Here is the sting of Archegos for Nomura and Crédit Suisse

Nomura has estimated a loss of $ 2.3 billion in 2020/21. The second biggest blow related to the crisis of the Archegos fund after that of Crédit Suisse which lost 4.7 billion dollars

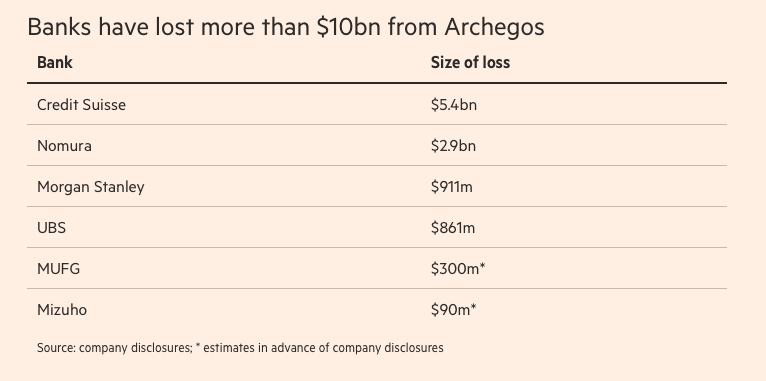

Archegos effect also for Nomura after Crédit Suisse. Bank losses due to the collapse of the Archegos Capital fund exceeded 10 billion dollars.

The Japanese financial group recorded a one-time loss of 245.7 billion yen ($ 2.3 billion) in its fiscal year 2020/21 following the Archegos debacle.

The troubles of archegos, Nomura never names when talking about an "American customer", will cause a further loss of about $ 570 million in the new 2021/22 fiscal, it said in a statement .

Nomura is in fact part of the series of banks that remained exposed to Archegos, a hedge fund and family office in New York managed by Bill Hwang, which capitulated at the end of March under a flurry of margin calls.

Nomura's is the second biggest loss after Crédit Suisse's. The elevetic group has estimated an impact of 4.4 billion Swiss francs (4.69 billion dollars) from the Archegos Capital Management affair. Credit Suisse also posted a fourth quarter net loss of approximately 1.4 billion, the largest quarterly loss since the 2008 global financial crisis.

It fared better for rival Swiss bank UBS, which said on Tuesday it had lost (only) $ 774 million from trading related to Archegos. Morgan Stanley lost $ 911 million and Mitsubishi UFJ Financial Group Inc. reported a charge of $ 270 million.

All the details.

NOMURA UPDATED THE LOSS

Nomura said on Tuesday it posted first-quarter losses of $ 2.3 billion, up from expected. On March 29, the Japanese institute warned of a possible loss of $ 2 billion "resulting from transactions with a US customer".

Yesterday, the Japanese group also specified that it had liquidated, as of April 23, 97% of its positions linked to the American hedge fund.

Nomura's last quarter closed with a loss of $ 1.4 billion and revenues down 28% to $ 1.5 billion.

Prior to the collapse of Archegos, Nomura was well on its way to record annual profit, backed by buoyant US business.

THE AMERICAN PROJECTS

CEO Kentaro Okuda has signaled that he will continue with plans to build a presence in the United States even after the collapse of Archegos which led to the company's largest quarterly loss since 2009.

Last month's implosion of Archegos reignited tough questions about whether Nomura has what it takes to achieve its goal of joining the top league of global investment banking by expanding into the United States.

THE ARCHEGOS BARREL

Like Morgan Stanley, Goldman Sachs and Credit Suisse, Nomura had funded the highly leveraged hedge fund's bets that did not go according to the fund's plans.

As a result, the aforementioned banks forced the hedge fund to sell billions of dollars of investments in order to limit exposure-related losses. However, they failed to see all the money they paid back to the customer.

Back in 2018, Goldman Sachs refused to do business with the Archegos fund. But then she retraced her steps, and like her, Morgan Stanley, along with Credit Suisse Group and other big business banks like Nomura, who channeled billions of dollars in loans to the Hwang fund.

The liquidation cost these banks $ 10 billion in losses.

Source: Financial Times

THE LOSS OF CREDIT SUISSE

Credit Suisse had to enter an expense of 4.4 billion francs ($ 4.69 billion) in its quarterly accounts, with 600 million in additional losses still expected.

The Swiss bank justified the loss incurred in the first quarter precisely with the exposure to the Archegos fund, stating that the result reflects "a significant burden, linked to an issue related to the US hedge fund that occurred in the first quarter of 2021, and which offset the positive performance (of the bank) in the wealth management and investment banking sectors ”.

The Archegos fund exposure scandal resulted in the resignation of Credit Suisse's head of investment bank division Brain Chin and the bank's risk manager, Lara Warner.

INVESTIGATIONS RELATED TO THE ARCHEGOS CASE

Meanwhile, Finma, the Swiss supervisory authority, has opened an investigation into the losses linked to the Archegos case after the Greensill crash in which Credit Suisse had already been damaged.

Regulators in the US, UK and Japan have also begun to investigate.

INCREASING NET INCOME FOR UBS DESPITE ARCHEGOS

The Swiss bank UBS instead closed the first quarter with a net profit up 14% year-on-year to 1.8 billion dollars, despite the collapse of Archegos having affected the balance sheets.

The Swiss bank also accuses a loss of 734 million dollars from the Archegos affair – the institute reported in a statement – in proportions, however, much lower than its competitor Credit Suisse.

In the results released yesterday, the Swiss group speaks of an impact of 434 million on net profit.

All remaining exposures were liquidated in April 2021 with losses related to “this incident recognized in the second quarter of 2021 of negligible entity for the group”, UBS points out.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ecco-la-stangata-di-archegos-per-nomura-e-credit-suisse/ on Wed, 28 Apr 2021 05:00:30 +0000.