China will get serious about the gallium and germanium blockade

China has effectively reduced exports of gallium and germanium to net zero. Here are the consequences for the United States and the European Union. Sergio Giraldo's article

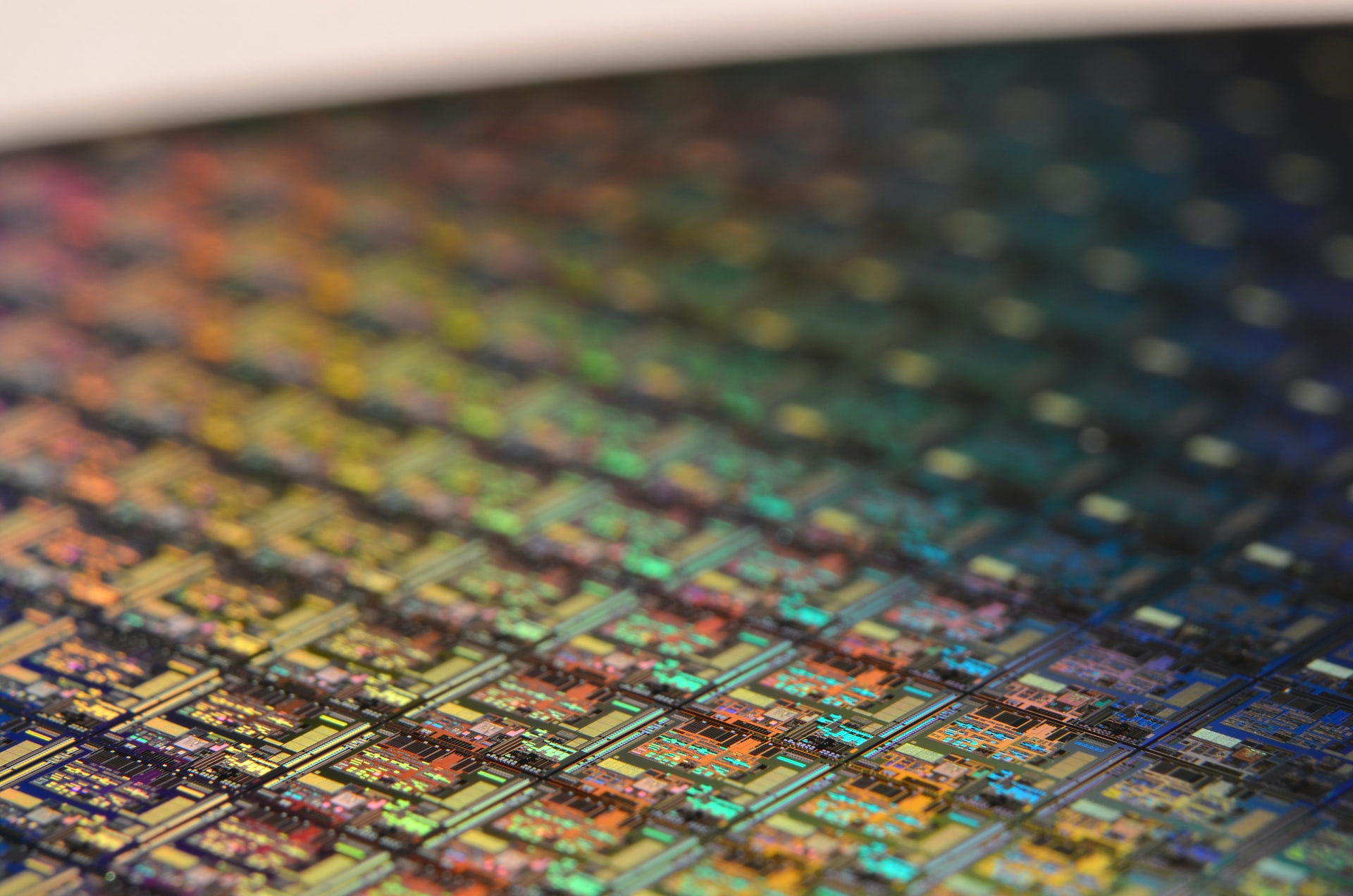

Beijing is serious. Not that there were any doubts, but when faced with the numbers even the most unbridled optimism must deal with reality. After announcing export restrictions in July, in August China effectively reduced exports of gallium and germanium, two metals essential to the ecological transition, to net zero . The two elements are used in the manufacture of microchips with different uses, in integrated circuits, laser diodes and LEDs, optical applications, catalysts and are used for both energy-related and military applications.

