How inflation will affect the Fed

Fed Facts and Forecasts. Analysis by Jeffrey Schulze, Investment Strategist, and Josh Jamner, Investment Strategy Analyst at ClearBridge Investments, part of the Franklin Templeton Group

Key elements to remember:

- In a recovering economy, the gradual removal of quantitative easing is a step towards a return to a more normal but still accommodative monetary policy, before the Federal Reserve finally comes to adopt a more restrictive policy by raising interest rates.

- The Fed attributes the high level of inflation primarily to pandemic-related forces, suggesting that price pressures will ease as the pandemic subsides; we therefore believe that long-term investors should try harder to understand the extent to which inflation will cool.

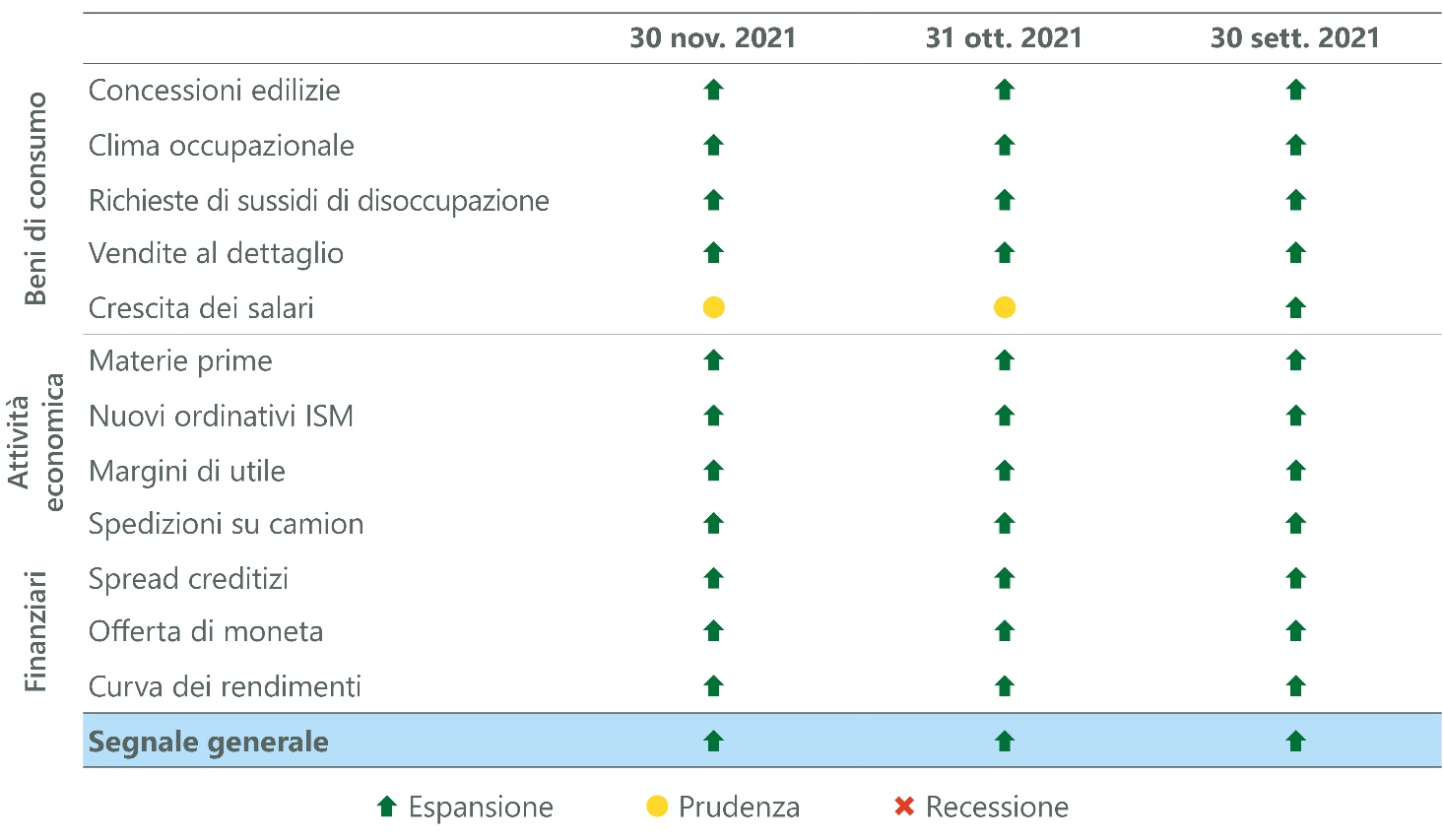

- Pending more information on the Omicron variant, two indicators on the ClearBridge Recession Risk Dashboard will be key to monitoring the effects of the Fed's tapering on financial conditions: Money Supply and Yield Curve.

