I’ll explain how Alitalia, Lufthansa and more are really doing

Not only Alitalia and Lufthansa. Here is the impact of the pandemic on airlines. The analysis of Professor Ugo Arrigo, an economist also expert in transport

Will Covid have the same effect on air travel as the meteorite that led to the disappearance of the dinosaurs? It is the most pessimistic hypothesis and fortunately has an infinitesimal probability of occurring, however it is beyond question that the pandemic was the famous black swan for the sector, made famous by the homonymous book by Nassim Taleb: a totally unexpected, impossible event to be foreseen in its scope and in its relevant consequences, which changes the course of events and drastically redesigns the scenarios we were used to.

We do not yet know if and when world air transport will be able to recover after the impact of the pandemic. The signs of partial recovery that emerged during the summer months are in fact put to the test by the rise in infections that are affecting many European countries and North America and the consequent return to restrictive measures on people's movements and behaviors.

Europe has been more affected by the epidemic and consequently the economic effects on air transport could be more consistent than the world average. So let's look at the most recent data, from Eurocontrol, the European body responsible for coordinating air traffic control over the skies of the old continent. On Monday 5 October there were 14,732 flights in European airspace, which corresponds to 44% of the 33,241 on the corresponding day last year. The fall is therefore, on the specific day considered, of 56%. The figure is essentially the same, -55%, if instead of considering the last available day we consider the last week instead.

This fall began in the very first days of last March and was noticeably accentuated starting from the middle of the month, coinciding with the spread in the various countries of restrictions on the movement of people, first introduced in Italy. At the end of March 83% of European flights had disappeared compared to the previous year and at the end of April even 87%. Therefore the flights were only 13% of those of 52 weeks earlier. Starting from the following month, with the relaxation of the restrictions, a very difficult recovery began: at the end of May the flights had risen only to 16%, at the end of June to 25%, at the end of July to 43%, to then reach the maximum recovery in mid-August with 49%. Since then, the resumption of infections has led to a new lowering of up to 45% in the last week available.

However, attention must be paid as these data refer only to flights and not passengers. But in reality in recent months the planes have flown much less full than in the past and therefore the data relating to passengers, on which the revenues of the companies depend, are much worse, as we will see in a future occasion.

Having examined the general picture of European air transport, it is interesting to see if there are significant differences between the major countries and between the major carriers, both traditional and low cost, including our Alitalia . For simplicity of analysis we limit ourselves to a photograph of air transport referring to the last available week, the one between Monday 29 September and Monday 5 October.

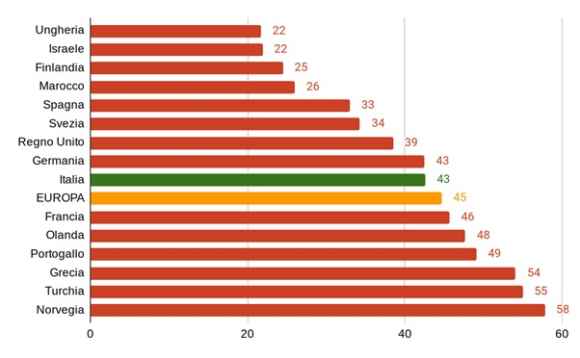

Graph 1 – Flights first week October 2020 in% corresponding week 2019

Source: Eurocontrol

In the last week only three of the large or medium-sized European and Mediterranean countries have recorded a flight number equal to at least half of those of the corresponding week of last year: Norway, Turkey and Greece. Three other countries are on values above the European average of 45%: Portugal, Holland and France. Italy and Germany are paired at 43% and slightly below the European average. Spain (33%) is worse along with Nordic countries such as Sweden (34%) and Finland (25%). Close the ranking, paired at 22%, Israel, in full lockdown due to the resurgence of the infection, and Hungary which has chosen to close its borders to protect itself from the virus.

Data on the whole far from positive, as can be well understood. In fact, the more than halving of flights for air carriers implies a more than halving of revenues, but not an equivalent reduction in industrial costs. In fact, by not flying, you save some variable costs such as fuel, airport and flight assistance charges and catering, but not others, such as the cost of aircraft, mainly leasing and maintenance, which are in the nature of fixed costs together with those of company structure. Personnel expenses can be saved, as happens in Italy, thanks to social safety nets, the cost of which for the public coffers, for almost 7,000 cassintegrated on just over 10,000 full-time equivalent employees, is estimated at over 320 million , compared to savings for company accounts of over 400 million. Since costs can only contract much less than revenues, the losses are bound to explode and require substantial public support measures even for those carriers that were in perfect health before the epidemic. And obviously the bigger the carriers the more they lose, even if this is a small consolation for our little Alitalia.