HOW MUCH IS CHINA WORTH IN THE GALLIUM AND GERMANIUM MARKET

China produces 98% of the world's gallium, while it is estimated that, at the moment, existing supplies of the two materials can last a maximum of five to six months.

It is the official data from Chinese customs that establishes the total stop to exports. August exports of germanium were zero, after a July of 8.6 tonnes, a record caused by the rush of foreign buyers to store as much metal as possible before the announced blockade.

The same goes for gallium, of which China is practically a global monopolist: zero exports after July which recorded 5.15 tonnes of exports.

The stop on foreign sales, which Beijing announced in the early days of last July, concerns some finished or semi-finished products (eight relating to gallium and six to germanium). Xi Jinping's Chinese government thus intends to face the American administration led by Joe Biden, in a war of nerves caused by the increased strategic and military importance of microchip production.

BEIJING'S BUREAUCRATIC LOOPHOUSE

The stop to exports of the two metals was achieved through a bureaucratic loophole. The Chinese government demands that, to trade these two materials abroad, exporters must obtain a special license linked to the dual use (civilian and military) of the semi-finished products. It takes almost two months to obtain authorization and so far no operator has obtained it.

Just yesterday, China's Ministry of Commerce announced that some Chinese companies have obtained licenses to export gallium and germanium. In a press conference, a ministry spokesperson said that the minister has approved some requests from Chinese companies that meet the required standards. There are no further details at the moment. We will have to wait for Chinese customs data relating to exports for the month of September.

The prices of the two materials on the Chinese market have had divergent trends. Gallium is abundant in China and the export ban has caused stocks to grow, so the price has fallen by almost 10%.

The price of germanium, however, which had smaller supplies, increased, albeit slightly, due to the reduced supply.

CHINA'S STRATEGY

In fact, China, from a position of strength, is influencing the world market of these elements and at the same time playing a very important strategic game. For years, Beijing and Washington have been at odds over the issue of chips and related applications, especially military ones. The United States is 100% dependent on gallium and 53% dependent on Chinese germanium. A dependence that forces the White House to come to terms with Asian economic and military power.

Chinese moves to block exports could also continue on a series of other materials, including the so-called rare earths, or graphite and other metals necessary for the ecological transition and the much-touted European and American Green Deal.

The decoupling strategies launched by the USA, at present, seem like a mirage and essentially resemble an own goal. As well as the more nuanced position of the European Union, an economic giant with feet of clay, which began a few months ago, through the mouth of the President of the Commission Ursula von der Leyen, to talk about de-risking, that is, a strategy of eliminating of the factors of geopolitical tension with Beijing without breaking commercial relations with the large Asian country.

The Critical Raw Materials Act approved in Brussels this summer, which should represent a pillar of European economic policy in view of the ecological transition, is in reality a declaration of impotence and merely acknowledges that the dependence on China on materials and technologies is now consolidated. It will be difficult for the European economy, continuing on this path, to do without the Chinese production and refining of these materials.

The risk of an escalation of global trade tensions remains, as demonstrated by the recent cut in crude oil production by Saudi Arabia and Russia, which caused an increase in prices. Yesterday Russia also announced a reduction in exports of refined products. The BRICS front (Brazil, Russia, India, China, South Africa) is presented as an economic and strategic counterpart to the West. Meanwhile, Xi Jinping plays cat and mouse, and we are the mouse.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/cina-blocco-export-gallio-germanio-rischi/ on Sun, 08 Oct 2023 05:55:35 +0000.