I’ll tell you about the failure of the Alitalia commissioners

The (bleak) balance sheet of Alitalia's 5 years of administration. The analysis of the transport economist, Ugo Arrigo, taken from Lavoce.info

Alitalia has entered its fifth year of extraordinary administration. It is therefore time to take stock. In fact, on May 2, 2017, the private shareholders of the company asked for and obtained extraordinary administration, motivated by the state of insolvency. In this way they handed over the business keys to the government, effectively nationalizing it.

The public decision-maker of the time, in assuming responsibility for the matter, made four mistakes in one stroke: 1) he entrusted the extraordinary administration to commissioners at least in part in continuity with the previous management; 2) instructed them to activate the procedures for the sale of company compendia without first verifying whether the company was salable in those conditions and without asking for essential restructuring and cost containment actions; 3) granted a bridging loan (600 million, increased to 900 only a few months later) that was excessive compared to the simple mandate to sell as soon as possible and in explicit contrast with the European rules on state aid ( Alitalia flies with state aid? ) ; 4) did not notify the European Commission of the loan, creating the conditions for opening an infringement procedure.

For its part, the Commission could have promptly expressed itself on the non-regularity of the loan and requested its cancellation, thus obliging the Italian decision-maker to adopt a real and rapid solution. Why in 2008 the bridging loan of the time, of only 300 million, was rejected in just five months, while the Commission has not yet expressed its opinion on the current one, which has now reached 1,400 million and fifty months after the first disbursement? The suspicion that emerges from the excessive discretion in the evaluation times is that it pursues objectives that go beyond those of exclusive protection of competition.

Unfortunately, in the past four years Alitalia has not been sold or restructured, and the bridging loan pending the European decision has gone up in smoke, not before having risen to 1,300 million at the end of 2019.

The buyer of dreams undermines what is possible

Regarding the non-sale, it should be remembered that from the beginning the buyer desired by the Italian decision-maker appeared the Lufthansa group which, however, never presented a formal purchase proposal and always remembered to be interested in forms of commercial cooperation but not acquisition. , at least not before a corporate restructuring by the Italian side.

While pursuing a buyer who was not there, a certain buyer, whose proposal, in the light of what happened later, would have resulted in a perfect squaring of the circle. The reference is to the American private equity fund Cerberus, which was willing to participate as a minority shareholder, given the EU ban on controlling interests in air transport companies by non-European subjects, in a project to relaunch Alitalia in partnership with Italian public entities and the employees themselves. The Cerberus offer, presented in autumn 2017, provided for an investment of up to one billion for 49 percent of the capital and control of the restructuring, which would however have guaranteed company size and perimeter, without downsizing and therefore sacrifices in employment and public costs. for the protection of workers. It was a market solution, able to pass the European evaluation, and the only known one capable of preserving the company that appeared in the four-year period of extraordinary administration. However, it was canceled from radar without any explanation.

In the meantime, in addition to not selling the company, the high management costs have not been reduced either, on the contrary, in the three years of extraordinary administration preceding the pandemic, they remained identical to those of the previous private management that led to insolvency.

