How will central banks do

“Inflation vs central banks with a focus on liquidity: the transition from cost to quantum”. The comment by Antonio Cesarano , Chief Global Strategist of Intermonte

The pattern of the markets these days continues to be woven by high inflation and the possible reactions of central banks. The issue is particularly relevant as it impacts on issues relating to liquidity in the system from two points of view: 1) cost; 2) the amount

In the meantime, the Ukraine / Russia affair acts as a temporary disturbing factor, assuming that everything is resolved in a form of agreement. Summarizing the terms of the affair, at the moment, the proposal to grant more autonomy to the Ukrainian regions up to the right of veto on the hypothesis of inclusion in NATO appears satisfactory from Putin's side and, in this direction, could be the message arrived from the reports of partial withdrawal of Russian troops.

The point now is that the government of Kiev (more pro-European / NATO) does not look favorably on this solution as it would imply the practicability of inclusion in NATO, given the almost certain opposition of some pro-Russian regions, Donbass in head.

The United States, then, currently mainly engaged on the China / Taiwan front, are putting pressure on the Kiev government trying to keep the tension high, making the Kiev government perceive that, if it does not accept the compromise, the Russians are always ready to invade in any time.

As noted at the beginning, the main theme (except for a strong escalation on the Ukraine theme) remains inflation and the reaction of central banks and its impact on liquidity which represents a strong support factor for global equity markets.

The first 40 days of the year focused on the cost of liquidity, i.e. the number of rate hikes that can be expected from the Fed and, in part, from the ECB. Result: traders now price 6/7 Fed hikes in 2022, giving an equal probability to the 25 or 50bps maneuver hypothesis at the March 16 meeting. On the ECB front, the opening of the Lagarde at the beginning of February led to pricing the end of QE in October and up to two increases by the end of the year.

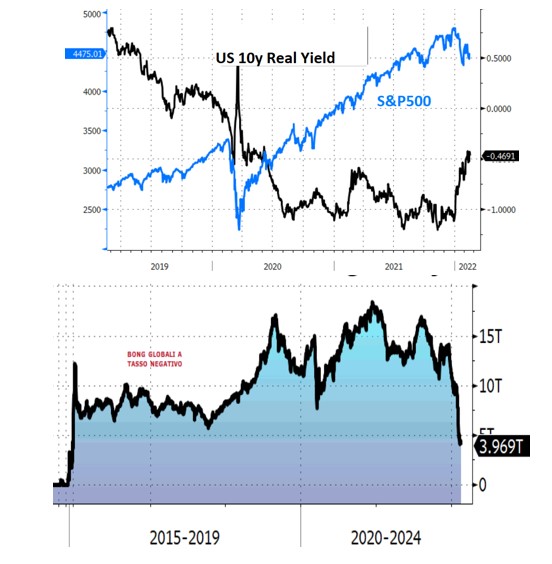

So, in summary, expectations have already worked a lot on the cost of liquidity and we have reached the US ten-year rate at the latest from mid-2019 / mid-2020, depending on whether you consider the nominal or real rate. The S&P 500 index at these dates was around 3000 points.

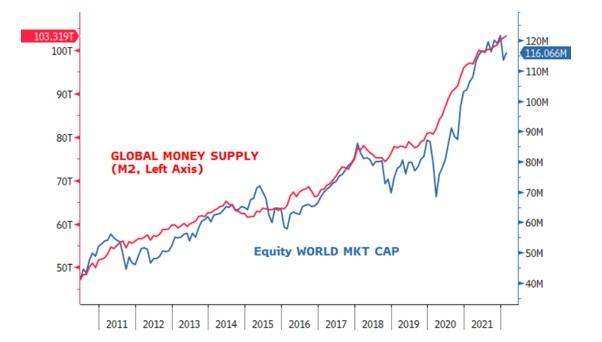

The theme is of great importance given in turn the importance of liquidity for supporting the markets, as is evident from the following graph.

How can we explain this relative strength of equity markets compared to the magnitude of the rate hike that has brought the amount of negative-interest global bonds to a minimum since 2015?

