Hole in public accounts, here is the lockdown effect

Collapse in revenue from 849 billion in 2019 to 785 billion in 2020. Tax burden is increasing from 42.4% to 42.5%. All the details in the Unimpresa study

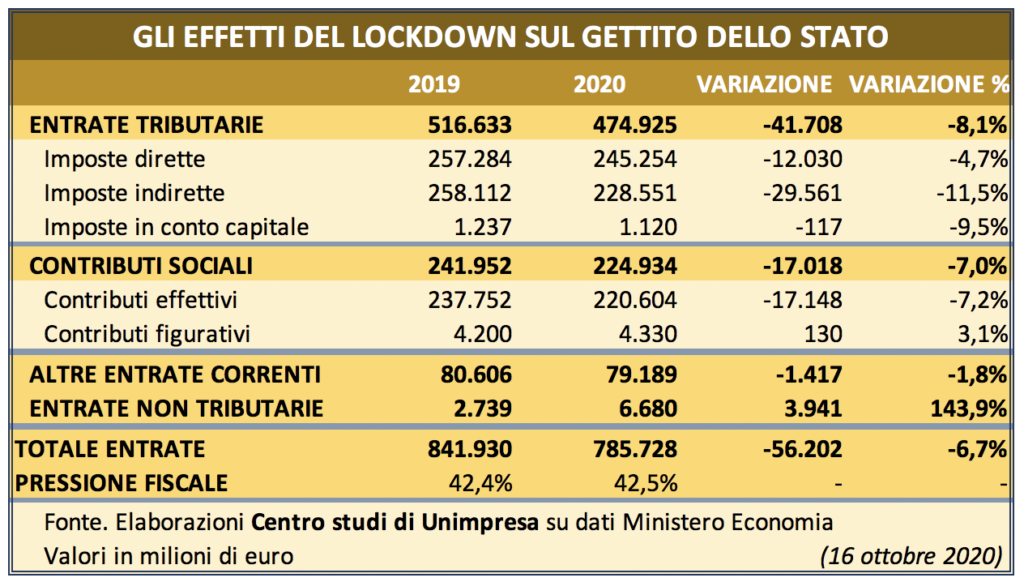

Lockdown effect on the economy and hole in the Italian public accounts of over 56 billion euros: this year 785 billion should reach the state coffers, with a drop of 6.7%, compared to 849 billion in 2019. With the country stopped , due to the Covid-19 emergency, consumption is mainly at the expense: not surprisingly, the revenue linked to VAT (the tax on purchases) should fall by over 10 billion, while direct taxes (including those on employment and corporate income) should fall by 41.7 billion, from 516 billion to 474 billion with a reduction of 8%. These are the main data of an analysis by the Unimpresa Study Center on the impact of the lockdown on the state finances, according to which the tax burden, despite the lower tax payments, will rise from 42.4% in 2019 to 42.5%. 'year.

LAURO: EMERGENCY BADLY MANAGED BY THE GOVERNMENT

“The health emergency , which caused a dramatic economic crisis, the borders of which are not yet fully known, was managed in the worst way by the government. All regulatory interventions and decisions taken, both by the premier and by individual ministers, were based on approximation and improvisation ”, comments the general secretary of Unimpresa, Raffaele Lauro. “All citizens and businesses will suffer from this managerial inability, both directly and indirectly, due to the negative effects on the state finances”, adds Lauro.

THE BACKLASH FOR THE STATE CASH

According to the analysis of the Unimpresa Study Center, which processed the data contained in the last Update Note of the Economic and Financial Document, from 2019 to 2020, due to the lockdown and consequent block of economic activities, the state coffers they will suffer a considerable backlash. The estimated lower revenue is equal, in fact, to 56.2 billion euros, with total revenues falling from 841.9 billion to 785.7 billion (-6.7%). In detail, tax revenues should drop, at the end of this year, compared to 2019, from 516.6 billion to 474.9 billion, with a decrease of 41.7 billion (-8.1%); direct taxes (including Irpef, Ires and Irap) should fall by 12.03 billion (-4.7%) from 257.2 billion to 245.2 billion; indirect taxes (the main one is VAT) will drop by 29.5 billion (-11.5%) from 258.1 to 228.5 billion; decrease of 117 million (-9.5%) for capital taxes, from 1.2 billion to 1.1 billion.

FISCAL PRESSURE: WHAT AWAITS US?

Overall decrease of 17.01 billion (-7.0%), from 241.9 billion to 224.9 billion, for social contributions; the actual ones should fall by 17.1 billion (-7.2%), while the notional ones should increase by 130 million (+ 3.1%), from 4.2 billion to 4.3 billion. A decrease of 1.4 billion (-1.8%) is also expected for other current revenues, from 80.6 billion to 79.1 billion, while non-tax revenues should grow by 3.9 billion (+143, 9%), from 2.7 to 6.6 billion. The reduction in taxes paid into the state coffers by taxpayers – both businesses and households – will be accompanied by a drop in gross domestic product, but this is not a proportional decrease, which is why the tax burden will rise from 42.4% in 2019 to 42.5% in 2020.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/buco-nei-conti-pubblici-ecco-leffetto-lockdown/ on Fri, 16 Oct 2020 13:40:52 +0000.