Not just defense, this is how multinationals get rich. Mediobanca report

Turnover and margins growing for multinationals in the first quarter of 2024. Regarding the performance of the sectors, the defense sector is second in the quarter behind Websoft, followed by aircraft manufacturers. Here is what emerges from Mediobanca's annual report on the annual accounts of over 240 global industrial multinationals

In the first quarter of 2024, the defense sector ranked second behind Websoft and ahead of aircraft manufacturers by turnover.

This is what is revealed by the latest report from the Mediobanca Research Area which examined the annual accounts of over 330 global industrial multinationals divided by sector, with overall revenues of 15.4 thousand billion euros in 2023 and capitalization of 30.3 thousand billion at the end of 2023 , equal to 32% of the overall value of world stock markets.

All the details.

HOW THE FIRST QUARTER OF 2024 WENT ACCORDING TO THE MEDIOBANCA REPORT

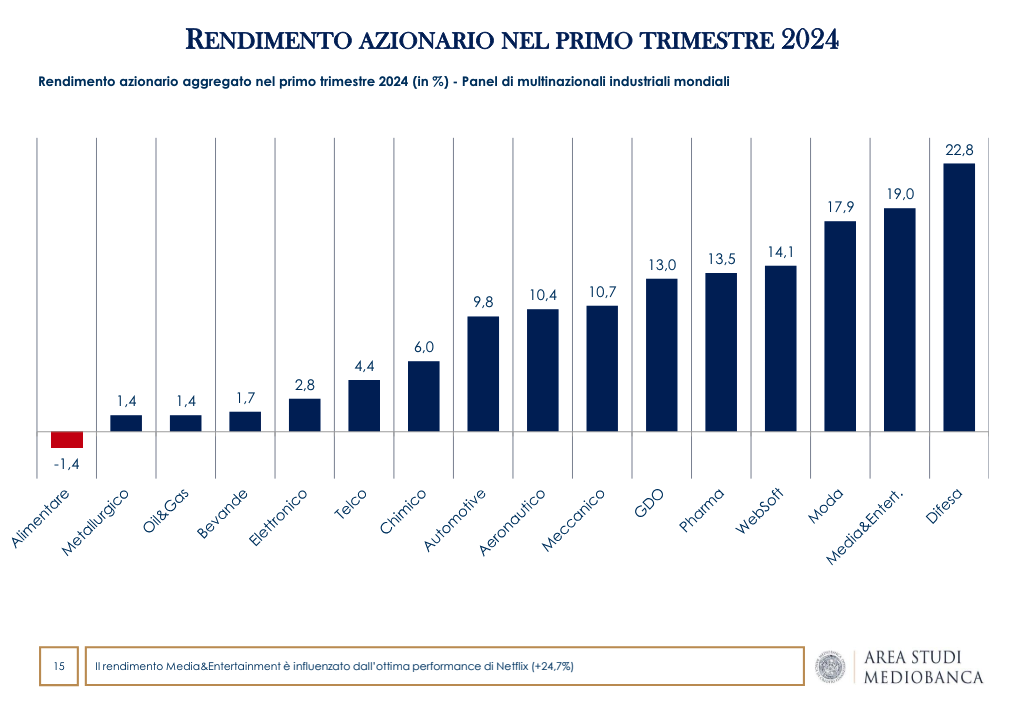

The defense big names (+22.8%) are positioned in first place on the podium for stock returns of global multinations in the first quarter of 2024 together with the Media & Entertainment sector (+19.0%) and Fashion (+17.9%); followed by Food (-1.4%), Metals and Oil & Gas (both +1.4%). The performance of Defense players is three times higher than the +7.1% of the world stock index, with the European groups (+42.3%) far ahead of the US ones (+8.6%).

