I’ll tell you about the latest crazes on Wall Street

The comment by Giuseppe Sersale, strategist of Anthilia Capital Partners Sgr on the outperformance of Wall Street in August

In the end, August proved to be a very positive month for equities. For the S&P 500 this is the best August since 1986, with a 7.01% gain. The Nasdaq was spectacular (+ 11.05%) driven by its mega caps (NYFANG Index + 21.2%).

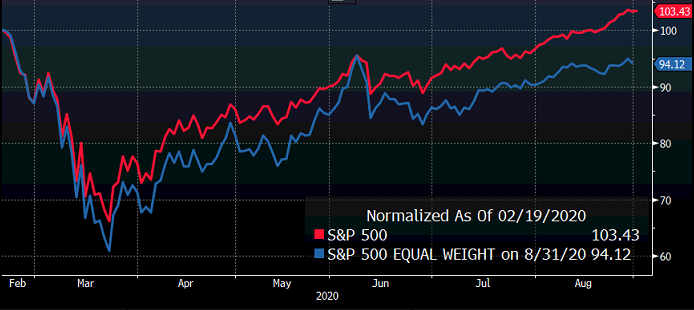

In fact, the phenomenon illustrated in the last Lampi and earlier in that of August 4 , relating to participation in the rally, was further accentuated, with the performance concentrated in a handful of big names and the rest much less involved. It is no coincidence that the S&P 500 Equal weighted index has been substantially lateral since mid-June.

A similar phenomenon can also be noted at the level of stock exchanges. For a Wall Street that made 7%, we have much less brilliant values for Europe (3.2%), Emerging (2.1%), with only Tokyo (6.1%) approaching US performance. Of course, the significance in this case is much smaller, if only because the US stock market alone accounts for over 50% of world capitalization.

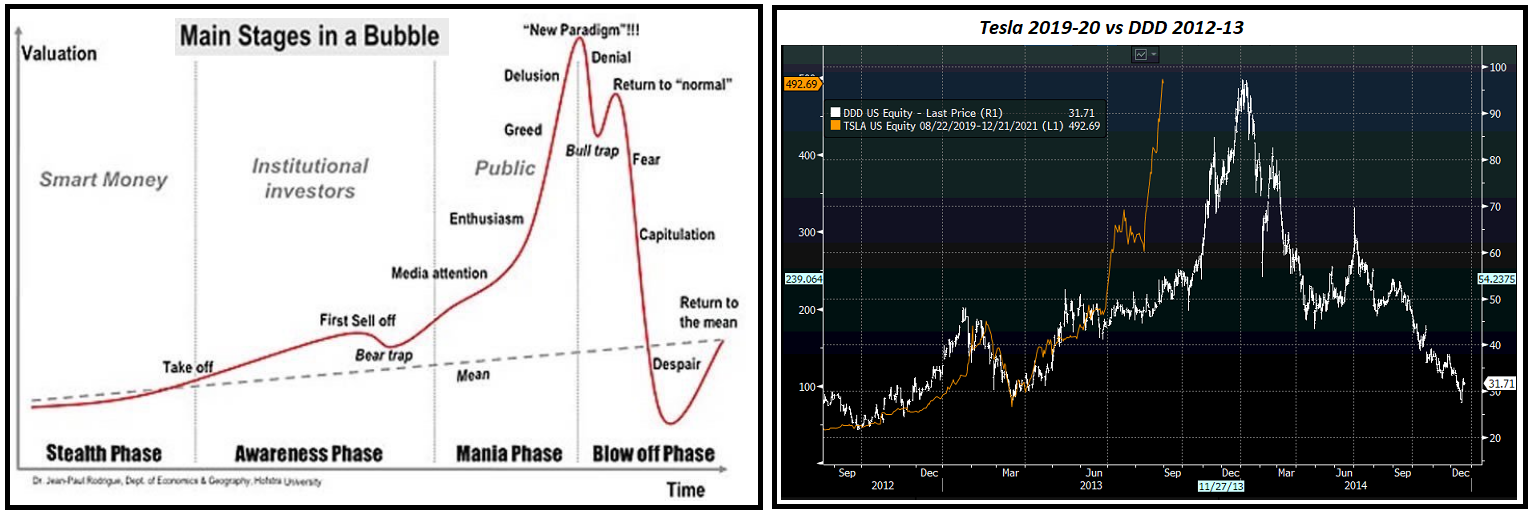

As already observed in the pieces indicated above, the phenomenon has, at least in part, to do with the actual greater effectiveness of these businesses in the new context created by the Covid epidemic. But the personal impression is that at this point investor appreciation of these undisputed advantages is bordering on mania. Suffice it to say that the simple announcement of a stock split resulted in a 70% rise in Tesla 's prices and more than 20% for Apple in one month. The increase since the beginning of the year for the 2 giants is respectively 470% and 80%. Tesla's movement seems paradigmatic of the bubble, and personally it reminded me of another technology whose perceived revolutionary nature had produced a similar price action in manufacturing companies: that of 3-dimensional printers.

