This is how much the ECB has made Italian banks flourish. Fabi Report

The banks' accounts for the first nine months analyzed by a report by Fabi, the banking federation led by Lando Maria Sileoni

The ECB makes the banks' accounts celebrate.

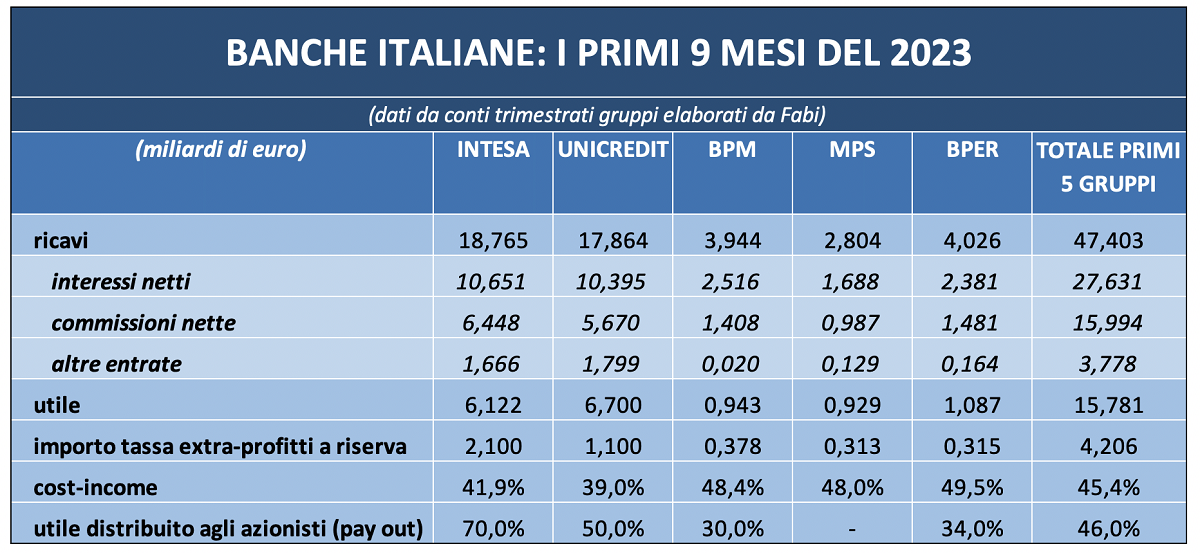

Almost 16 billion euros in profits (15.7 billion, in detail) in the first nine months of 2023 for the top five Italian banks. The increase in interest rates decided by the European Central Bank further pushes the results of the country's banking sector: the "turnover" stood, after three quarters, at 47.4 billion, mainly supported by revenues linked to interest on credit businesses and families (27.6 billion), an area that corresponds to almost double the amount collected, among other things, with commissions on services and managed savings activities (15.9 billion).

This is what emerges, among other things, from an analysis by Fabi, the banking federation led by Lando Maria Sileoni. Here are all the details of the analysis.

Compared to the total revenue, the first five groups achieved 58.3% with interest margin and 33.7% with commissions, while 8% (3.7 billion) was represented by other revenues (trading and Other financial income). A photograph, the one that emerges from the accounts of the first nine months of the year, which seems to relaunch, in the Italian banking sector, the importance of traditional activities, which had been overtaken in 2020 and 2021 in favor of commissions.

Already last year, the interest margin had once again become the main source of revenue for Italian credit institutions. As regards the tax on extra profits recently introduced by the government, all banks, including the first five groups covered by the analysis, have opted for the non-distributable reserve provision equal to 2.5 times the theoretical amount of the levy fiscal: for the top five banks it is 4.2 billion for 2023.

COST-INCOME AT 46%, IT WAS AT 62% IN 2018

The result of the accounts ranging from January to September 2023 also reveals the clear improvement in credit quality for the entire sector which translated, for the first five groups, into lower risk provisions and lower write-downs. The increase in profits and profitability, also the result of careful management on the expense front, is also reflected on the cost/income side: the average result for the first five groups is equal to 46% (ranging from 39% to 49 .5%): this parameter, which indicates the efficiency of a bank (the lower it is, the more positive), has never been so low and only five years ago, in 2018, for the entire sector, it stood at 62% average.

2023 WILL BE FRAMED: THE OBJECTIVES OF THE INDUSTRIAL PLANS ACHIEVED EARLY

The first nine months of the year gave the banks record numbers: these are the best results ever in terms of both profits and revenues. The objectives of the industrial plans were largely achieved well in advance and non-performing loans (NPLs) no longer attract attention as in the past because the quality of the credit remains decidedly good. All the main credit institutions – but in general this applies to the entire sector – have benefited from the moves of the European Central Bank and the photograph of the balance sheets speaks of two levers of growth in numbers: on the one hand the increase in the interest margin , on the other the lower credit risk (there are, in fact, few provisions and few coverages).

If we add to this the improvement in capital ratios and liquidity levels, 2023 will be a year to remember and the next two years, also according to the indications contained in the documents of the main banks, will lead to similar if not better results. Furthermore, the rise in interest rates has given banks back a now forgotten revenue channel: the interest margin has doubled for almost everyone and the unexpected part of the cost/income has never reached such low levels and with such speed. There is a golden rule that still unites the entire sector: bank top management is careful to ensure dividends, even above estimates, to remunerate shareholders, but it does not seem to be taken into adequate consideration as much as the financial effects of the crisis are weighing on family savings and assets.

SILEONI: “FINANCIAL AWARDS TO THE RIGHT WORKERS. AT THE PRINCIPALS OF 30 MILLION A YEAR, 1,000 YOUNG PEOPLE COULD BE HIRED"

“The data I presented today during the meeting at Abi demonstrate, once again, that with the new national contract important economic rewards must be guaranteed to workers. The average 435 euros per month requested by all the unions represents a legitimate request and justified both by the recovery of inflation and by the recognition for productivity. By 2020 and 2021, banks had begun to earn more from fees than from loans. With the rise in rates, everything changed already last year. In 2023 the interest margin even doubled. If anything, what the CEOs earn is a gift: those of the top 16 groups earn, overall, 30 million euros a year, a stratospheric figure that would allow them to hire up to 1,000 young people in the bank", comments the general secretary of the Fabi, Lando Maria Sileoni.

“The reduction of working hours and the participation of workers' representatives in the boards of directors of banks are two topics that are of fundamental importance for us and on which we need a clear response from the banks. As for the sale of financial and insurance products, it is essential to confirm the agreement on undue commercial pressure in 2017 in the new contract", adds Sileoni.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/banche-contri-trimestrali-analisi-fabi/ on Thu, 09 Nov 2023 15:10:50 +0000.