Because Omicron’s impact on the financial markets will not be very short. Moneyfarm report

Omicron. Micro variable, maxi impact? The analysis by Richard Flax, Moneyfarm's Chief Investment Officer

Financial investors are not virologists, but unfortunately they have their own opinions, explicit or not. To reuse an old example, in April 2020, with the markets on the swing, investor decisions actually reflected sentiment with respect to the trend of Covid, at least in economic terms.

When they bought risky assets, they believed that the economic impact would somehow be managed. If they were selling it meant that they were pessimistic about the evolution of the epidemic. An investor could reasonably argue that, without a clear idea of the evolution of the pandemic, the right thing to do is to sell. But relatively few investors have the opportunity to liquidate all their assets and history teaches that intercepting the right moment to re-enter the markets is anything but easy. So, like it or not, most investors will have to express an opinion on the Omicron variant.

What should we think, then, even if we are not virologists? The first certainty is that the data are still very premature. The variant is too new, the data is insufficient. But, having unmarked this non-secondary clarification, there are some points that are worth touching on. First, the consensus seems clear enough that transmissibility is higher than previous variants. Secondly, the lethality of the variant is less clear, also due to health interventions (vaccinations or boosters) and the prevalence of cases among young people which make it difficult to assess the actual risk of the disease in the groups most at risk. Third, a combination of high transmissibility and low severity can still cause significant economic and social damage, at least in the short term, as various services can struggle due to resource scarcity. Consider that in the countries where the Omicron infection is more advanced, hospitals are under pressure not so much because of the too high number of patients, but because of the numerous defections due to illness of medical and health personnel.

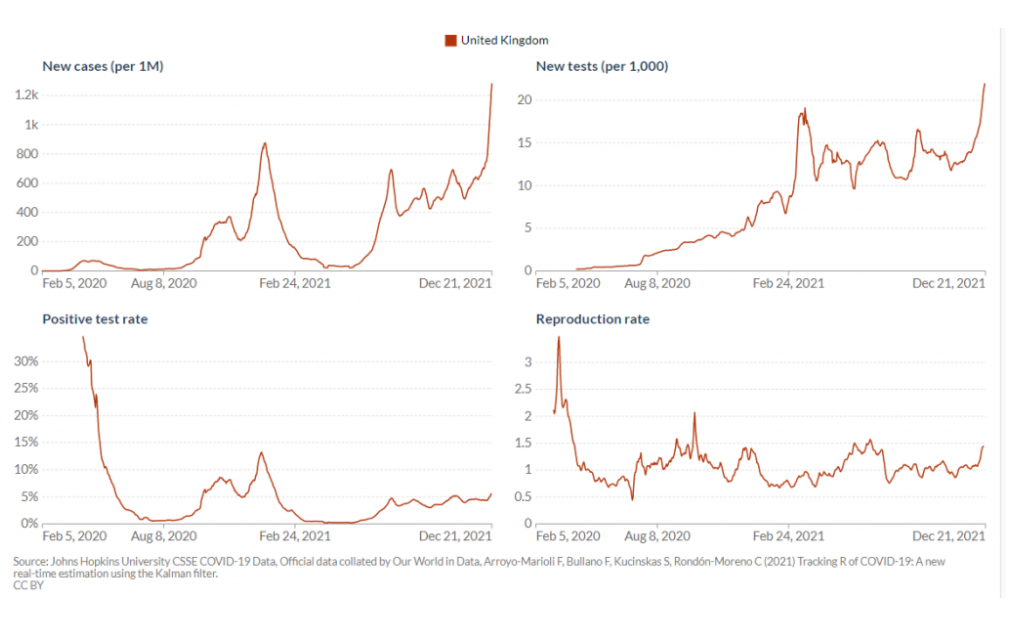

Still looking at the UK, the graphs below, which come from Our World in Data, suggest some interesting nodes. New cases have increased, as has the number of tests. The rate of positive tests hasn't moved much, which could suggest that increased testing is behind at least part of the increase in cases.

The next graph shows hospital admissions in the UK. This is a fundamental fact: the capacity of the national health system is the special observation that could trigger any restrictive measures. Fortunately, we have not seen a large increase in the number of hospital admissions so far. It could be a matter of timing (as Imperial College suggests) or a sign that Omicron's impact won't be as severe as previous variants.

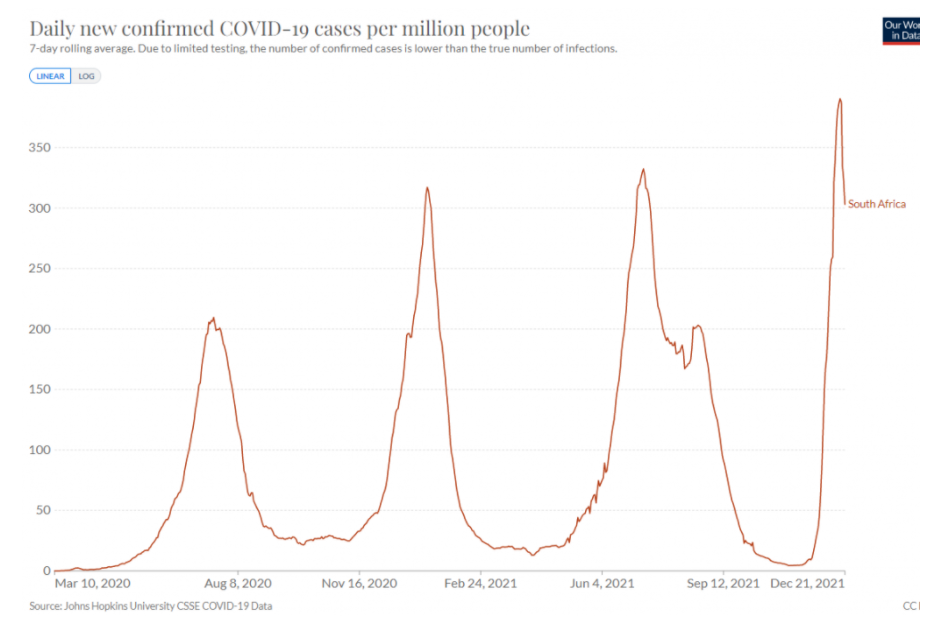

Finally, for those feeling optimistic, one could look at the number of confirmed cases in South Africa, one of the first countries to identify the Omicron variant. Initial data tell us that the number of confirmed cases per million people, although starting from a very high level, has started to decline.

It's early to deliver a verdict, but there are some signs of cautious optimism. Markets will focus not so much on new case data as on hospital capacity, and this is the metric to focus on. For now, we believe that Omicron's own impact on financial markets will be relatively short-lived and therefore we have not felt the need to make any changes to the positioning of our portfolios. We will continue to monitor the data in the coming weeks.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/perche-limpatto-di-omicron-sui-mercati-finanziari-non-sara-brevissimo-report-moneyfarm/ on Sat, 01 Jan 2022 06:10:37 +0000.