Geox isn’t breathing so well anymore

Geox's first quarter results disappoint market expectations and the Venetian footwear company revises its guidance. All the details

In the aftermath of the results for the first quarter of 2024, published yesterday with the markets closed, Geox is under pressure. The Venetian footwear company has in fact disappointed the market's expectations and revised its guidance.

NEGATIVE QUARTER FOR GEOX

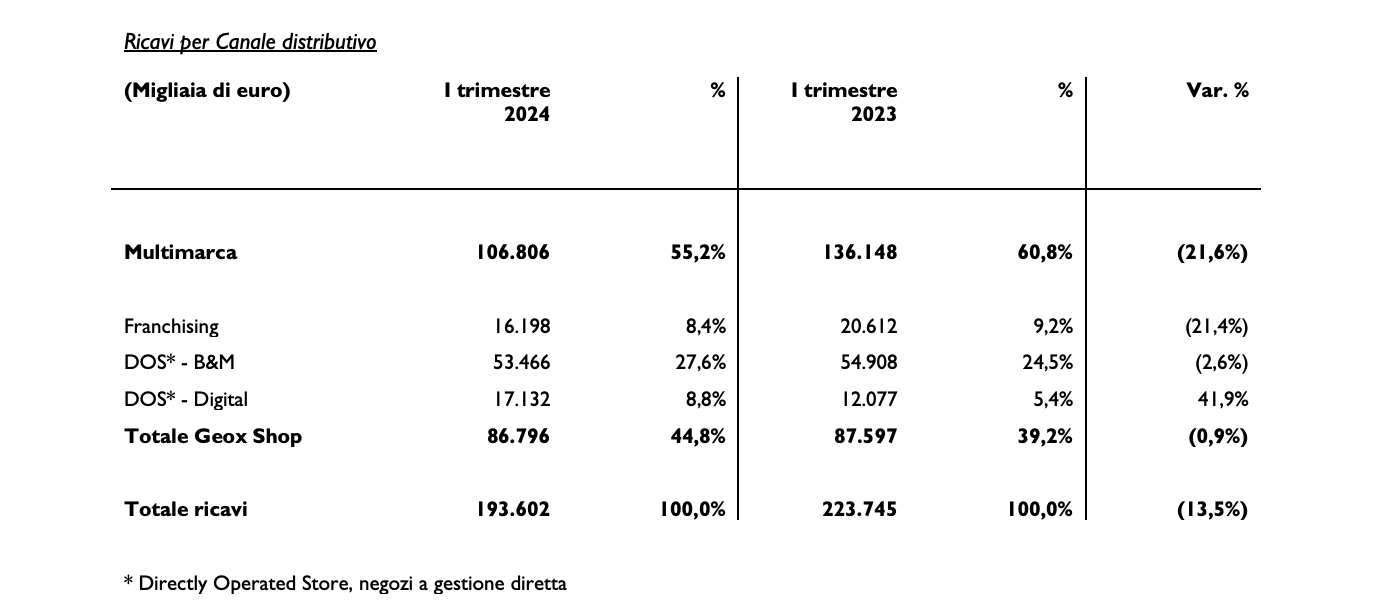

In the first three months of the year, Geox recorded consolidated revenues of 193.6 million (expectations were for revenues of 197 million), a decrease of 13.5% compared to the previous year. The decline, explains the company in a note, is "mainly attributable to the performance of the multi-brand channel, which recorded a contraction of 21.6% compared to the previous year". “Solid performance”, however, of the physical DOS channel (+4.4%) and above all of the digital DOS (+41.9%).

