Here are the sectors that (not) will restart. Report Ref

The analysis by the economist Fedele De Novellis, editor of the report Congiuntura Ref

Among the various elements to be taken into account in order to understand the characteristics of the current cyclical phase there is certainly the peculiar divergence in the trends of the different sectors, which in turn translates into a different dimension of the excesses of job offer according to the different professional skills. .The characteristics of this crisis from a sectoral point of view make it very different from all the recessions of the recent past. While traditional economic cycles are linked to fluctuations in the demand for durable goods and machinery, and fluctuations in the demand for more contained services, this time the cycle has been driven by decisions relating to social distancing, which have hit the sectors to a greater extent. services.

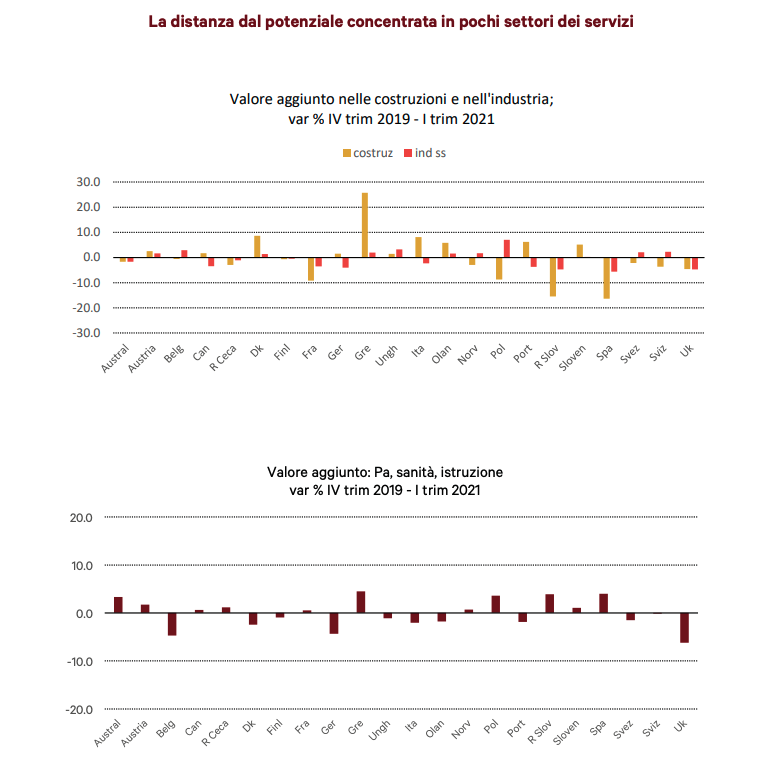

As can be seen from the attached set of graphs, which shows the variation in value added with respect to pre-crisis levels for a group of countries selected on the basis of the availability of basic data, industrial activity is now in most cases above the pre-crisis levels, or in any case presents limited distances.