THE DEFENSE PLAYERS SPIN

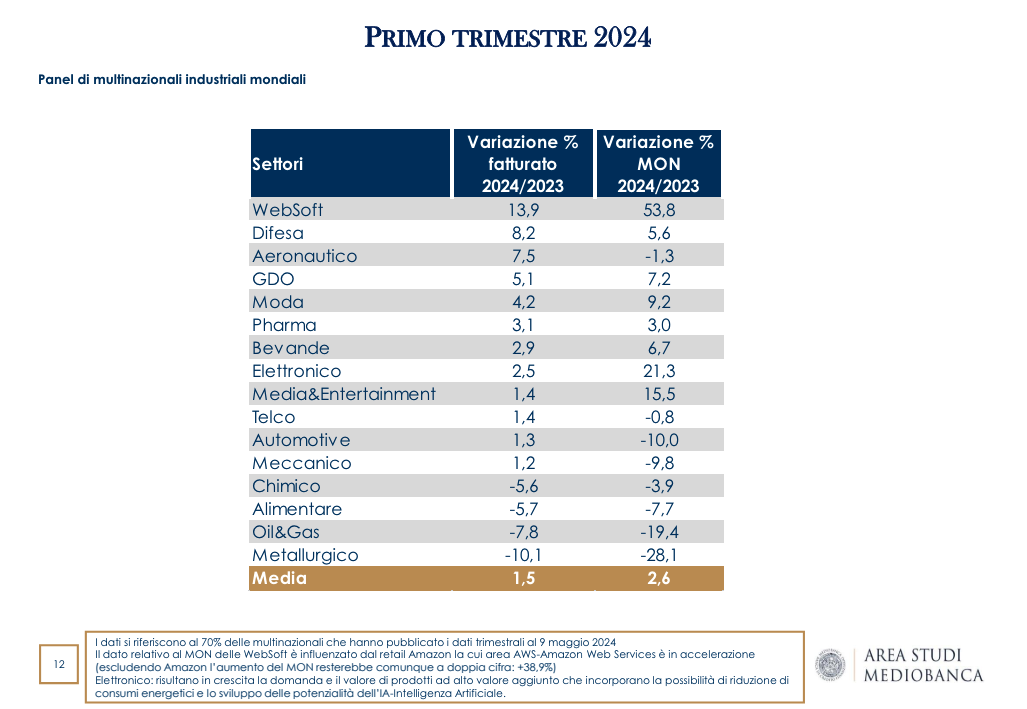

The best performances are the prerogative of the German Rheinmetall (+80.5%) and Hensoldt (+80.3%), followed by the Swedish Saab (+56.7%) and Leonardo (+55.9%), with Fincantieri ( +21.9%) in ninth place. In the same period, the turnover of the world's largest industrial multinationals grows on average by 1.5% over the first quarter of 2023. WebSoft stands out (+13.9%), followed by Defense players (+8.2%) and by aircraft manufacturers (+7.5%); revenues from Metallurgical (-10.1%), Oil & Gas (-7.8%), Food (-5.7%) and Chemical (-5.6%) decreased.

PROFITABILITY ALSO INCREASE

Furthermore, Mediobanca also shows an increase in profitability on average: in the first quarter of 2024 the net operating margin marks +2.6% y/y. Double-digit acceleration in WebSoft (+53.8%), Electronics (+21.3%) and the Media&Entertainment sector (+15.5%), with a sharp contraction in Metallurgical (-28.1%) , Oil & Gas (-19.4%) and Automotive (-10.0%).

