Here are the effects of the EU’s “Fit for 55” package

The analysis by Natalia Luna, Senior Analyst, Responsible Investment, and Andrea Carzana, Fund manager Sustainable Outcomes Pan European Equities at Columbia Threadneedle Investments

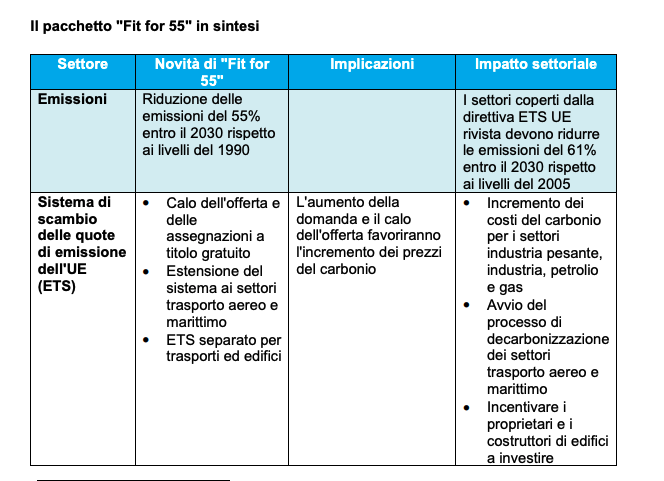

The European Commission has presented its "Fit for 55" package , proposing a transformation path that will allow the European Union to achieve the goal of reducing net greenhouse gas emissions by at least 55% by 2030. a crucial milestone to ensure that the EU reaches carbon neutrality by 2050.

The package contains a number of concrete and detailed initiatives to reduce emissions. Before being adopted, it will be debated and voted on by the European Parliament and the Member States, so not all proposals may end up becoming law. Nonetheless, it's a great place to start.

It is also interesting to analyze what has been announced and, in this case, to show how the proposed framework will benefit the sustainable themes pursued by the Threadneedle (Lux) Sustainable Outcomes Pan European Equity (SOPEE) fund.

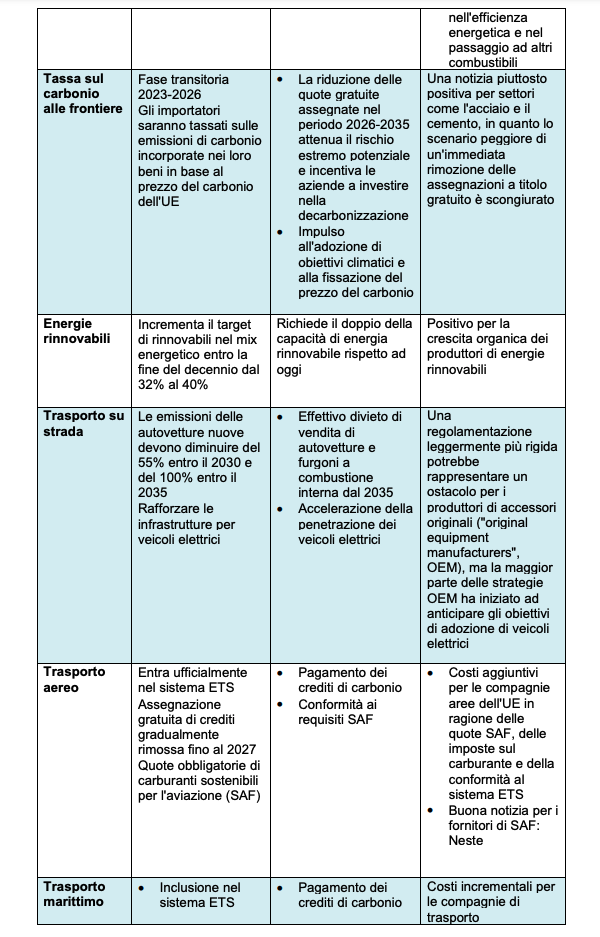

CARBON TAX AT THE BORDERS

The Carbon Border Adjustment Mechanism (CBAM) will initially apply to cement, fertilizers, iron and steel, aluminum and power generation, as well as Scope 1 direct emissions. carbon embedded in their goods based on the EU carbon price. This mechanism will apply over a three-year period starting in 2023 and could be extended to other sectors after 2026. Free allowance allocations for these sectors will be phased out by 2035, decreasing by 10% per year until to reach zero altitude. This is a positive factor for the construction sector and for CRH, a building materials company and one of the positions of the SOPEE fund, as the free emissions allowances could be removed as early as 2023. But the proposed date implies that the sector will not it will have to bear the full incremental cost of carbon before 2035, which leaves more time to accelerate emission reduction plans and adjust prices to a higher level.

The most interesting and significant aspect of CBAM is that it is a starting point, a prelude to tighter carbon regulations on a global scale. Deferred implementation could result in CBAM becoming an effective tool for accelerating other countries' decarbonisation plans, spurring more debate on global decarbonisation and more ambitious climate goals.

