Here are the effects of the aggressive ECB

What changes after the ECB's decision to raise the ECB's reference rates by 25 basis points, to the highest since May 2001. The analysis by Althea Spinozzi, Senior Fixed Income Strategist for BG SAXO

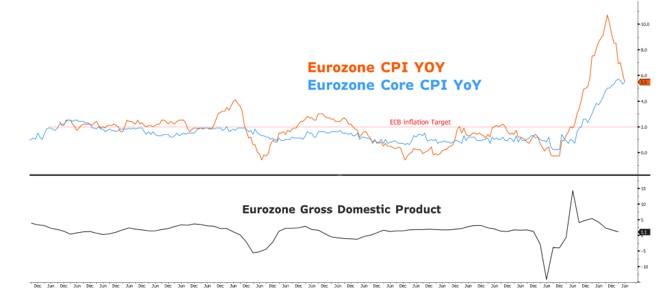

While the ECB's rate hike at this latest meeting is taken for granted, the market is starting to question whether the European Central Bank will be able to hike rates again in the autumn.

The data indicates that we are heading towards a recession. Germany's manufacturing PMI on Monday fell to its lowest level in 2008. The ECB's bank lending survey showed credit standards tightened further and loan demand fell sharply in the second quarter of 2023.

However, inflation remains an issue with core CPI at 5.5%. Not only that, but economists now expect Germany's monthly CPI to show a 0.3% rise in prices in July, which, when annualised, returns almost double the central bank's target.

The question is whether the Governing Council of the European institute will feel confident of continuing to raise rates in the coming months as well, bringing that on deposits to a peak of 4%, given that today it decided to raise the three interest rates by 25 basis points reference interest rate of the ECB, at its highest since May 2001.

Three possible scenarios

So, let's see three possible scenarios that could occur between September and October:

- Neutral meeting : rate hike by 25 basis points, fiscal policies unchanged. Indications of another rate hike depending on the data and therefore if necessary.

- Hawk meeting : rate hike by 25 basis points, fiscal policies unchanged. Governor Lagarde focused on wages and indicating that at least one more rate hike is justified to fight inflation.

- Accommodative meeting : rate hike by 25 basis points, budgetary policies unchanged. Governor Lagarde warns that this could be the last rate hike and that inflation will continue to fall as economic activity slows.

The market broadly expects the ECB to remain neutral and data dependent (option 1). However, there is a possibility that the ECB will turn to a hawkish message (option 2).

The reason for this lies in the concept of the "medium-term symmetrical inflation target" introduced by the ECB in 2021. According to this framework, inflation is equally undesirable when it rises above or falls below the target of 2%. By “medium term ”, the central bank is referring to the fact that it will not focus on short-term inflation dynamics, where deviations are inevitable.

While the ECB's inflation target has been transformed within the new framework (previously, the inflation target was "below, but close to 2%"), the adoption of this strategy was essentially a dovish move . Indeed, it is changing the way the central bank looks at the effective lower limit rate – the concept that policy rates cannot move too far into negative territory, while there is no limit as to how high the ECB can raise them . In summary: the ECB has ensured that in the midst of a recession, in which recovery is slow, it can forcefully cut rates and prolong accommodative monetary policies to avoid persistently low inflation, as we have experienced over the past decade. The above leads us to think that the ECB may prefer to hike rates now and cut aggressively later because one problem needs to be solved before tackling another. So unless the economy is in a dire state, a 4% rate spike remains a strong possibility and the ECB will prefer to steer into a hawkish stance rather than show its dovish fears.

What are the short-term consequences of an aggressive ECB?

Certainly a further flattening of the German yield curve. If the ECB maintains its hawkish stance, the market will price in another rate hike in September or October. This means that 2-year Schatz yields will resume their rise towards 3.5%. However, the belly of the curve and long-term yields could adjust lower as the odds of an impending recession increase. Bond futures will have to get ahead of rate cut expectations, moving the first rate cut from June to April next year.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/bce-aggressiva-effetti/ on Thu, 27 Jul 2023 13:29:14 +0000.