GROWTH CONTINUES IN 2023

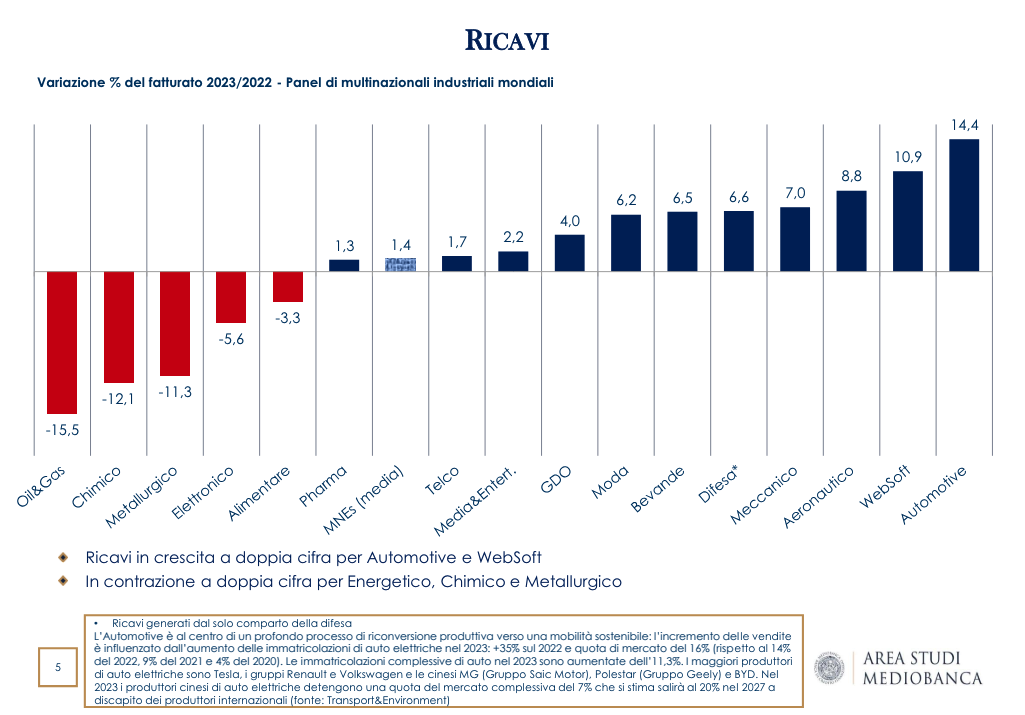

Instead, reviewing the accounts for 2023, Mediobanca notes that the revenues of the world's largest industrial multinationals are on average growing by 1.4% compared to 2022 . Car manufacturers stand out (+14.4%), at the center of a profound process of production reconversion towards sustainable mobility, and WebSoft (+10.9%), while Oil&Gas is in double-digit contraction ( – 15.5%), the Chemical (-12.1%) and the Metallurgical (-11.3%).

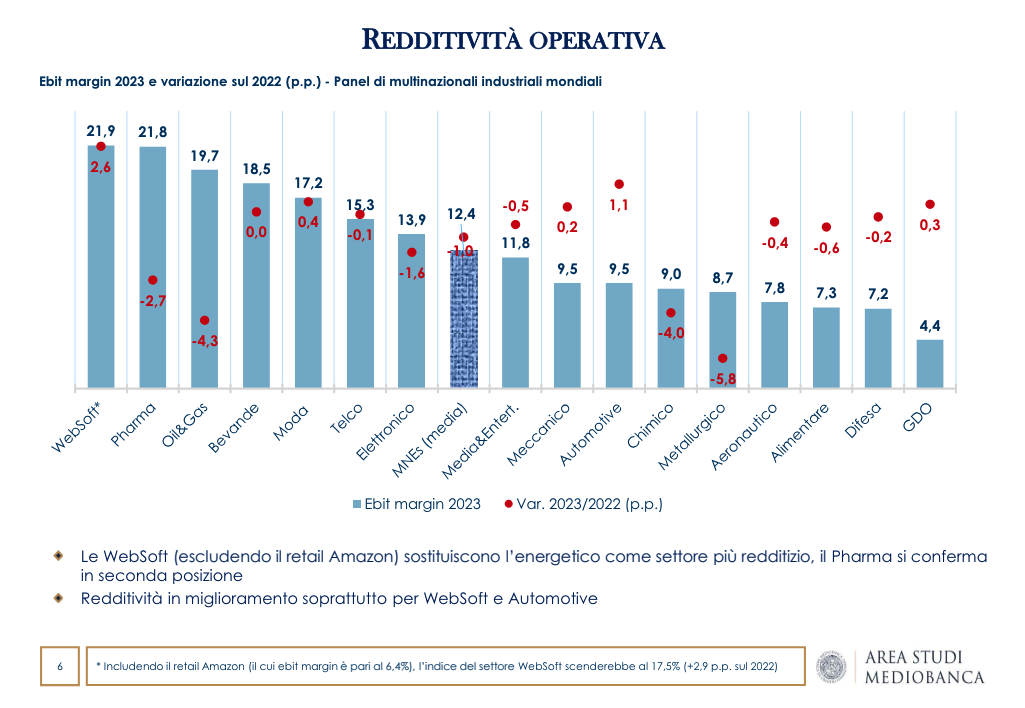

WEBSOFT REPLACE THE ENERGY SECTOR AS THE MOST PROFITABLE SECTOR ACCORDING TO THE MEDIOBANCA REPORT

The incidence of the net operating margin on the turnover (ebit margin) of multinationals is slightly decreasing, to 12.4% (-1.0 pp on 2022). Profitability rewards WebSoft with the highest ebit margin (21.9%; +2.6 pp)1, followed by pharmaceutical companies (21.8%; -2.7 pp) and Oil&Gas (19.7 %; -4.3 pp), in first position in 2022. Above average profitability also for the Beverage industry (18.5% as in 2022), Fashion (17.2%; +0.4 pp) , Telcos (15.3%; -0.1 pp) and Electronics (13.9%; -1.6 pp). Large-scale retail trade comes last (4.4%; +0.3 pp).

