Inflation, here is the comparison between today and the sixties / seventies

The analysis by Michael Bazdarich, Economist and Product Specialist of Western Asset, part of the Franklin Templeton Group

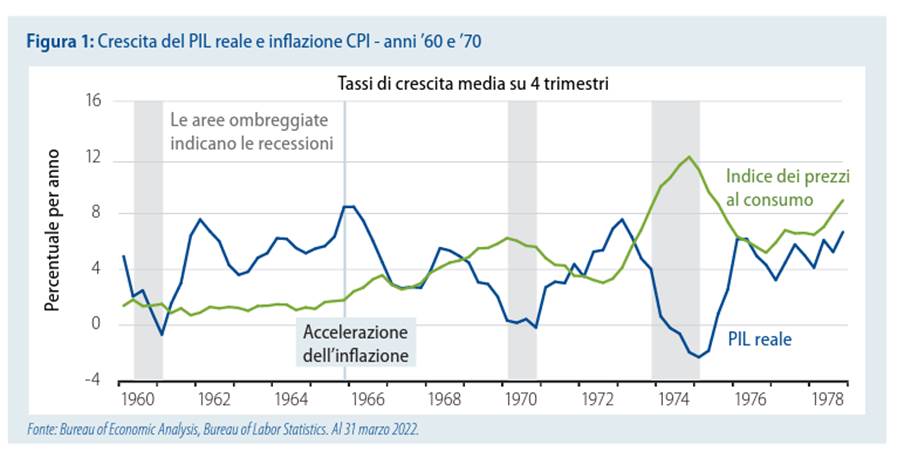

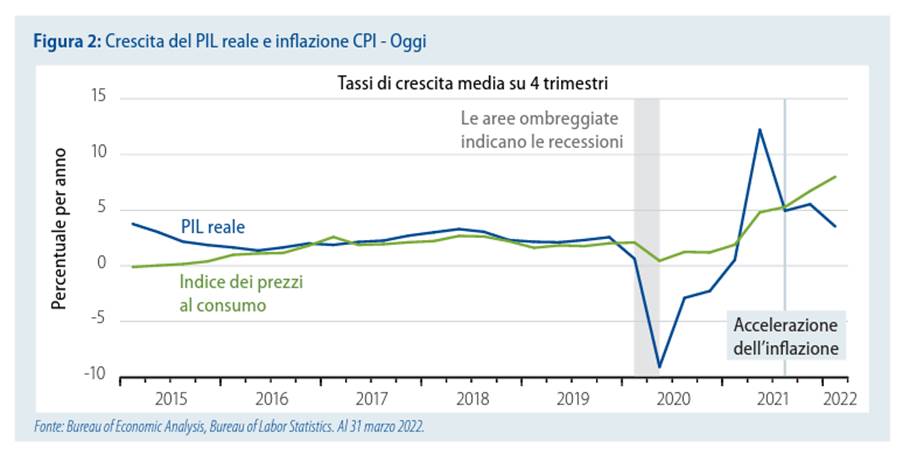

Inflation in the US is currently at the highest levels since the late 1960s / early 1970s. However, the context today has some important differences from that period. Inflation has risen today without there being a real growth boom in the United States, 55 years ago it didn't. At the moment, wages and real incomes are also falling, a trend that was absent at the time of the surge in inflation in the 1960s. Moreover, currently the gap between the price increases of goods and services appears wider than in the 1960s and 1970s, a sign that in the 1960s inflation was monetary in nature while today it is fueled by restrictions on the supply side.

The party of the 60s vs the shipwreck of the 2020s

In the 1960s William McChesney Martin, Chairman of the Federal Reserve (Fed), used the metaphor: "to take away the punch bowl just as the party gets going", still famous today. He meant that it was the Fed's job to intervene just as economic growth was starting to pick up momentum and inflationary pressures were rising in order to cool growth and prevent such pressures from becoming persistent and generalized.