Inflation forces the Fed to balance the double mandate

Last month the Federal Reserve unveiled its strategy to slow the pace of quantitative easing (QE) purchases on Treasury and mortgage-backed securities, a process known as tapering. This program was introduced at the emergence of the pandemic to support economic growth by keeping interest rates low, and has succeeded in stimulating investment and spending while reducing the cost of money. QE has been used by the Fed in recent years (and by other central banks previously) to complement its primary policy tool (the Fed Funds rate) which has been weakened by reaching the zero threshold. When interest rates have already been lowered to zero, QE is the other tool the Fed uses. With the current economy recovering, the removal of QE is a step towards returning to normal before the Fed raises interest rates.

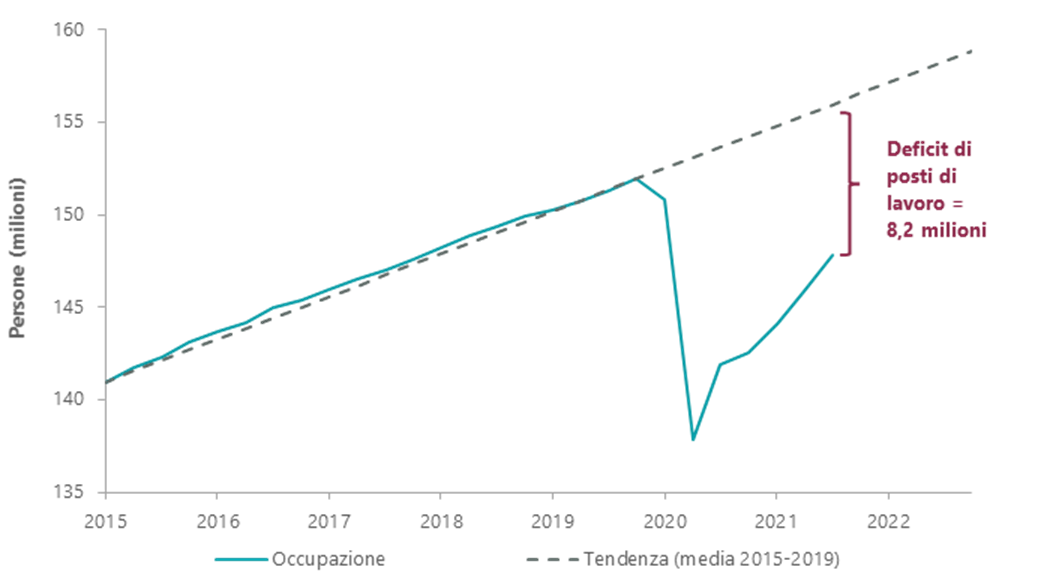

The timing of the Fed's tapering has been the subject of much debate for many months. Its dual mandate consists of stable prices and maximum occupancy. On the latter front, the total number of workers employed in the United States is 4.2 million below the pre-pandemic peak. Progress, however, continues at a steady pace, as evidenced by the 531,000 jobs created in October as well as the substantial positive revisions of the previous months. Thinking about the level that the labor market "could have reached" without the pandemic, that is, assuming the continuation of growth in line with the pre-pandemic trend, the employment deficit or output gap is even more marked: 8.2 million jobs missing jobs. This issue, one of the main issues the Fed thinks about in planning a policy renormalization, may explain why it has been so patient so far. In a recovering economy, the removal of quantitative easing is a step towards a more normal but still accommodative monetary policy before rate hikes occur.

The other component of the dual mandate is to pursue price stability, which has been a central element for investors and market watchers in recent months. In October, on an annual basis, the consumer price index reached 6.2%, the highest level in the last 30 years. Core spending on personal consumption – the Fed's preferred inflation parameter – recorded a more moderate 4.1%, which however remains the highest figure in the last 30 years. This is likely to be well beyond tolerable from a flexible average inflation target perspective. However, the Fed continues to attribute the high price growth primarily to pandemic-related forces, suggesting that inflation will subside as the pandemic subsides.