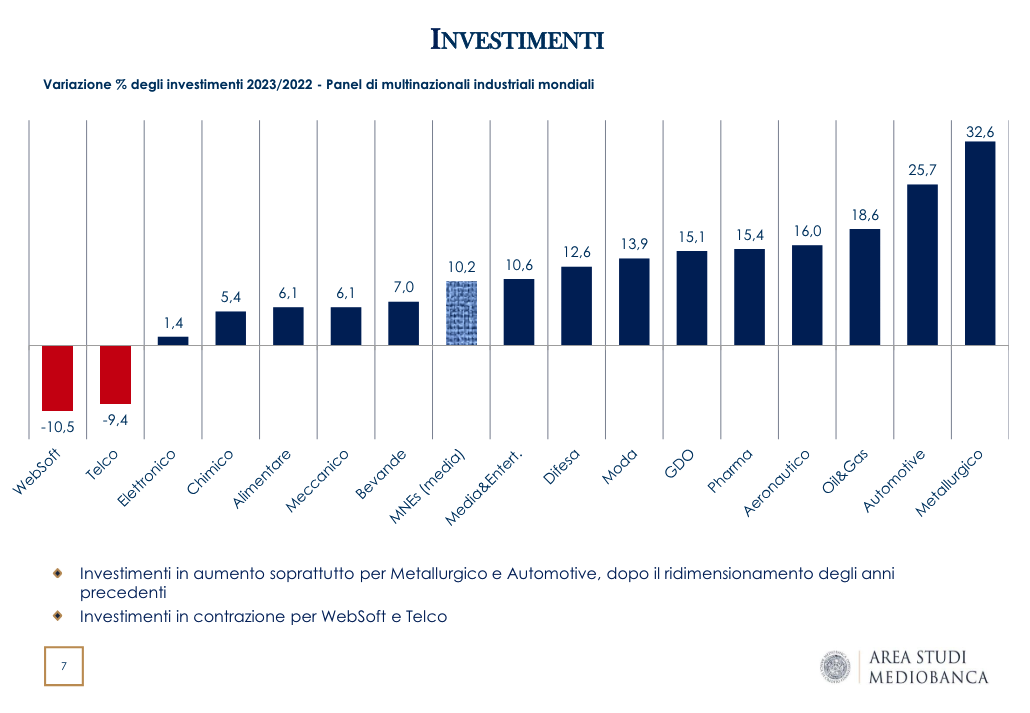

INVESTMENTS GROW COMPARED TO 2022

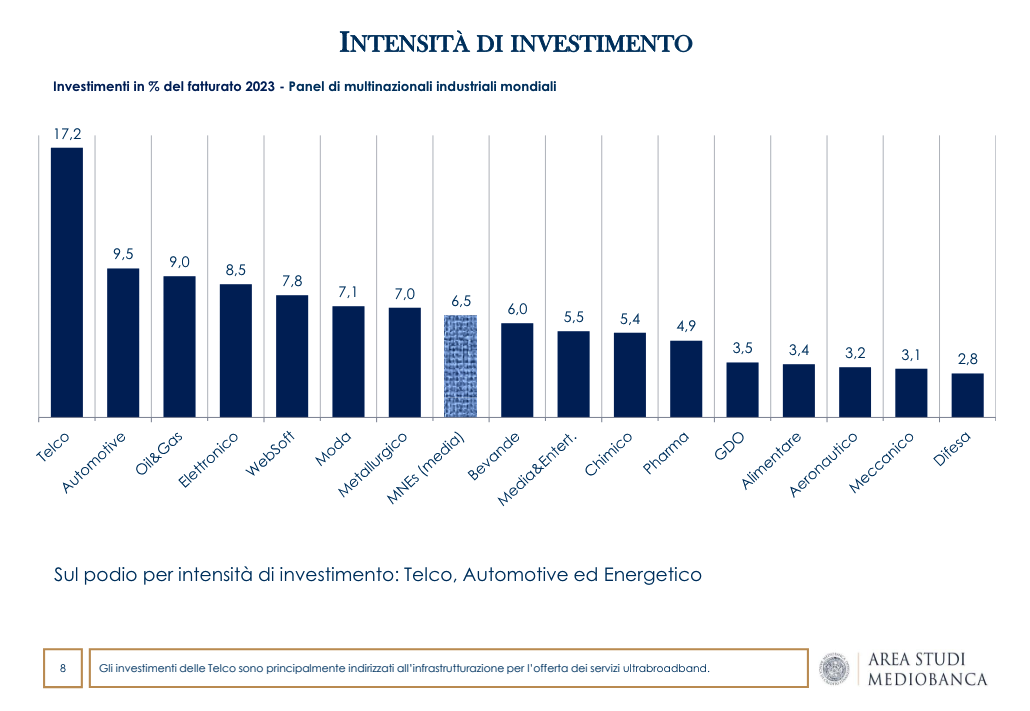

Then with regards to investments, the latter mark an average increase of 10.2% in 2023 compared to the previous year, with more evident progressions for the Metallurgical sector (+32.6% compared to 2022) and the Automotive sector (+25.7 %) and contractions for WebSoft (-10.5%) and Telco (-9.4%). On average, investments represent 6.5% of revenues, with