Catl and more: who are the leading manufacturers of batteries for electric cars

China's Catl alone is worth more than a third of the world market for batteries for electric cars. All the numbers (even of the rivals)

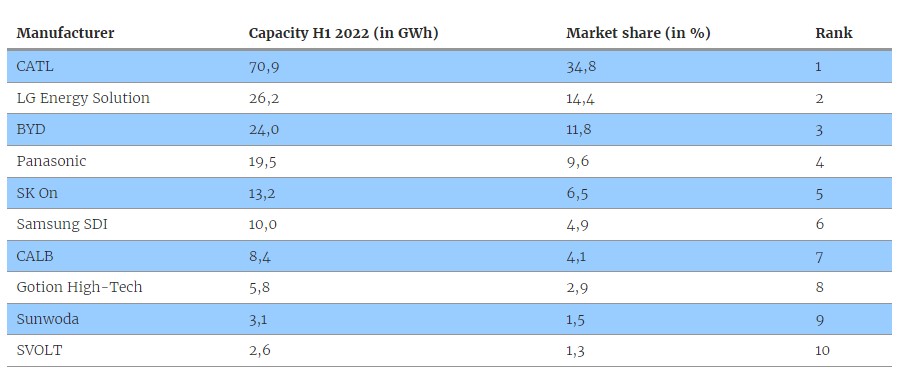

According to a study by SNE Research, a South Korean company that carries out market analyzes, in the first half of 2022, batteries were installed on electric vehicles worldwide for a total capacity of 203.4 gigawatt hours. The Chinese company Contemporary Amperex Technology Co. Limited (better known as CATL) was the first producer, with a capacity of 70.9 GWh and a market share of 34.8 percent.

CATL, LG AND BYD

The gap between CATL and its competitors is considerable. In second place in the ranking is the South Korean LG Energy Solution, but its market share is “barely” – if compared with that of CATL – of 14.4 percent, with a capacity of 26.2 GWh.

In third place is BYD, from China, with 11.8 per cent of the market and 24 GWh of capacity.

– Read also: Electric cars, the Chinese BYD overtakes Tesla on sales

THREE COMPANIES ONLY CONTROL THE BATTERY MARKET

Beyond CATL's dominance, the SNE Research study shows that three companies alone control 61 percent of the world's production of electric car batteries.

THE OTHER PRODUCERS

All other companies have single-digit market shares. Panasonic – Japanese and a major Tesla supplier – is in fourth place, with 9.6 percent. SK On , South Korea, has 6.5 percent. Then, again from South Korea, there is Samsung SDI with 4.9 percent. The Chinese CALB, Gotion High-Tech, Sunwoda and SVOLT have market shares of 4.1, 2.9, 1.5 and 1.3 per cent respectively.

AN EXPANDING MARKET

As Electrive points out, data from SNE Research tells of the rapid expansion of the battery market. Throughout 2021, CATL had produced batteries with a capacity of 96.7 GWh; in the first half of 2022 alone it has already reached 70.9 GWh.

In the first half of last year, BYD had a 6.8 percent market share. In the same period of 2022 it reached 11.8 percent. CALB went from 2.7 to 4.1 per cent; Gotion – more modestly – from 2.1 to 2.9 percent.

THE EXCEPTIONS

Not all companies have grown, though. LG Energy Solution has lost market share and has not significantly increased its production capacity (from 27.3 GWh in the first half of 2021 to 29.2 GWh in the one just ended).

WHO GROWS MORE

On the other hand, CATL recorded a strong expansion: from 32.9 GWh to 70.9 GWh. BYD went from 7.9 GWh to 24 GWh.

Beyond LG Energy Solution, South Koreans also grew: SK On, for example, reached 13.2 GWh (a year earlier it was 6.2 GWh); Samsung SDI went from 6.6 GWh to 10 GWh.

THE NEXT MOVES OF CATL

To respond to rival South Korean companies such as LG Energy Solution and SK Innovation, and to adapt to the political will to "shorten" supply chains, CATL is working on opening factories outside China and Asia. For example, it wants to open a factory in Germany by the end of the year and – wrote Reuters – one in the United States.

Since its listing on the Shenzhen Stock Exchange in 2018, CATL's shares have grown by nearly 2,000 percent.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/energia/catl-batterie-mercato-primo-semestre-2022/ on Sun, 14 Aug 2022 05:46:21 +0000.