How and why the housing crisis threatens pensions and insurance

Althea Spinozzi's analysis for the BG SAXO Study Center on the consequences of the imminent real estate crisis

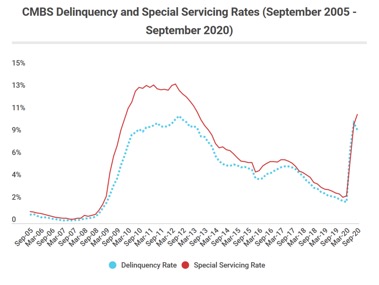

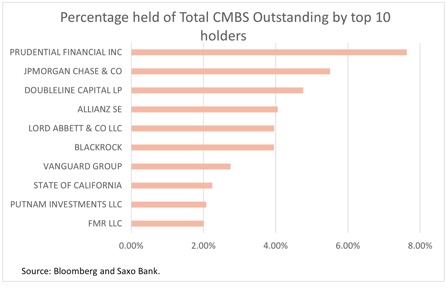

Similar to what we witnessed during the 2007 Global Financial Crisis, the next crisis could also be triggered by subprime mortgages. However, it is more likely to start with commercial rather than residential real estate. As the restrictions imposed by governments in order to deal with the spread of Covid-19 increase, the economy continues to suffer and the defaults of securities backed by commercial assets and Special Servicing rates are also increasing (the rates applied by service providers debt restructuring), causing large losses for many financial institutions. In the US, among the 10 companies that hold the largest share of CMBS (Commercial Mortgage – Backed Securities), 7 are Pension Funds and insurance companies, which means that “our” pension plans will be the first to suffer.

The term "recovery" is losing its meaning following the new wave of Covid-19 cases. Contagion containment measures are causing serious economic uncertainty and we are witnessing a recession that is getting worse every day. At this point, the market is starting to understand the irrationality of the bull market and that bearish positions, on the other hand, may outweigh what we are heading for. While the effects of the restrictions imposed by governments are easily visible economically, it is equally unclear what the event that would cause a collapse of the markets might be. Compared to what happened in 2007, in reference to the subrime mortgage crisis, the current crisis is more likely to be triggered by commercial ones.

According to Trepp, a leading data provider in the securitized mortgage industry, the number of CMBS (Commercial Mortgage – Backed Securities) defaults and Special Servicing rates (rates charged by debt restructuring service providers) are reaching maximum levels observed during the 2007 Global Financial Crisis.

Source: Trepp

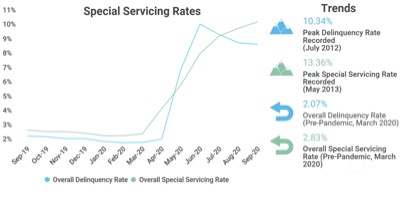

Although it would seem that insolvency rates are decreasing from the previous peak in July, in reality, some exceptions have been granted on many loans, whose judgment has therefore not been updated to "insolvent" despite these will continue to be managed by the companies of Special Servicing. It is necessary to wait a few months to better understand if these businesses are actually able to repay their debts. Therefore, the data that can be observed in the following graph could, in reality, be worse than what is shown, due to the “concealment” of elements of insolvency.

Source: Trepp

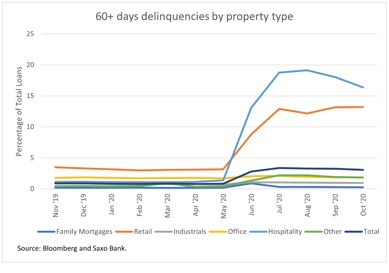

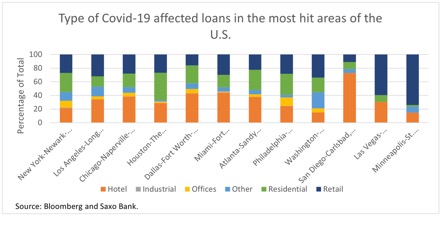

As can be seen from the following graph, however, the sectors that are suffering the most from the pandemic are those of retail and hotel activities.

This also explains why the cities that are experiencing the most insolvency cases in the US are those with the largest amount of shops and hotels.

Unfortunately, we have not been able to identify the owners of the CMBSs who have been directly impacted by the effects of the pandemic, but we have identified the American companies that hold the largest share of CMBS overall. In this way, it is possible to get an overview of what could be the companies that could be most affected by an increase in mortgage defaults related to commercial real estate.

We discovered, therefore, that among the 10 companies that hold the largest share of CMBS, 7 are Pension Funds and insurance companies; the only question we ask ourselves at this point is: too big to fail?

The ETFs that can be found on the BG Saxo platform and that allow exposure to what is described in the article are:

- iShares CMBS ETF (CMBS: arcx)

- iShares Core US REIT ETF (USRT: arcx)

- iShares Mortgage Real Estate ETF (REM: bats)

- iShares US Mortgage Backed Securities UCITS ETF (IMBS: xlon)

- VanEck Vectors Mortgage REIT Income ETF (MORT: arcx)

- Vanguard Mortgage-Backed Secs Idx Fund (VMBS: xnas)

- iShares MBS ETF (MBB: xnas)

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/crisi-immobiliare-pensioni-assicurazioni/ on Sat, 14 Nov 2020 06:33:05 +0000.