the highest values found for Telco (17.2%), Automotive (9.5%) and Oil&Gas (9.0%).

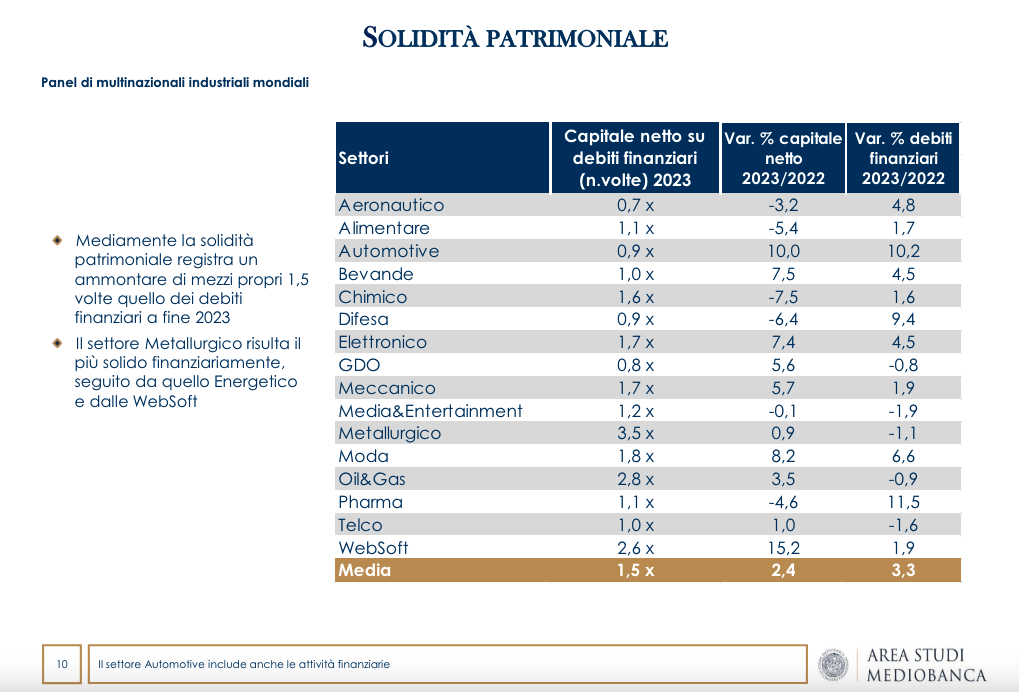

METALLURGICAL SECTOR THE MOST SOLID AT FINANCIAL LEVEL

The financial structure records an increase in equity (+2.4%) just lower than that of debt (+3.3%), with net capital equal to 1.5 times financial debt at the end of 2023. The sector metallurgical is the most solid (net equity 3.5 times debt), followed by energy (2.8) and WebSoft (2.6).

