How to change gas storage?

What strategies can Italy activate to prepare its gas storage for next winter? Carlo Stagnaro's analysis for La Voce

The extraordinary energy council of 28 February lit a beacon on European gas storage. According to reports from the European Commissioner for Energy, Kadri Simson, the filling level at the end of April will be around 18 per cent, compared to 30 per cent in previous years. If, therefore, no major problems are expected to make it through the winter season, it is essential to take all necessary steps to ensure that you are ready for the start of the next thermal year. But why is storage so important?

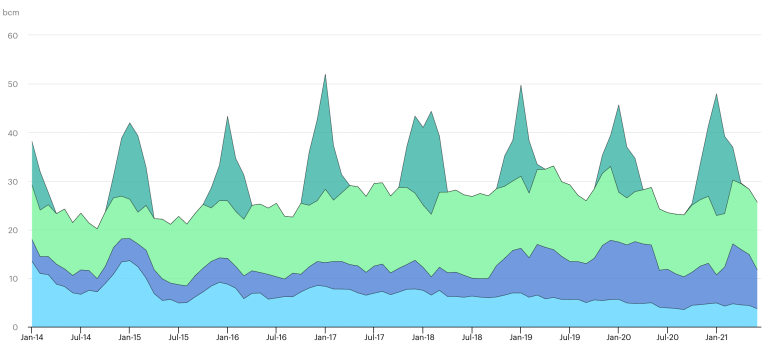

The demand for gas in Europe is highly seasonal and peaks in the cold months. Peak consumption, when temperatures are colder, can even be double that of the hottest days (Figure 1). To compensate for the pronounced seasonality and make efficient use of the transport infrastructures, operators buy quantities of gas when the demand is minimal and withdraw the methane when the demand for heating increases.

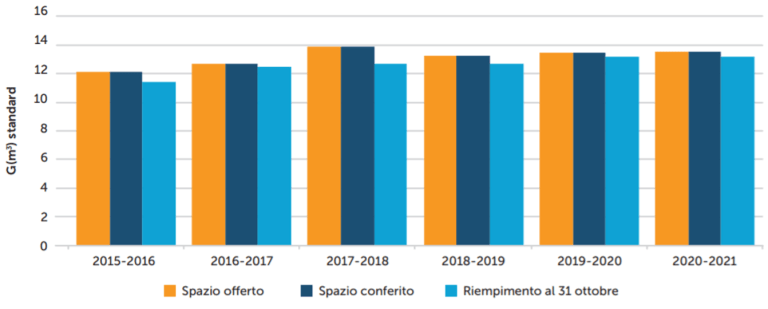

In Italy, storage is managed by private operators: the main one is Stogit, a company of the Snam group, which controls ten of the fifteen existing sites. Since they have some characteristics of the natural monopoly, their use is regulated: the Energy Authority establishes the criteria for the quality of the service and confers the capacity to the operators through bankruptcy procedures. Currently, the total capacity is around 14 billion cubic meters (Figure 2), plus another 4.6 for strategic storage (which can only be moved by order of the government and in emergency situations).

