How the central bank anti-crisis vaccine will work

Does the vaccine come from central banks? The comment by Andrea Delitala, Pictet Asset Management's head of euro multi asset .

We analyzed the possible evolutions of the Covid-19 pandemic with Professor Massimo Galli. Also on the basis of what the Professor shared, we then outlined the macroeconomic and market scenario, in a context in which the economy and markets seem to follow paths that are in many ways separate.

MACRO SCENARIO

They will probably be surprised at the International Monetary Fund to see the speed of the economic recovery after the shock caused last winter by the COVID-19 pandemic. If already at the time of the publication of the World Economic Outlook in June, the forecasts of the international organization had seemed somewhat pessimistic (almost -5% of global GDP in 20201), today, after a summer of better than expected macroeconomic data, the scenario outlined by the IMF seems fortunately averted, at least for the moment. As an example for comparison, Pictet AM's recently revised upward estimates predict a global GDP contraction of around -4% this year, followed by a sharp rebound in 2021 (over + 6%). Therefore, at least in the forecasts, the much coveted "V" recovery scenario seems to materialize, where the minimum point of this "V" seems even less deep than initially assumed.

This is a scenario that mainly rewards the emerging countries, in particular the Asian ones, favored both by a better management of the health emergency (with the exception of India, which has recently fallen back into chaos) and by a lesser dependence of their economies on the services sector, the most affected by the crisis: the tertiary sector represents, in fact, only 50% of the GDP of these countries, against 70% for the developed countries.

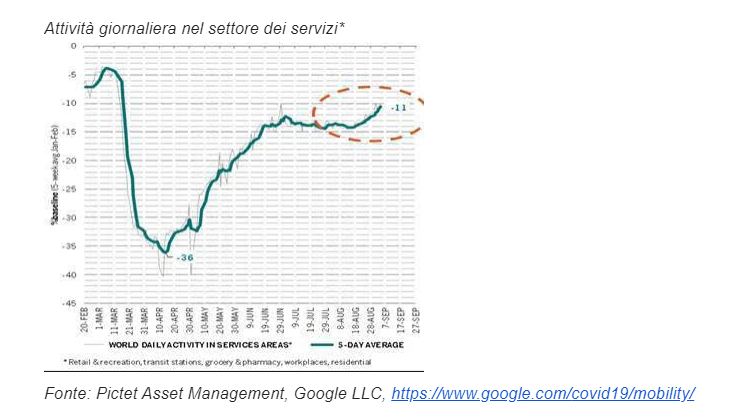

In fact, services show a less stentorian recovery dynamic, as they are more linked to the mobility of people, and despite the fact that real-time indicators of daily activity in the services sector started to rise again in August, these are still below pre-Covid levels.

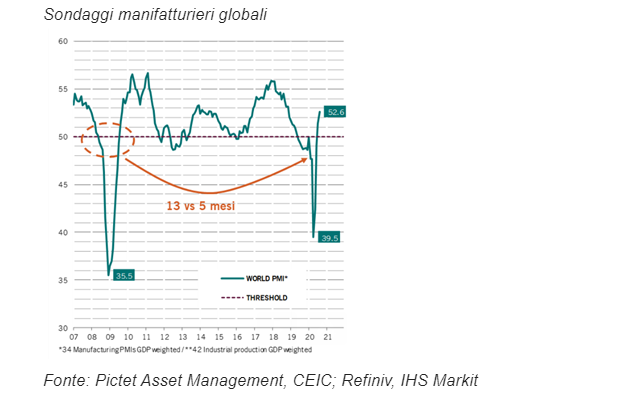

On the contrary, in the manufacturing sector the recovery in activity was decidedly faster, exceeding even the rosiest expectations: globally, SMEs took only 5 months to return to expansion territory (beyond the 50 threshold), a a path that during the last great crisis of 2008-2009 had been completed in 13 months. It should therefore come as no surprise that China, the main manufacturing power in the world, is currently the only country that has returned to GDP levels at the end of 2019, clearly also due to the fact that it was the first to enter a state of emergency and then to get out effectively.

