Why does Arm beat forecasts but fall on the stock market?

Despite the good results in the quarter to September 30, Arm's stock drops by 7 percent: the company's forecasts for the coming months disappoint Wall Street analysts. All the details

On Wednesday, Arm, a British company specializing in the design of microchips, reported its first economic results since its initial public offering in September, which had brought its valuation to $54.5 billion.

ARM EXCEEDS EXPECTATIONS, BUT FALLS ON THE STOCK MARKET

Arm's results in the fiscal second quarter, which ended on September 30, exceeded analysts' expectations: revenue amounted to $806 million, compared to the $744.3 million expected by Wall Street, with earnings per share of 36 cents. .

Yet the company's stock lost about 7 percent. It has to do with the fact that Arm's expected revenues for the current quarter are (slightly) lower than those estimated by experts: Arm in fact expects earnings per share of 21-28 cents and sales of 720-800 million; analysts, however, expected a profit of 27 cents per share and revenues of 730-805 million.

THE RESULTS

Results for the period ending September 30, however, show a 28 percent year-over-year increase in total revenue. Arm reported a net loss of $110 million, due to more than $500 million in stock-based compensation from the initial public offering; in the coming quarters these compensations should amount to 150-250 million.

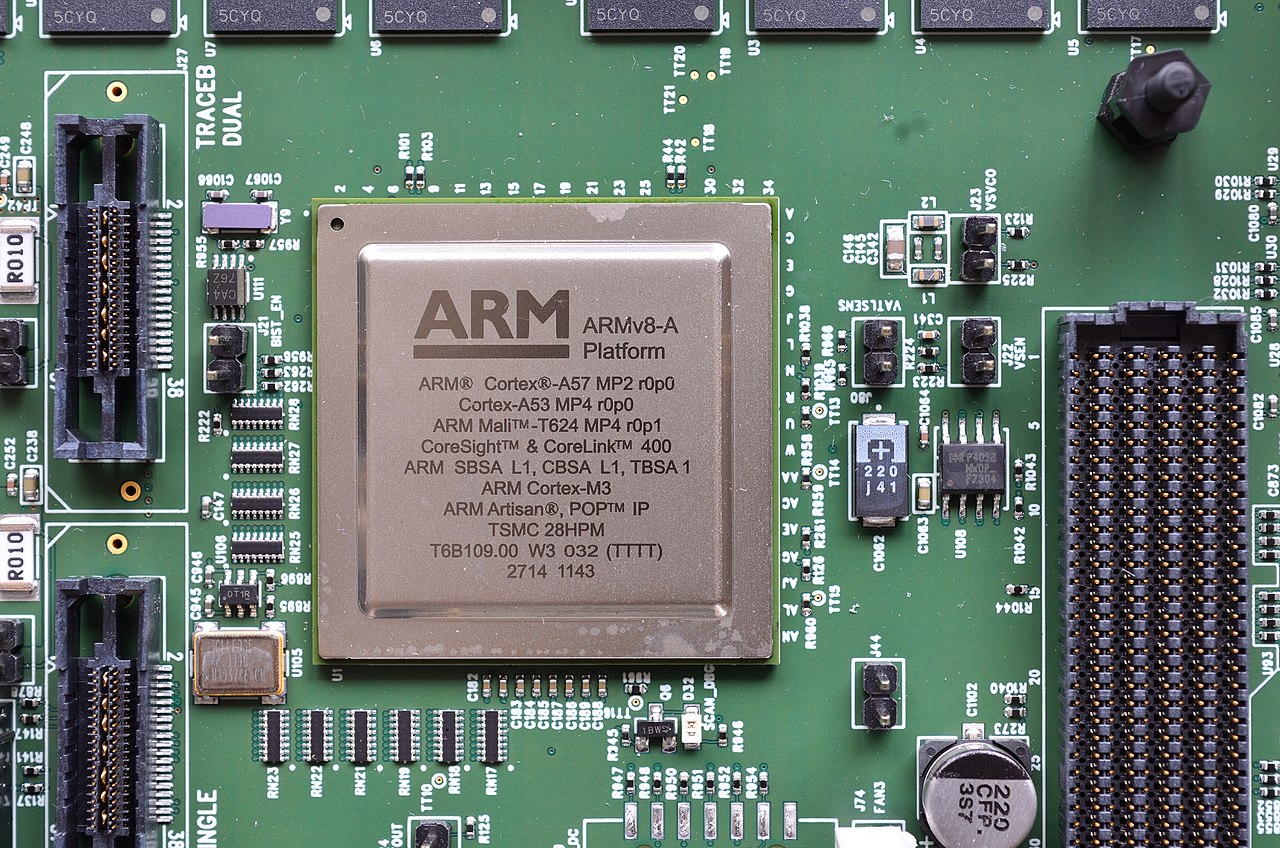

Arm does not physically produce microchips, but "limits itself" – so to speak – to designing them; it then licenses its designs to other companies, collecting a fee based on how many units are made from its designs. Chips produced with Arm's intellectual properties are present in almost every smartphone and in many computers and various electronic devices. Over seven billion Arm-based microchips were shipped last quarter.

In the three months to September 30, Arm's revenue from royalties paid by customers for the use of its intellectual properties was $418 million, down 5 percent year-on-year. But license sales were worth 388 million, 108 percent more than in the same period last year: it is a sign – reports CNBC – of how Arm is able to sell greater volumes of technology to its current customers, a metric looked at carefully by industry analysts.

The company said Google, Meta and Nvidia are all developing artificial intelligence microchips using its technology.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/arm-risultati-trimestre-30-settembre/ on Thu, 09 Nov 2023 08:45:51 +0000.