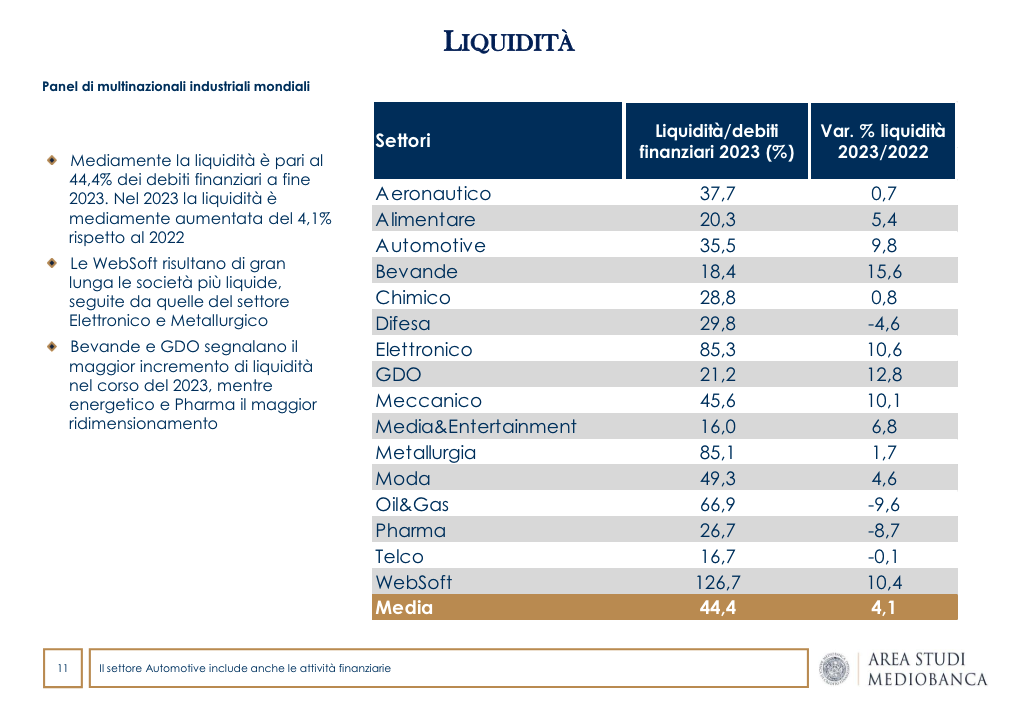

Liquidity is increasing (+4.1% over 2022) which stands at 44.4% of financial debts at the end of 2023. WebSoft are by far the most liquid companies, followed by those in Electronics and Metallurgy.