POINT ON THE PANDEMIC

However, the improvement in the economic context does not allow us to let our guard down. The risk of a second wave of infections from Covid-19 remains and is very real. The number of cases has risen in recent weeks and intensive care is returning to a worrying crowding, requiring the authorities to remain vigilant and balanced in balancing the economic aspects of the pandemic with the social and health ones. On the medical front, in any case, today we have elements that allow us to face the health emergency with greater preparation than in the past. First of all, we are aware of the fact that the virus is in circulation, unlike what happened in the first wave in which it had circulated freely for 3-4 weeks. It seems trivial, but this involves the adoption of more virtuous behaviors in terms of social distancing and greater protection of the population groups most at risk, the elderly and people suffering from other diseases, i.e. those people who could more easily clog intensive care if came into contact with the virus. If for a real vaccine, according to the authoritative opinion of Professor Massimo Galli, it is impossible to make precise predictions on the timing of realization and on the efficacy or persistence over time of the neutralizing antibodies produced, on the other hand we now have therapies that are they have been shown to be effective in limiting the effects of the infection, while not acting on their cause (they are not, in essence, aetiological, but rather symptomatic, therapies).

ECONOMIC POLICIES

As Remdesivir has proved to be one of the most effective drugs so far in curing the effects of Covid-19, the liquidity injected into the economic-financial system by central banks around the world, combined with a mix of supportive fiscal measures by the governments, has on the one hand protected the real economy but above all supported financial activities: it is in fact known that excess liquidity (or that which is not absorbed by economic activity) feeds equity and bond valuations. In this regard, however, it should be noted that the peak of liquidity injection seems to be behind us, above all due to the slowdown in the expansionary maneuvers of the Fed and PBoC which, as is done with a patient who shows signs of recovery, are starting to reduce the amount of treatment administered. But the central banks themselves have developed a real tonic for the financial markets: the guarantee of a persistently accommodative stance. If, in fact, the lack of initiative shown by the ECB in the meeting of 10 September, in which no monetary easing measures were adopted to counter the strength of the euro, it is also true that the bank's commitment central to guaranteeing and supporting the region's public and private debt has never failed. The specific QE (PEPP) remains fully operational and perhaps will also need to be increased given that in Europe part of the fiscal policy support, that provided by the Commission (Next Generation EU), will only arrive in the course of 2021. But the substantial change in monetary policy it took place on the other side of the Atlantic Ocean. During the annual Jackson Hole meeting, Fed President Jerome Powell announced a historic change in the mandate of the US central bank: a new definition of the inflation target was adopted, again at 2% but no longer just prospective (ie indifferent to the past) but based on the average inflation targeting over a period which also includes the measurements of the past months. Although details on the method of calculating this average level have not yet been disclosed, it is a move, in some ways announced, which makes official the Fed's more relaxed attitude towards inflation. Indeed, it leaves open the possibility that inflation will push more or less steadily above the threshold, once considered healthy, of 2%, without the central bank offering resistance. All other things being equal, therefore, the Fed will wait longer before raising reference rates even if inflation were to rise rapidly (once productive resources are fully utilized again, i.e. towards 2022), especially if it comes from prolonged periods of low inflation like the current one. Thus officially postponed the first rate hikes, which today seem even more distant, the end of the era of preventive restrictions was sentenced, i.e. the Fed's monetary tightening that anticipated the appearance of an upward trend in inflation (as occurred between 2015 and 2018, for example). The move announced by the US central bank has further implications, primarily with regard to the labor market. Partly set aside the binary objective of price stability and maximum employment, the latter assumes an even more central role in defining overseas monetary policy. This is certainly an encouraging sign in a historical moment in which the unemployment rate in the United States, after having reached a peak of 15%, stands at 8.4% according to the latest non-farm payrolls data at the beginning of September (also if many of the current unemployed, about 6 million, are considered “temporary”, ie able to recover a job within 6 months).