AIR TRANSPORT AND SEA TRANSPORT

The European Commission proposes that sustainable aviation fuel (SAF) be mixed with jet fuel on flights departing from any EU airport in the coming years in order to reduce emissions, an issue that we covered in a recent viewpoint. The new proposal calls for the implementation of increasing SAF blending quotas with a blending target of 2% in 2025, 5% in 2030 and 25% in 2035 compared to current levels of around 0.1%.

The aviation sector was also included in the EU Emissions Trading System (ETS). Sectors covered by the revised EU ETS Directive – which will see further market tightening in support of higher carbon prices – will need to reduce their greenhouse gas emissions by 61% by 2030 compared to 2005 levels. 4.2% annual reduction in free assignments based on 2010 flight levels.

These proposals will impose additional costs on the aviation sector and create winners and losers. Airlines will have to take into account the adoption of SAFs and the purchase of carbon certificates, and their success will depend on their ability to pass on costs to customers. For a company like Neste, the world's largest producer of renewable diesel and sustainable aviation fuel made from waste and residues as well as one of the positions in SOPEE, this is great news, as its SAF production will rise from 0.1 to nearly 1.5 metric tons per year by 2024.

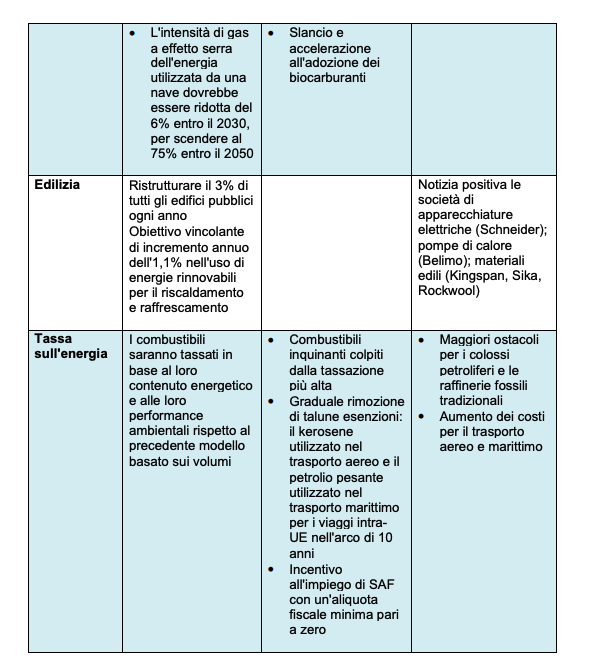

The maritime sector has also been added to the EU ETS and this will have an impact on intra-EU travel, 50% of emissions from non-EU travel and emissions from docking in an EU port. The sector will have to reduce its greenhouse gas intensity (compared to a reference value not yet determined) by 2% by 2025, by 6% by 2030, by 13% by 2035, by 26% by 2040, by 59% by 2045 and 75% by 2050.

Neither kerosene used in the aviation industry nor heavy oil used in shipping will be fully exempt from energy tax for intra-EU travel. Within a decade or so, the minimum tax rates for these fuels will increase, while sustainable fuels will benefit from a zero rate that will strengthen their adoption and diffusion.

ELECTRIC VEHICLES

By 2035, the European Union will only produce electric cars. Indeed, the "Fit for 55" package proposes that emissions from new passenger cars decrease by 55% by 2030 and by 100% by 2035. This proposal implies the gradual elimination of internal combustion vehicles by 2035, a reduction in emissions more faster than expected, which will require more sustained growth in electric vehicles. However, these goals could pose a challenge for automakers and will also require an acceleration in the roll-out of electric vehicle infrastructure, including increasing the number of charging points to one million by 2025 and to 3 million by 2030.

This is great news for semiconductor companies, crucial for such uptake. Infineon, which we hold in our portfolio, is a leading company in the power semiconductor segment, a market that is expected to experience enormous growth, as all of these proposals imply that the number of electric vehicles on the road must necessarily increase. Electrical equipment companies such as Schneider will also benefit, as they are critical to the implementation of the charging network.

BUILDING RENOVATIONS

The roadmap proposed by the Commission plans to raise the energy saving target from 32.5% to 36% by 2030. There is also a new binding target of 1.1% annual increase in the use of renewable energy. for heating and cooling; among other things, renewables will have to represent 49% of the energy used in buildings by 2030.

We have already addressed this topic in a previous viewpoint in late 2020, but the new proposals are even more ambitious. While this requirement previously only covered government buildings for renovation, now the public sector will be required to renovate 3% of its buildings each year, including schools and hospitals. However, further support policies in terms of funding, incentives and other regulations will be needed to achieve these efficiency targets.

While emissions regulations are still a short-term barrier to construction, the new EU regulation is a positive in the long run and could benefit decarbonisation leaders by offering greater access to capital and potentially a lower relative cost base. . For companies like Belimo, SIKA and Schneider, which we hold in SOPEE, this should translate into a high level of sustained organic growth with solid pricing capability. Electricity companies will also benefit, as commercial and residential buildings will be crucial for transforming energy across the grid.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/energia/ecco-quali-saranno-gli-effetti-del-pacchetto-fit-for-55-dellue/ on Sun, 01 Aug 2021 06:09:40 +0000.