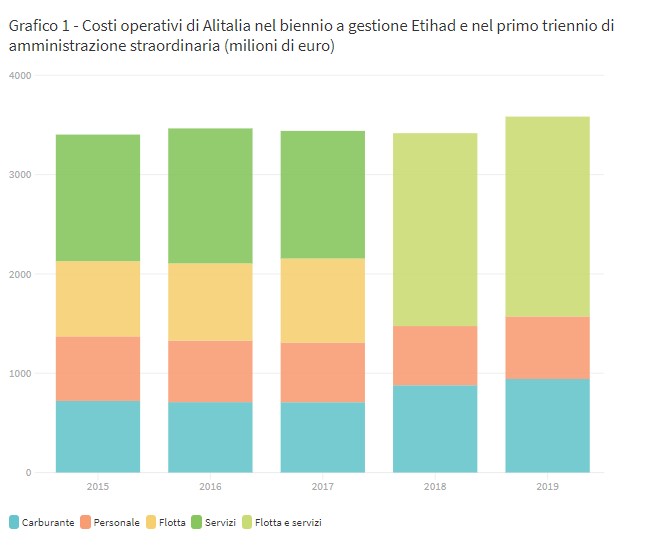

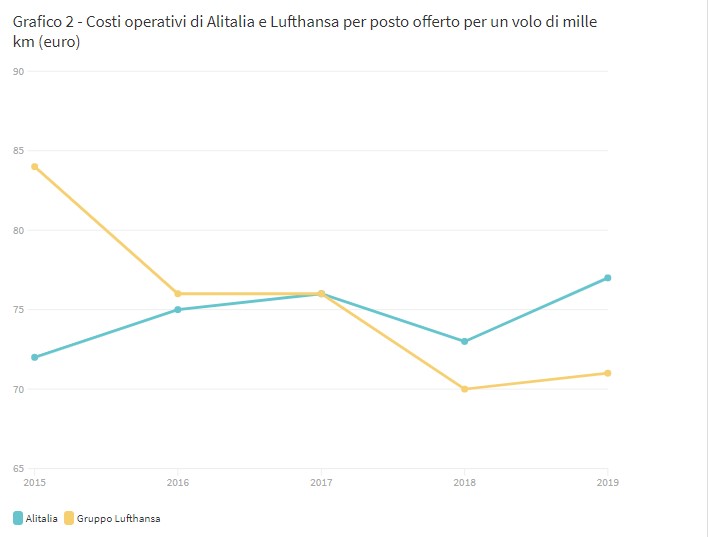

Alitalia's industrial costs, taken from official company information, are shown by macro-category in graph 1, which shows in the years 2015-2018 a constant aggregate level of just over 3.4 billion and rising in 2019, mainly due to effect of the fuel component, towards 3.6 billion. These overall costs are convertible into unit costs only on the basis of estimates, since the extraordinary administration has never published industrial data in recent years. Graph 2 shows for the five-year period considered the average cost per seat offered for a flight of one thousand kilometers in the case of Alitalia and that of carriers belonging to the Lufthansa group.

In the five-year period 2015-2019, the Lufthansa group achieved an important containment of unit costs, dropping from 84 to 71 euros for a seat offered for a flight of one thousand km. Instead, Alitalia has risen from 72 euros in 2015 to 77 in the last year, completely losing the cost advantage over the German group. In 2015 the gap was in favor of Alitalia for 12 euros, while in 2019 it became negative for 6 euros, with a relative worsening of 18 euros. Basically at the beginning of the period Alitalia was more efficient, despite the extra costs ascertained, than the Lufthansa group and its problem was above all the low unit revenues, eroded by the competition, as documented in a previous contribution.

THE CROSSROADS OF TODAY

Figure 2 is the most significant representation of four years lost without making any meaningful choices. Now we have reached the last decisional crossroads, from which three roads branch off.

The first is to take note of our inability to manage a national carrier rationally and according to market conditions and consequently to close Alitalia, taking on the social costs of protecting over 10 thousand employees. With this solution we would completely rely on the market, aware that it is not on the benevolence of the managers of the large low cost carriers that we can trust for our air transport.

The second is to relaunch Alitalia by creating the necessary conditions of economic sustainability. It is the path that has been given up by letting go of the Cerberus proposal and which appears completely impossible to pursue alone. The Italian state could, however, promote European integration, seeking a group in which to become a shareholder using the three billion euro allocated to the new national carrier. In this way, a European group would be asked, by conferring the residual assets of Alitalia and the allocated capital, to organize according to market rules an intra-group company cut to the transport needs of our country and of a sufficiently large and proportional size compared to those of the our market.

Compared to these two opposing hypotheses, the third appears as a non-solution, and is therefore the most likely in a country accustomed to freezing problems rather than solving them. It is a question of moving forward with the project of ITA, the new Italian flag carrier do-it-yourself that promises to be microscopic in terms of fleet, employees and expected traffic and large only for the public funds that it should absorb.

In Europe after liberalization, large aircraft companies survived in large countries and small companies in small countries, but there has been no case of a traditional small company surviving in a large market.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/smartcity/alitalia-fallimento-commissari-amministrazione-controllata/ on Mon, 28 Jun 2021 06:14:09 +0000.