FINANCIAL MARKETS

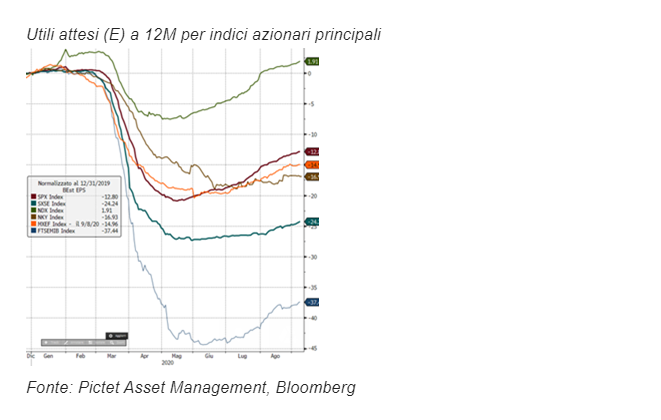

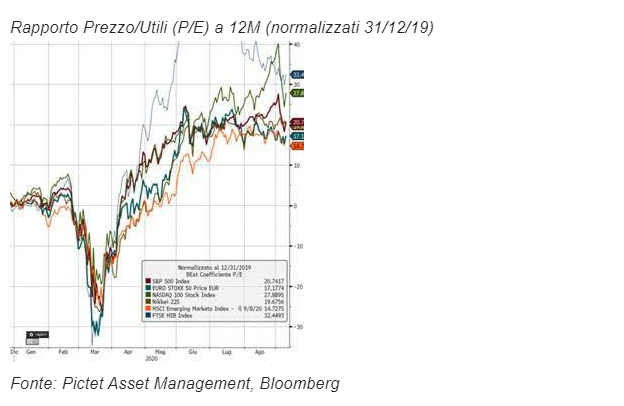

In the economic scenario outlined, clearly improving, but still extremely uncertain and in any case recessive, the unbridled rush of the stock markets from the lows of mid-March seems to confirm the effectiveness of the treatments administered by central banks and governments. In fact, the reduction in real rates down to -1% (-0.5% since June) on US 10-year TIPS is due to an increase in inflation expectations (break-even) with the same nominal yields to maturity. This drove all financial valuations allowing for the continued expansion of multiples (price / earnings ratio) despite a slight increase in equity risk premiums (earnings' yield – bond yield).

The partial withdrawal of liquidity by the Fed is probably a contributing factor to the recent market correction, which has particularly affected the tech sector, the protagonist and driving force of the rally up to now and on which investor positioning was very concentrated, triggering a profit taking phase. The limited scope of the market movement makes it difficult, at the level of portfolio construction, to identify assets capable of effectively protecting: the classic decorrelators, such as bonds, VIX and yen, have in fact reacted in a limited way to the reversal of the last sessions, imposing highly tactical management of equity exposure.

On the other hand, valuations on the Nasdaq had reached outliers. Although earnings reviews for index companies had been rising for months now (more decisively than the rest of the US market and anticipating European stock exchanges), inflating the denominator of the tech sector's price / earnings ratio, this was was pushed to stellar levels by the rush of the lists. From this point of view, the recent correction, largely limited to tech, can be understood as a pause for reflection with which we wanted to eliminate an excess. It is more difficult to imagine that this is the beginning of a bear market, at least as long as real rates remain in abundantly negative territory, dragged below -1% by the rise in inflation expectations. From now on, although the Fed's turnaround has removed important brakes, these expectations are likely not to deviate significantly further from the current level of inflation (below 1%). If, as it seems, central banks do not move nominal rates, real rates will therefore remain more stable, acting as support but no longer as drivers of the equity rally: other health and / or economic levers will also be needed in order for it to continue its running.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-funzionera-il-vaccino-delle-banche-centrali-anti-crisi/ on Mon, 21 Sep 2020 04:53:59 +0000.