AREAS WHERE IT IS BETTER AND WHERE IT IS WORSE (INCLUDING WARS)

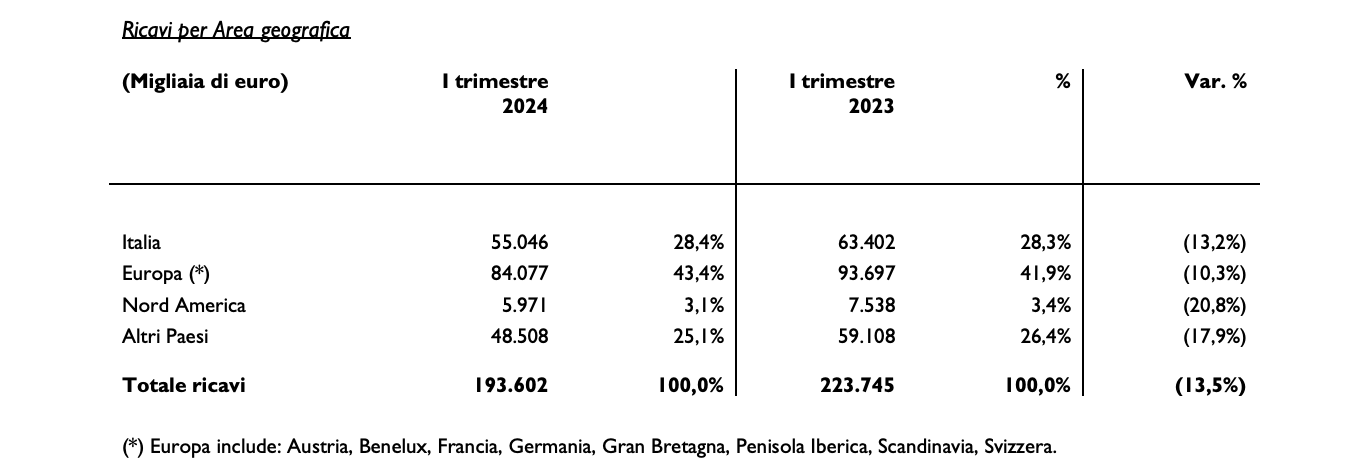

The group's largest revenues, equal to 43.4% of total revenues, come from the Europe area – which includes Austria, Benelux, France, Germany, Great Britain, the Iberian Peninsula, Scandinavia, Switzerland – and amount to 84.1 million EUR. However, they recorded a decline of 10.3% compared to 93.7 million in 2023.

Even in Italy, which with 55 million euros represents 28.4% of the group's revenues, there was a decrease of 13.2% compared to the 63.4 million in 2023.

North America reports a turnover of €6.0 million, down 20.8% and the rest of the world reports a turnover down 17.9% compared to the first three months of 2023. In particular, the note reports, “in the Middle Eastern area, turnover suffered a significant decrease, in line with what was already highlighted in the fourth quarter of the previous year due to geopolitical tensions and the outbreak of the Israeli-Palestinian conflict”.

Although in Ukraine, Israel and Palestine , all involved in conflicts , "Geox's business is mainly developed through third parties, multi-brands and franchising and can be considered of insignificant dimensions", in relation to Russia, where it continued to operate despite the invasion of Ukraine , "the revenues recorded in the area are substantially in line with what was expected with approximately 19 million euros in the first quarter (approximately 9.8% of consolidated turnover)".

THE REVIEW OF THE GUIDANCE AND THE REACTION OF THE STOCK MARKET

In light of the start of the year, management has revised the guidance: operating margin confirmed to increase by 50 basis points (over the entire financial year) compared to the previous financial year, 2024 revenue forecasts have been redefined as a mid-single digit reduction compared to to the previous one. Management is also working on the preparation of the new 2025-2027 strategic plan which will be presented during the financial year.

The stock ended up losing more than 3 points .

“The continuation of the complexity and uncertainty observed in all our main reference markets in these first months of the 2024 financial year require the maintenance of a prudent and focused approach to the growth of the most profitable markets, the rationalization of processes and efficiency of the cost base,” commented CEO Enrico Mistron.

WHAT THE ANALYSTS SAY

For Intermonte analysts "the results are below expectations" and "the revision of the turnover guidance puts a break-even year-end in 2024 at great risk". However, they expect “sustainable visibility and targets” from the plan that will be presented later in the year.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/geox-non-respira-tanto-bene/ on Wed, 15 May 2024 14:10:33 +0000.