good for equities.

We must also consider that higher interest rates mean higher borrowing costs for governments, businesses and individuals. As a result, consumption and investment are likely to suffer. With the quantity tightening and the need to refinance debts, it is possible that the equity market will see the initial momentum run out.

Trend reversal compared to 2022

Taking a step back, we believe some of the big market moves of 2022 could experience at least a partial reversal in 2023.

If US inflation is indeed under control, we could see a weakening dollar, with the Fed suspending rate hikes, or even starting to cut them, while other central banks continue to raise them. A weaker dollar may be good for global equities, including European equities, not least as dollar-denominated commodities (such as oil) become cheaper.

In terms of sectors, energy was the best performing within the MSCI Europe ex UK index in 2022, with a gain of 27.9% (YTD to 31 October 2022). The sector is unlikely to outperform the index by a similar extent in 2023.

Furthermore, if Europe were to enter a recession, corporate earnings would likely be downgraded. Companies and sectors with the potential to deliver some earnings stability will therefore be the focus of investors' attention over the next 12 months.

Banks are one sector that could generate good results. Many eurozone banks are still attractively valued and rising interest rates are good for loan repricing. It is clear that a recession would cause an increase in bad debts, but if the recession is short and/or shallow, the negative impact would be more limited than feared.

Economically sensitive sectors, such as capital goods or semiconductors, could also fare relatively well, especially if the recession turns out to be short-lived.

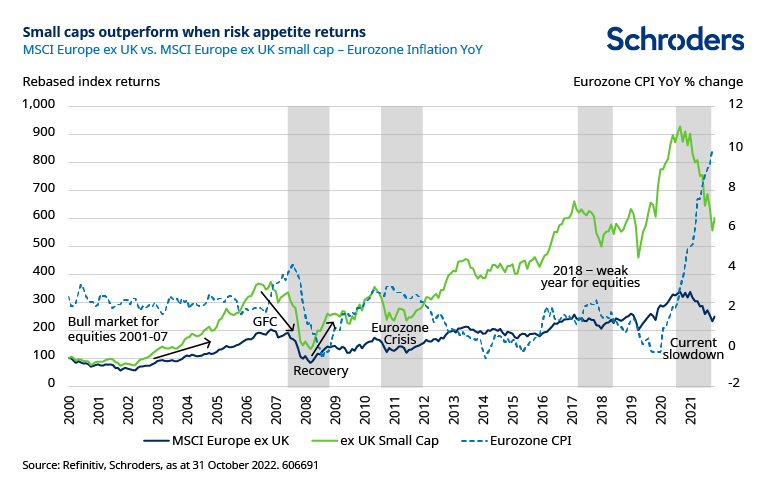

Instead, a sector that suffered particularly in 2022 is that of small and medium-sized enterprises. Again, we could see a trend reversal. In general, in fact, a more favorable sentiment towards equities tends to lead to an outperformance of small-cap stocks compared to large-cap stocks.

Now is not the time to position yourself aggressively

Longer-term trends may support some areas of the market. While overall investment may decline due to rising financing costs, we believe the trend towards more localized manufacturing will continue.

Another area of investment focus will be defense, with increased spending by governments following the war in Ukraine.

The energy transition remains a key issue for Europe and energy security has become paramount. Investments could be directed towards those projects that offer the fastest return in terms of safety.

We believe that the worst-case scenario, i.e. a deep and prolonged recession, can be avoided. This would help improve sentiment towards eurozone equities, which is currently very much out of favor with investors.

The great unknown remains the war in Ukraine. In light of this and the uncertainties surrounding growth prospects, now is not the time to position aggressively. As always, we will focus on the best stock-level opportunities, targeting specific areas of growth, which can be found even in the most challenging economic times.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/il-calo-dei-prezzi-energia-puo-favorire-la-ripresa/ on Sun, 25 Dec 2022 06:17:21 +0000.