The success of McChesney Martin or his successor in the 1970s as Fed Chairman is questionable, but the metaphor itself is accurate. And it seems that current Fed Chairman Jerome Powell intends to follow McChesney Martin's lead. In any case, there is a problem: in the 1960s, when inflation began to rise, the US economy went through a phase of "euphoria", but today the climate is much less optimistic.

After the brief recession of 1960-1961 – probably triggered by the outcome of the 1960 elections – early 1961 saw the establishment of the Kennedy-Johnson administration, determined to boost economic growth and bring unemployment down. The economy was already emerging from the recession, so fiscal stimulus policies triggered an accelerated expansion.

From the peak of the cycle in the first quarter of 1960 to the fourth quarter of 1965, real GDP (gross domestic product) growth – net of the declines due to the recession which is offset by growth in the early stages of the recovery – stood at 4.9% average per year. Unemployment went from 5.2% in April 1960 (at the height of the expansion) to 4.0% in December 1965.

From every point of view, there was a substantial acceleration of economic growth in the US and it is no coincidence that inflation began to rise precisely in 1965. After settling at an average level of 1.2% between 1960 and 1964, inflation jumped to 1.9% in 1965 and then spiked in 1969. The Fed, under the leadership of McChesney Martin, later lived up to its mandate and began pulling the brake. However, central bank policy was rejected by President Lyndon Johnson, who focused on the 1968 elections and financing the Vietnam War. The removal of Fed constraints and accommodative federal policies have resulted in a rapid resumption of global growth.

Despite the deceleration due to the Fed's temporary credit squeeze, from the fourth quarter of 1965 to the peak of expansion in the third quarter of 1969, real GDP growth averaged 3.9% per annum and also in the five-year period preceding the growth had been extremely high. Unemployment still fell to 3.5% despite the mass influx of baby boomers into the labor market.

In 1969, CPI inflation stood at over 6%. Not even the Johnson administration could prevent the Fed from addressing the problem. As a result, the US economy went into recession in late 1969. Subsequently, there was much more sluggish growth than in the 1960s.

One thing is certain, before inflation became a hot topic in the late 1960s, the US economy had marked the most sustained expansion phase since the start of the surveys, as shown by the average GDP growth of 4.5%. in the nine and a half years from the peak of the cycle in the first quarter of 1960 to the peak of the cycle in the third quarter of 1969. By way of comparison, peak-to-peak economic growth over the seven-plus years of the previous two cycles in the 1950s had been in average at 2.8%.

Leaving aside the statements of politicians, the growth of the US economy today is nowhere near comparable to the surge of the 1960s. All things considered, today's expansion is even slower than the much-vilified one following the Global Financial Crisis (GFC). Meanwhile, last year, when inflation started to rise, unemployment was still well above the pre-COVID-19 period.

Of course, in the third quarter of 2020, GDP growth was very strong. However, this phase of expansion came after the second quarter of 2020 in which the contraction in GDP had been significant. Even now, six quarters later, economic growth trends are not those of the pre-pandemic period. If we balance the recessionary and expansionary phases, a bit like in the 1960s, real GDP growth averages a measly 1.2% in the fourth quarter 2019-first quarter 2022. By way of comparison, even adding the severe recession during the CFG to the shaky post-CFG recovery results in average real GDP growth of 1.7% per year from peak to peak between Q2 2008 and Q4 2019.

As for unemployment, at the end of 2019, just before the outbreak of the COVID-19 pandemic, it was at 3.5% in the presence of stable inflation. At the end of 2021, concurrent with the acceleration of inflation, it stood at 4.7% and since then the contraction has been modest, at 3.6% – a slightly higher level than in December 2019.

In summary, in the 1960s, inflation had only started to rise after more than five years of much faster growth and much lower unemployment than before. Today, on the other hand, the price increases occurred after a single year characterized by growth however insufficient to recover the losses due to the recession triggered by the COVID-19 pandemic and by an unemployment rate higher than that of the pre-recession period. This time there is nothing to celebrate.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/inflazione-ecco-il-confronto-tra-oggi-e-gli-anni-sessanta-settanta/ on Mon, 15 Aug 2022 06:11:57 +0000.