Here’s how the Italian economy will go. Report Ref

The trends of the Italian economy in the analysis of the economist Fedele De Novellis, editor of the report Congiuntura Ref

Within the international scenario briefly summarized, Italy has recorded a positive trend in the past months. From the point of view of growth, the accounting data for the second quarter showed a rebound, which brought the recent performance of our economy into line with that of the other major countries in the euro area. This is a significant aspect: Italy's distance from GDP levels prior to the Covid-19 crisis is in fact close to that of France and Germany, and presents a better trend than Spain. Compared to the two largest euro area countries, we recorded a deeper fall last year, and therefore a more lively recovery in the most recent phase. Looking at the trend in aggregate demand, the accounting data showed growth in all the main components, with the exception of inventories.

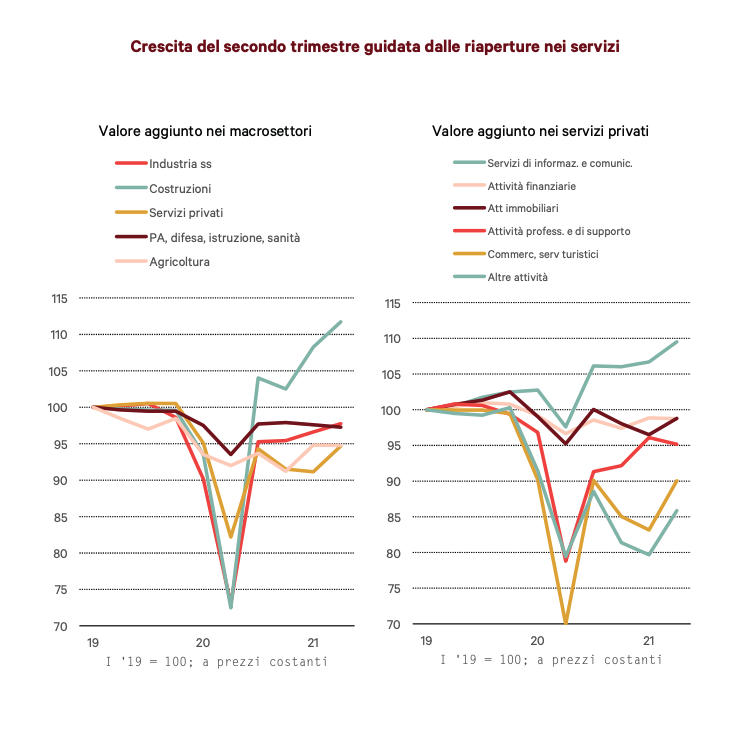

However, growth is mainly driven by the consumption of services; in fact, of the 12 billion in higher consumption compared to the previous quarter, over 10 are in services. The rebound is concentrated in the sectors where the restrictions linked to the distancing measures have been removed, and therefore mainly the hotel and restaurant sector; recreational activities also recover. Naturally, the data on the composition of demand are symmetrical to those on the sectoral evolution of value added. The fact that domestic demand has concentrated on services also explains the low elasticity of imports with respect to GDP growth, so much so that the contribution of net exports to growth is positive despite the rebound in GDP. The balance of goods and services, however, decreased, due to the loss of terms of trade linked to the increase in the cost of imports, especially following the increase in the prices of raw materials.

Beyond the specific features of the quarter, the most significant element of this phase of exit from the crisis is represented by the investment boom, and in particular for the construction sector, where the effects of the shift in private demand linked to the '' increase in the time spent at home which pushes towards greater attention to the care of the living space, to that of monetary policies (low rates on mortgages) and fiscal policies (incentives for restructuring and resumption of public works). The data for the third quarter should be in line with those of the second, even if the growth will be less lively. The data on business confidence in July-August showed a slight decline in industry, in line with what has been observed in the other major economies. The results are instead very positive in market services thanks to the reopening of activities related to tourism.

Probably in the third quarter the tourism supply chain will still record an increase in production levels, even if less marked than that observed in the second; furthermore, the industry should show a relatively stable trend in production levels after the growth in the first half of the year; the increase in GDP should therefore halve compared to the second quarter. However, considering the increase already achieved, this year's GDP growth will be higher than what is incorporated in the most recent forecast scenarios, reaching an average increase of between 5.5 and 6 percent for the year.