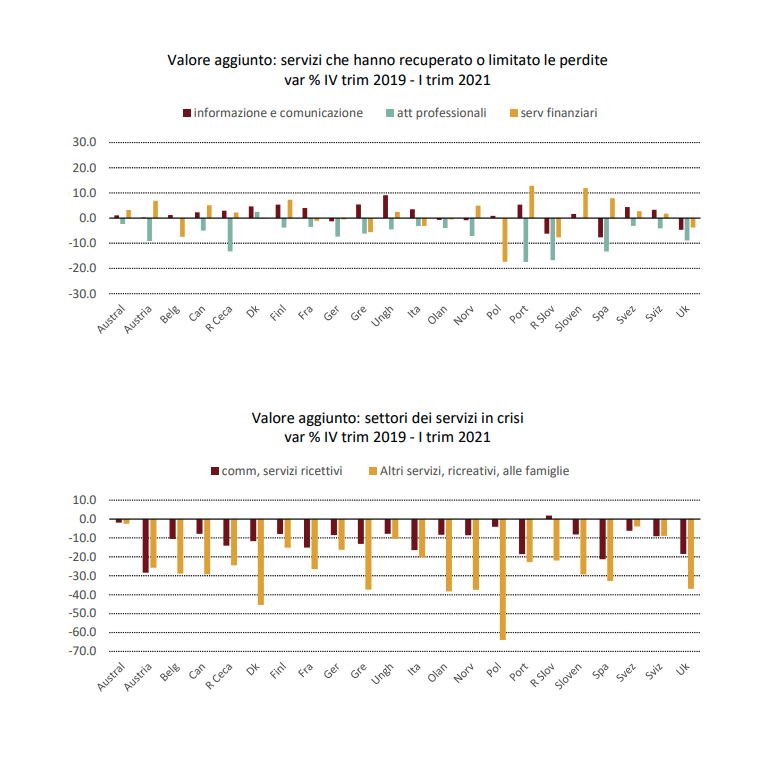

In services, on the other hand, there is still a relative distance from pre-crisis levels, but with a clear distinction between the various sectors. Using the breakdown of national accounts on a quarterly basis, the services are broken down into seven sectors. Of these there are five in which the losses are modest as the respective business has been affected by the separation measures to a lesser extent, as in the case of financial services, public administration, administrative and professional services, communications and real estate activities. . Serious losses, on the other hand, hit the aggregate of "trade and hospitality services" and that of "recreational and family services" (whose weight on the economy is still modest) which includes all entertainment activities.

We can therefore say that as we emerged from the lockdowns, the recession has become increasingly limited to a limited number of sectors, and still characterized, however, by a deep crisis.

Starting from these divergences, some characteristics of the current economic situation follow, which can be summarized as follows.

• First of all, given the marked recovery in industrial activity, the indicators of the confidence climate of manufacturing companies recorded a significant recovery, reaching high levels for some months, consistent with a phase of lively production growth in the coming months. Indicators of the degree of utilization of plants in industry have also increased a lot.

• Among the sectors where demand recovered faster following the strengthening of the industrial cycle, there are the raw materials sectors, also following the need of companies to replenish inventories, which had been reduced in the first months of the crisis.

• Furthermore, since the first phase of the recovery triggered mainly activities in the manufacturing sectors, it also resulted in a complete recovery of world trade.

• Of course, the extent of sectoral differences means that countries have differentiated trends also on the basis of their respective specialization. In relative terms, sectors such as hotels, catering or recreational services tend to have a greater impact in advanced economies, albeit with relatively different situations. Industry and the agricultural sector, on the other hand, have a greater weight in emerging countries; however, even among these there are economies heavily dependent on tourism.

THE RECOVERY AND POSSIBLE PRICES ON PRICES

In light of these considerations, some useful reflections can also be made with respect to the recent debate on inflation risks and on the most appropriate strategies for organizing the exit strategy from the exceptionally expansive policies adopted after the start of the Covid-19 crisis. . In particular, the economic scenario in the phase immediately preceding the acceleration of vaccination campaigns reveals different sectoral situations in terms of the size of the spare capacity. This means that in some sectors, economic activity has already returned to its potential, while in others the distances are significant. The paradox is therefore that by now we may have come close to specific bottlenecks, even if GDP is still far from the pre-crisis trend. Of course, this means that the risk of facing price tensions depends very much on the mix of the composition of demand that will emerge in the coming months, and therefore on the sectors that will record the greatest employment increases. If demand continues to rise in sectors that are already in tension, the prospect of a phase of labor market tensions associated with price and wage pressures would obviously open up.

However, this risk is currently low as demand is likely to increase in the coming months especially in the services sectors further back in the cycle. However, short-term frictions cannot be ruled out. This is because the logic of closures / openings tends to generate fluctuations in activity in the sectors concerned even in a very short time, sometimes within a few days; since the reactivation of entire sectors requires organizational efforts, the adjustment of the offer may not be immediate, thus generating short-term tensions on prices. However, effects of this kind should be transitory, also because the sectors still in crisis are low-capital-intensive, where the recovery in demand can be accompanied by a rather rapid reactivation of supply.

As an example, many industrial enterprises after a period of closure require massive investments and long times to be able to resume their activity; on the contrary, for activities such as those of commerce, catering or the hotel sector, the closure of a business and the opening of another, perhaps in a different place by the same entrepreneur, is an almost routine experience.

IN CONCLUSION

In summary, the analysis focused on some useful evidence to assess whether there is a risk that the output gap has narrowed, determining the conditions for a lasting increase in international inflation. The hypothesis we embrace is that there is still a significant spare capacitance in most economies, but concentrated in a few sectors. This means that, to the extent that the expected recovery in the next few months should lead to increases in demand, especially in these sectors, it is possible that it does not lead to pressure on prices. However, the speed with which the decisions relating to closures / reopenings modify the conditions of the various sectors can lead to difficulties in the timing of adapting the offer to the increased demand, triggering episodes of transitory price increases.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ecco-i-settori-che-non-ripartiranno/ on Sun, 20 Jun 2021 05:43:45 +0000.