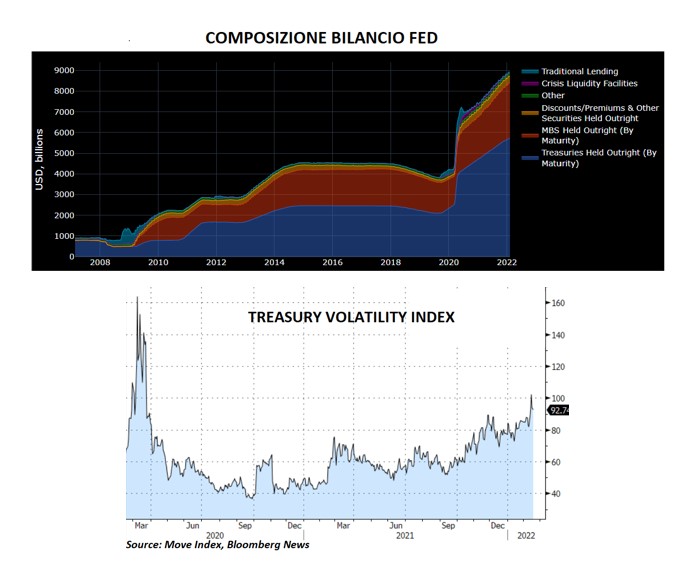

The explanation could lie in the fact that the chapter of the reduction of the FED budget has not yet opened, although the FED has already outlined the first guidelines, ie reduction of reinvestments concentrated above all on MBS securities.

This discussion could come to life between March and April, that is after the FED meeting of March 16 when the intention to proceed with a rapid start of the reduction of reinvestments could be announced, leaving open the possibility of providing for the sale of assets, in order to particular part of the approximately $ 2500 billion of MBS in the portfolio, as ventilated by some FED members such as George.

The underlying bond market is gearing up for the most sensitive issue related to the Fed's balance sheet reduction, as evidenced by the volatility of treasuries, which has reached its peak since 2020.

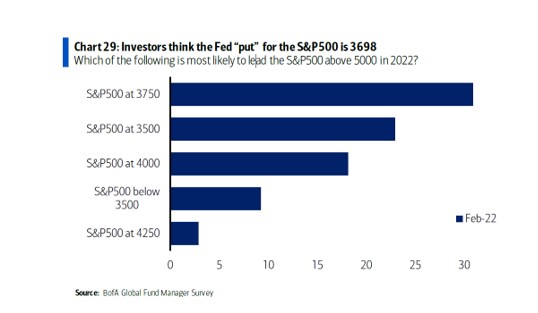

Traders for their part are taking note that this time the Fed put could be positioned at lower levels, as emerged from the BofA survey.

OPERATIONAL

- The trend in rates continues to be temporarily upwards on average. However, we are approaching potentially extreme thresholds in the area of 2.25 / 2.5% of the treasury and 0.50% of the Bund

- Between March and April, the issue of the reduction of the Fed balance sheet will be addressed, which could lead in that period to a second phase of correction of the stock markets, worried by the impact that the maneuvers on the balance sheet may have on liquidity

- From April / May there could progressively be a reversal in the trend of long-term rates that would begin to reflect concerns on the growth front, as the data certify the impact that the persistent phase of negative real wages (wages rise less than inflation) produces in terms of reduced consumption

- During the second quarter, therefore, the space could gradually open up for a gradual repositioning from value to growth, especially after the US quarterly season in April which could show a slowdown in part already anticipated by the guidance in the USA.

- Meanwhile, pending the two meetings of the ECB on March 10 (when US inflation data for February will also be released) and the Fed on March 16, value remains favored with possible rotation within value. Growth for now is useful for taking advantage of tactical rebounds

- On the EurUsd front, the trading range 1.1150 / 1.16 still remains, with the possibility of going higher in the second quarter as the slowdown in US growth and the acceleration of the tapering of the ECB.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/banche-centrali-inflazione-liquidita/ on Sat, 19 Feb 2022 07:29:11 +0000.