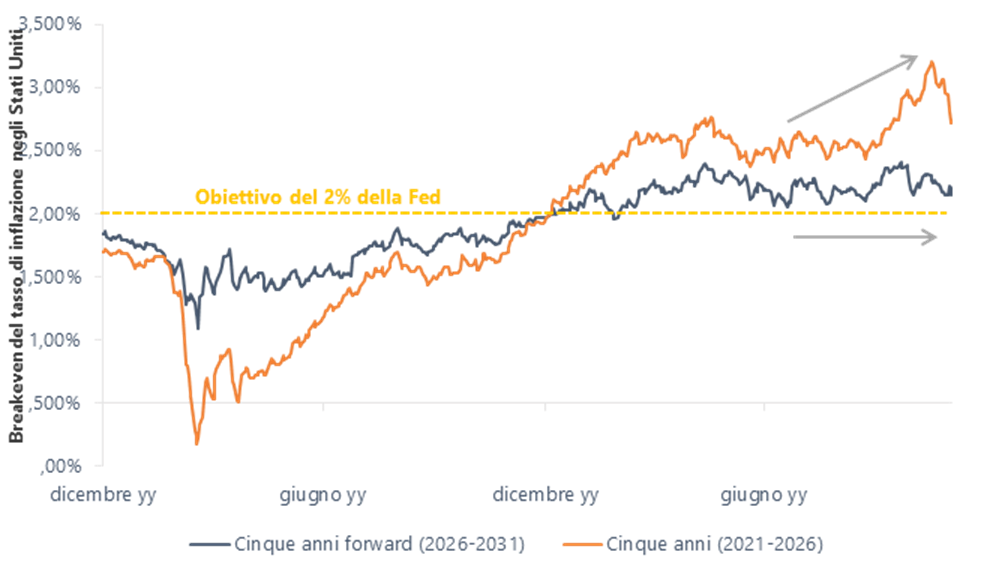

In our view, long-term investors should primarily look at how far inflation will cool. Many components of inflation that are less affected by the pandemic have been running longer in recent months, even though they suggest price increases of around 2%. Consequently, one of the key debates in the financial markets concerns the level that inflation will mark in the second half of 2022, in 2023 and beyond. The idea prevails that inflation will remain high, or even increase further in the coming months, before cooling down. Financial markets currently support this view and breakeven rates – inflation levels corresponding to Treasury and TIPS yields – suggest a slowdown in inflation next year.

It is important that the Fed stressed that politics does not travel on automatic pilot: the pace of tapering could accelerate or slow down if inflation or economic conditions justify such an adjustment. In a passage, Powell recently suggested that the Fed should consider accelerating the pace of QE tapering in December, despite the unknowns associated with the Omicron variant. The intervention caught some investors (including us) off guard, as many initially assumed that Omicron would reduce the chances of an acceleration in Fed tapering given the unknown risks to the economy.

It is reasonable to think that this variant may turn out to be far less dangerous than feared, but the perception that the Fed may not protect investors as much as in the recent past has triggered a spike in volatility. It's an understandable reaction when we consider the combined risks of a more aggressive Fed and Omicron, but it also foreshadows a possible rebound in risky assets if the tensions produced by the new variant dissolve. Pending more information on the variant, two indicators on the ClearBridge Recession Risk Dashboard will be of paramount importance to monitor the effects of Fed tapering on financial conditions: Money Supply and Yield Curve. Currently, both remain in expansionist territory, but on closer inspection with a "less green" signal compared to several months ago. That said, there were no changes to the dashboard this month.

Taking a step back, business leaders must be credited with making possible one of the fastest recoveries from one of the deepest recessions on record. No policy response is perfect, but in March 2020 it would have been hard to imagine that financial market prices would more than double from their lows in just 18 months. Faced with the recovery in the labor market and the rush of inflation, the Fed decided it was time to renormalize the policy. Most importantly, in Q4 the Atlanta Fed nowcasting model (GDPNow), designed to gauge US real intra-quarter growth, currently estimates GDP of 9.7%. The squeeze has officially begun, but we must not forget that tapering is equivalent to taking your foot off the accelerator and not stepping on the brake pedal – as happens when you increase rates.

The Fed remains extremely dovish from a historical perspective given the robust economic environment. Assuming we can avoid the worst-case scenario, that of a variant that renders vaccines ineffective, we believe that any correction would be a great entry point for investors in this mid-term start of a new economic expansion.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-inflazione-influenzera-la-fed/ on Sat, 01 Jan 2022 06:03:27 +0000.