We will see if the epilogue will be similar, or Tesla will instead confirm the expectations. We must also take into account the relative size of companies and that electric mobility is certainly not destined to remain a niche business like 3D printers, but obviously the other manufacturers are equipping themselves and many have the means and technologies.

Coming to everyday life, the last few days have seen markets try to price the “Fed turn”, in the direction of greater tolerance of inflation. This will be achieved by pursuing an average target of 2%, which implies that any periods of inflation below the target (such as the current one) must be followed by periods with above target inflation. secondly, for monetary policy purposes, it will only detect the decline in employment from the maximum level, and no longer its arrival at levels that in the past were considered at risk of generating inflationary spirals. The reaction contemplated higher treasury yields on the long end of the curve, pricing higher inflation risk and a further decline in the dollar possibly discounting even more negative real rates. Part of Wall Street's outperformance can obviously be attributed to this new stance.

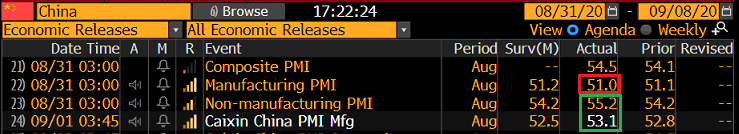

On the macro front, the week started yesterday with the official Chinese PMIs for August, which saw manufacturing disappoint marginally, and services surprised on the positive side. This is why today's positive surprise on manufacturing calculated by Markit (highest since 2011) was well taken.

Good numbers also in Japan, (revised flash from 46.6 to 47.2) Korea (48.5 vs. 46.9 July), Taiwan (52.2 vs. 50.6 July) while Australia slowed down but at a good level (53.6 vs. 54.0 July). Only Sydney, of the main squares, has suffered.

Europe approached the session with a nervous tone. There was the revision of the manufacturing PMI in August, after the sound disappointment of the flash ones (even if it was more the services that disappointed) and despite this the € opened the session flirting with the 1.20 vs $ share.

Non-manufacturing PMIs didn't bring big news. If the French number was revised upwards, the German one lost something.

As suspected, it is Spain (49.9 from prev. 53.5) to take on the disappointment that transpired for the rest of Europe from the comparison between the flash data, while Italy did well. The divergence seems to reflect the different fortunes on the epidemiological front. We will see what the services will say on Friday, since it is there that the containment measures hit the most.

The numbers cemented the strength of the €, which came temporarily to pierce the 1.20 level, and this is how the Eu equity has further depressed, while US equities (at least the Nasdaq) and precious metals have continued to show resilience.

In the afternoon, ISM manufacturing surprised positively once again, reinforcing the impression of US recovery (56 from prev 54.2 and vs expectations for 54.8). Strength is well represented in the sub-indices, with new orders, +6.1 points to 67.6, marking the highest in 16 years.

It must be said, based on the latest reports, that the impact of the second wave of Covid and related measures was very modest in the US.

Ironically, the good numbers helped EU equities. Yes, because 1.20 has acted as a barrier, and the dollar has recovered, almost canceling today's decline. The effect was almost immediate on the continental indices, which closed with marginal movements, with the exception of London, closed yesterday while Europe was falling, and today hampered by the pound. Yields generally decline in the final part of the session, while the spread returns to decline. Not even the dollar's turnaround bothered Wall Street, which continues to chase its champions. It takes something more convincing. Considering the positioning record (in particular the Lungo €, as shown by the latest CFTC report), it is not entirely to be excluded. Moreover, it is the EU now that must contain the onset of Covid.

On the macro front, the week ends with a bang on Friday, with the services and composite PMIs in August, and the August labor market report. Of course, the Fed stance change takes away a bit of glamor, to tend, to payrolls, if particularly good data will not impose tightening of monetary policy. But for now, with unemployment at 10% and Powell "not even considering the thought of a hike," we are still a long way from that stage.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/vi-racconto-le-ultime-manie-di-wall-street/ on Wed, 02 Sep 2020 08:10:04 +0000.