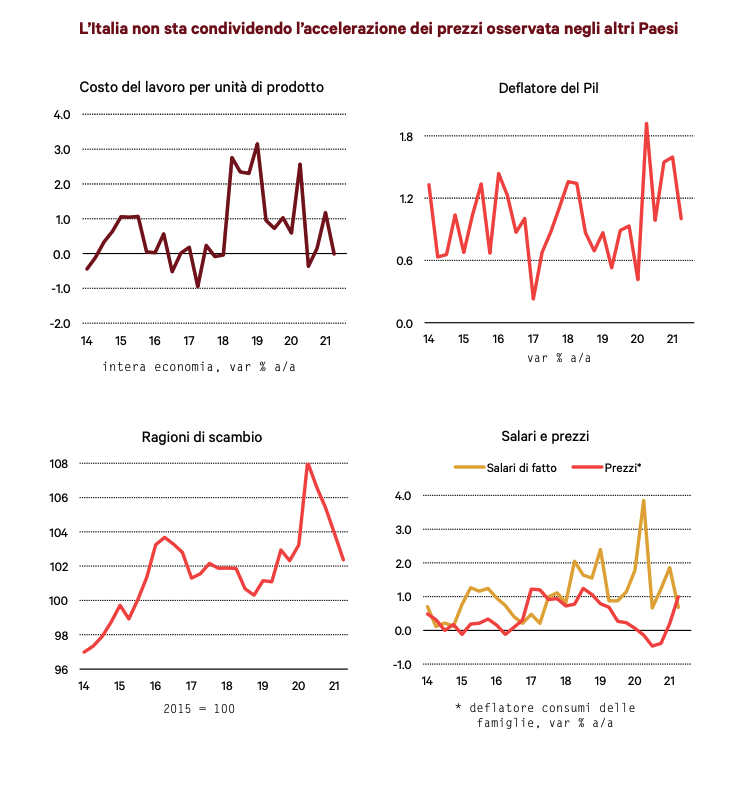

On the price side, the accounting data show that up to the entire second quarter of the year of inflation in Italy, very little was actually seen, and that little is entirely attributable to the worsening of the terms of trade, linked to increase in commodity prices. The growth in unit labor costs remained close to zero, while that of the GDP deflator barely touched 1 per cent. The low dynamics of the internal components of inflation is a result of the stagnation phase of wages; despite the recent tensions that have characterized some segments of the labor market, accounting wages have maintained a growth of around 1 per cent, which leads to a zeroing of real wages given the increase in consumer inflation. The stability of internal costs has therefore made it possible to compensate for the increase in the cost of imports linked to the increase in the prices of raw materials.

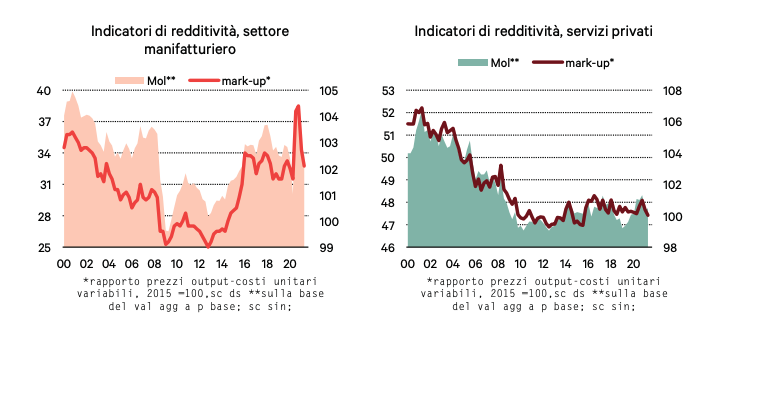

The contraction in profit margins of industrial companies also contributed to the relative stability of the price framework, which had increased significantly in the second half of last year (when, symmetrically, the fall in import prices had not been translated downwards on prices. ). These basic trends also characterized the picture of the following months; the data for July-August, as we have observed, in Italy showed much more contained increases in inflation than in the other advanced economies, and confined to the components of energy prices.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/le-tendenze-in-italia/ on Sun, 05 Sep 2021 06:04:24 +0000.