WEBSOFT, AUTOMOTIVE AND ELECTRONICS ON THE PODIUM FOR SHARE RETURN

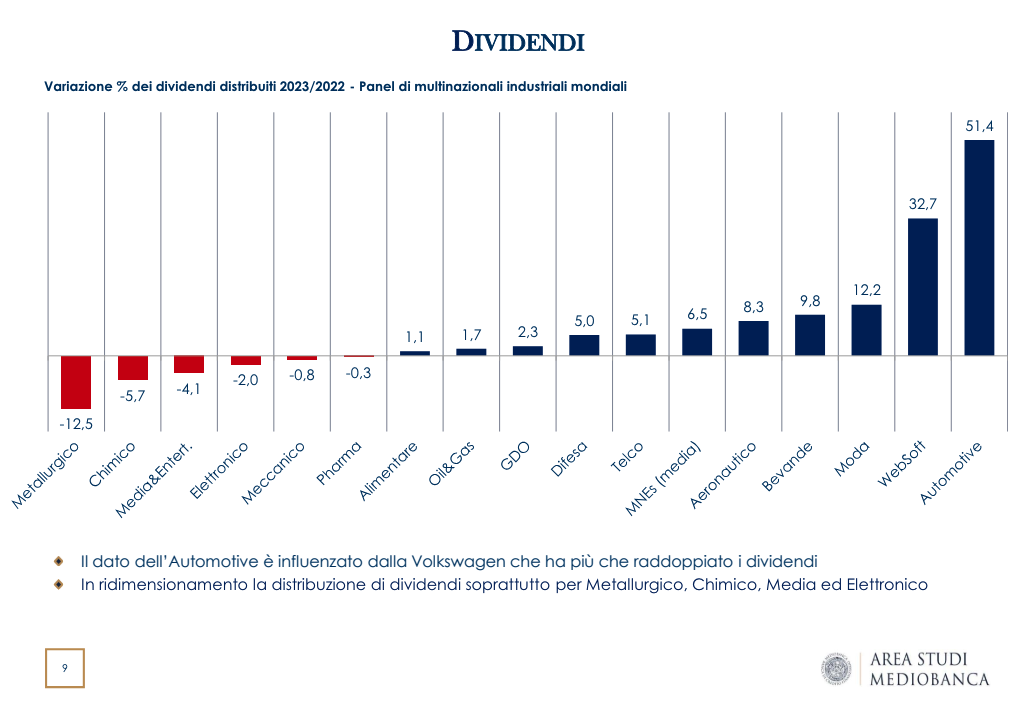

In 2023, the stock performance of industrial multinationals sees WebSoft (+70.6%), Automotive (+51.1%) and Electronics (+48.6%) on the podium, while the Beverages industry is decreasing (-4.8%) and Food (-2.1%).

FOCUS ON CAPITALIZATION

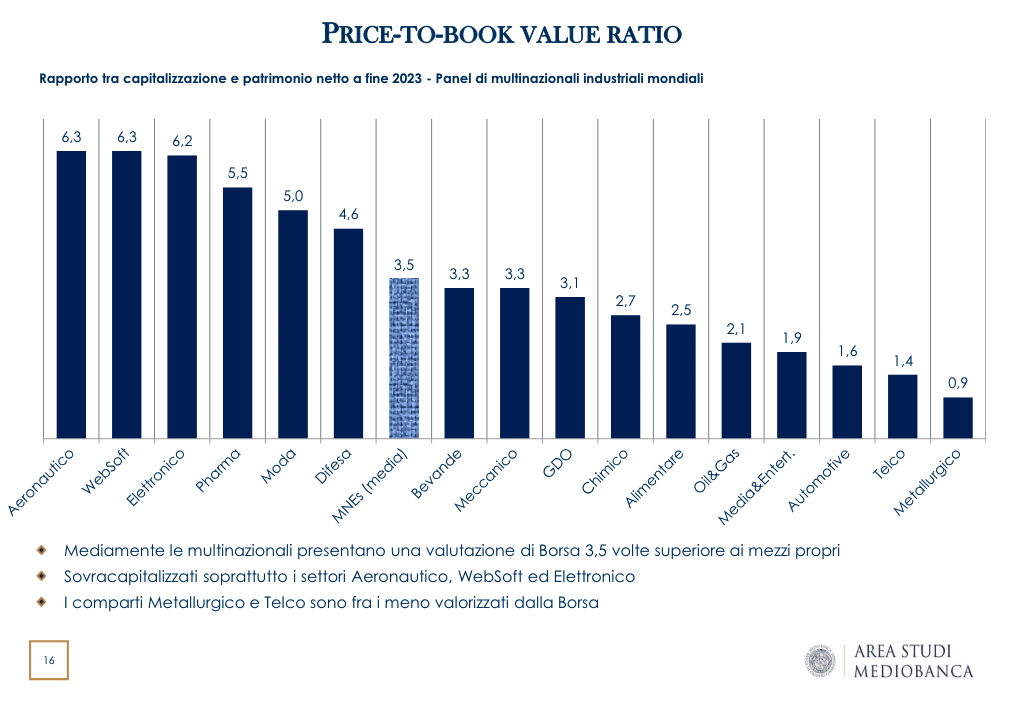

Finally, the Mediobanca report certifies that "multinationals have a capitalization equal to 3.5 times their own resources, with the highest price to net worth ratio for aircraft manufacturers (6.3), WebSoft (6.3 ) and Electronics (6.2); the Automotive (1.6), Telco (1.4) and Metallurgy (0.9) sectors are among the least valued on the stock market".

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/non-solo-difesa-ecco-come-si-arricchiscono-le-multinazionali-report-mediobanca/ on Wed, 15 May 2024 05:36:15 +0000.