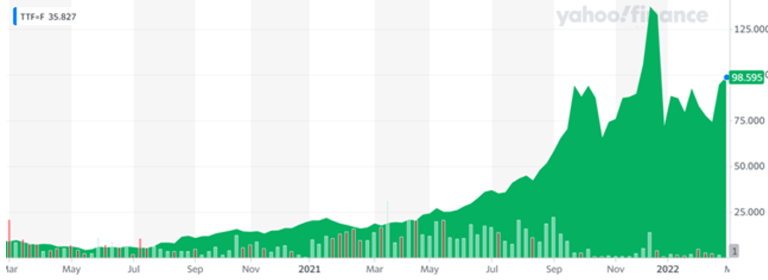

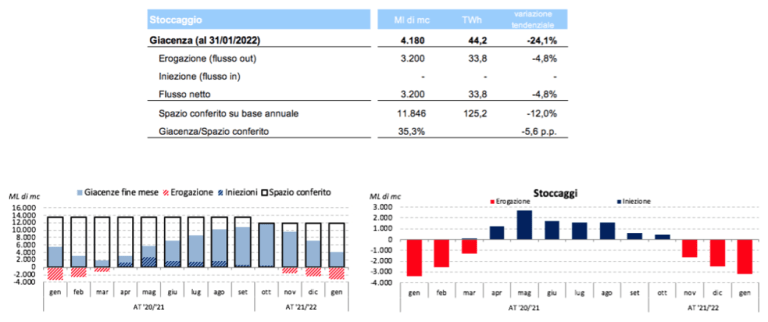

The gas that is injected (and withdrawn) from storage belongs to the operators themselves. Except for the strategic storage part, their business model is essentially commercial. In fact, the seasonal variability in consumption corresponds, in normal times, to a similar variability in prices. For example, in July 2019, a thousand cubic meters of gas cost around 107 euros, while in November of the same year, almost 160 euros. This spread has always made it possible to align the economic incentives of individuals with the security needs of the system. Things began to spoil in the middle of last year: the sudden rise in gas prices (Figure 3) took operators off guard, resulting in fewer purchases than usual (Figure 4). A bullish dynamic, in fact, has two implications: on the one hand, greater risks, because the summer-winter spread could be eroded; on the other hand, higher costs, linked to the immobilization of gas.

The situation is now becoming explosive. Prices have steadily reached levels never seen before, around (or above) four to five times the historical averages. Worse still, the forward curve seems to have canceled any seasonal spread : the TTF (the gas traded on the Amsterdam market that acts as a benchmark for Europe) with physical delivery this summer is around 140 euros / MWh, while for the winter period is approximately 120 euros / MWh (corresponding, respectively, to approximately 1,400 and 1,200 euros per thousand cubic meters). In addition to these prices, the storage of 14 billion cubic meters of gas (the potentially available capacity) implies an immobilization of the equivalent value of approximately 15-20 billion euros. The delta in forward prices, projected on the entire raw material, involves an expected loss of 2-3 billion. There is therefore a serious risk that, in the absence of interventions, the filling of the stocks at the beginning of winter will be unsatisfactory. Furthermore, the lower the amount of accumulated gas, the lower the pressure at which it can be delivered is reduced, which can lead to further problems in the event of an emergency.

How to get out? Commissioner Simson spoke of the possibility of establishing minimum fill levels . A similar request came from the International Energy Agency . The basic choice, even before the practical methods, concerns the degree of socialization of the risks: to what extent it is considered desirable that the cost of safety be borne by the community, and how much it is appropriate that it be shared by the operators , thus encouraging them to manage supplies more efficiently? In the first case, it is possible to follow the compulsory path or even assign to a regulated entity, for example Snam, the task of filling all the storage space left free after a certain date (for example, 1 August) . In this case, the cost of the entire operation would become part of the gas tariffs and, if the selling prices were lower than the purchase prices, Pantalone would pay the difference.

Alternatively, a more market path could be pursued, with a better distribution of risks between individuals and consumers. Today the storage fees are paid by the operators. In a completely changed context, the storage activity is no longer a service that is rendered to the operators, but a service that the operators render to the system. It could therefore be envisaged that the auctions for the allocation of storage volumes could close at negative prices. This would allow the opportunity cost of operators to be incorporated into the storage activity. Furthermore, it would make the expenditure for system security emerge in a transparent way which, with other mechanisms, would end up "sunk" within tariff components that are incomprehensible to most. Negative prices, on the other hand, are a rare but not unprecedented phenomenon in the energy sector: we have seen this, among other things, in the case of electricity and oil .

Or hybrid systems could be found, as Germany appears to be doing, through a mechanism of rewards and penalties (and ultimately obligations) borne by operators. Some form of cost and risk sharing is inevitable: the question is which is the most effective tool. Intervening on tariffs and allowing negative prices makes it possible not to upset the functioning of the system, leaving the roles of each market participant intact, and to minimize the expense to be borne by consumers.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/energia/stoccaggi-gas-cosa-fare/ on Sun, 06 Mar 2022 07:17:33 +0000.