But how are the main European groups behaving with respect to their reference markets? Have their flights recovered more than their home market, in which case is their market share measured on flights growing, or less? Let's see it first for the main flag carriers and then for the main low cost carriers.

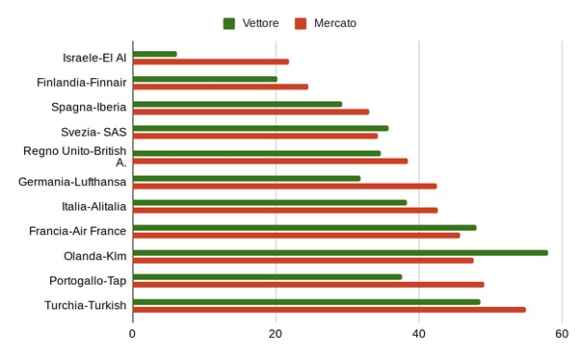

In the first week of October, Alitalia carried out 38% of flights compared to the corresponding week of last year, a lower percentage than the entire Italian market, where instead the flights totaled 43%. Our flag carrier has therefore reduced its market share compared to a year ago. Moreover, this is a phenomenon that seems to concern the generality of European flag carriers, as evident in Graph 2.

Chart 2 – Flights of carriers compared to their markets in the first week of October 2020 in% of the same week of 2019

Source: Eurocontrol

Lufthansa also appears to have recovered fewer flights than the entire German market: in the first week of October it was only 32% of its flights the year before compared to 43% of the entire market. The same goes for British Airways, with 35% of flights compared to 39% of the market. There are few exceptions of airlines that have recovered more than their markets: Air France (48% against 46% of the market) and above all KLM, the carrier that has risen the most, with 58% compared to 48% of the market. SAS is also above the above level of the Swedish market, but in reality it also covers the Norwegian market, which leads the ranking of countries in Figure 1, and the Danish market.

What is the most correct strategy of air carriers? Recover flights more slowly to minimize losses, given that, with fewer passengers traveling, the more you fly the more you lose? Or favoring the defense of its market shares, accepting greater losses? Very difficult to say.

In any case, what emerges in Europe is that, while in general traditional carriers grow less than their markets, there are necessarily others that grow more. Who I am? Small carriers, regional but also low cost, helped by the small number of people who fly? Or the usual large low cost carriers which usually take advantage of periods of crisis to accelerate their presence on the markets, succeeding better than in normal periods in stealing significant space from traditional airlines? Let's check if this hypothesis is true by examining the offer behavior of the four major European low-cost carriers.

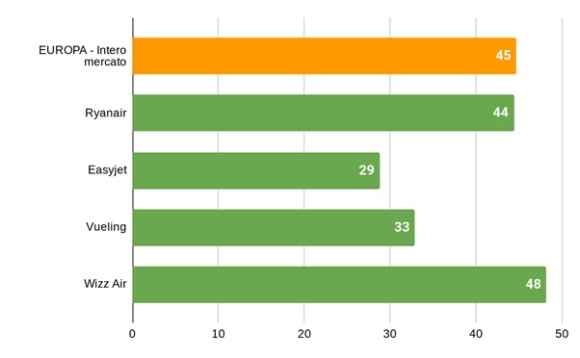

Chart 3 – Flights of low cost carriers compared to the entire European market in the first week of October 2020 as a% of the same week of 2019

Source: Eurocontrol

In reality, the hypothesis is not confirmed in Graph 3, which reports the same calculation as Graph 2 but refers to the four main European low cost carriers compared to the entire market. Ryanair is in fact performing the same percentage of flights as last year as the set of all carriers operating on European skies (44% against 45%), while the value of Easyjet and Vueling is significantly lower than the average: respectively 29% and 33% compared to the flights of the same carriers last year. Only Wizz Air is a significant exception, with a recovery rate of 48% compared to flights a year ago. The Polish-Hungarian carrier had been the first to massively resume flights and by July had already recovered three quarters of the previous year's flights and then recovered to over 80% in August. In recent weeks, however, it has suffered from the effects of the new European restrictions (let's not forget that the main office is Hungary which has closed its borders) and has significantly reduced overall flights.

As we have seen, the health crisis has produced significant effects on the supply of European air carriers, measured by the number of flights performed. Even greater effects, however, concerned the demand side, actual travelers, which decreased significantly more than flights, and the economic accounts of airlines, severely tested and up to the limit of the risk of survival from the crisis. But we will talk about these aspects in the next episodes.

Article published on il sussidiario.net

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/smartcity/vi-spiego-come-va-davvero-alitalia/ on Sun, 11 Oct 2020 13:38:27 +0000.