How are the prices of raw materials and foodstuffs going?

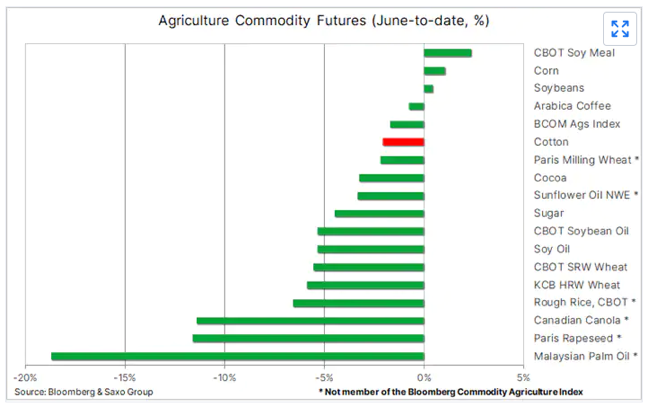

Global food price inflation has shown signs of easing since peaking in March, and we are seeing most of the major commodity futures bearish this month. The analysis by Ole Hansen, Head of Commodity Strategy for BG SAXO

According to the FAO, global food price inflation currently hovers around 23% year-on-year. The global food price index compiled monthly by the United Nations organization reached a record high in March after Russia's attack on Ukraine, a leading global supplier of high-quality wheat and the largest exporter of oil. of sunflower, has pushed prices to levels such as to touch a real food crisis.

By now, however, it can be said that concerns have begun to ease with palm oil prices falling sharply on the prospect of increased supplies from Indonesia, a major producer that has temporarily introduced export restrictions to March.

Meanwhile, harvesting winter wheat in Europe and North America has alleviated some of the supply problems caused by the lack of Black Sea shipments from Ukraine.

The prospect of a drop in prices remains weak, however, with weather concerns still the focus of attention in countries such as India and France. Also, important from a food security point of view, next winter the negotiations for Ukrainian grain exports via a protected corridor in the Black Sea have made little progress and, unless Ukraine manages to empty its silos sooner. that the next (reduced) harvest arrives, the prospects for low supply will remain so.

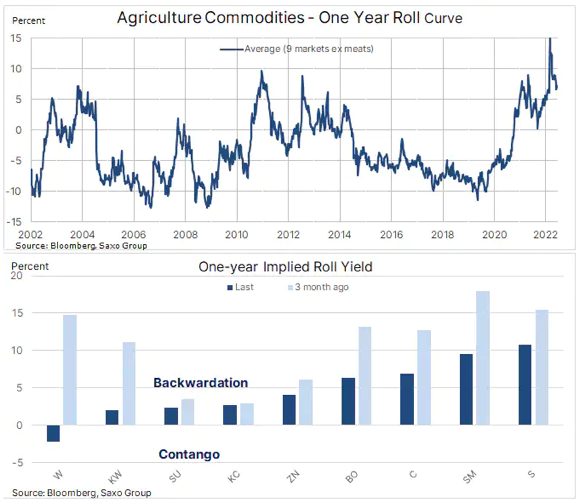

The graph below clearly shows how the agricultural market has changed over the past two years. Over a six-year period starting in 2014, the agricultural market has seen a period of broad supply driven by crop-friendly climatic conditions and low costs. During this period, the market was trading in Contago, which is the phenomenon that occurs when the price of a futures contract is higher than the price of the underlying (the spot price).

This calm period was abruptly ended in early 2020, when the pandemic led to a temporary disruption of supply channels. Furthermore, the meteorological phenomena of colder than normal temperatures in the equatorial Pacific Ocean region have begun to create difficult growing conditions, especially in South America, but also in the United States and Australia. These favorable price developments were then boosted in early 2022 by rising diesel and fertilizer costs and Russia's attack on Ukraine, a major global supplier of key food products, from wheat and maize to all. 'sunflower oil.

However, the easing conditions since the peak in March have seen CBOT grain shift from a Backwardation, when the current price, or spot price, of an underlying asset is higher than the prices traded in the futures market, close to 15% to a little Contago.

In Europe, however, the difference in the level of grain grinding remains high with a drop of close to 15%, highlighting the current challenges for the outlook for European crops and uncertainties about the outlook for new crop supplies from Ukraine next autumn. .

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-vanno-i-prezzi-di-materie-prime-e-beni-alimentari/ on Mon, 27 Jun 2022 05:20:51 +0000.