Is the EU plan to reduce dependence on Gazprom feasible? Analyses

EU plan against dependence on Russian gas: facts, numbers, analyzes and scenarios. The point of Mark Lacey, Head of Global Resource Equities, and Alexander Monk and Felix Odey, Portfolio Managers, Global Resource Equities, Schroders

Russia currently meets 35-40% of the Old Continent's gas needs. The war in Ukraine highlighted Europe's urgent need to diversify its gas sources, as well as the long-term goal of switching to clean energy sources.

At the end of March, the EU signed an agreement with the US on liquefied natural gas (LNG) which establishes a framework for the supply, by the end of the year, of natural gas to the EU equal to approximately 10% of gas. which the Old Continent currently receives from Russia.

In the long term, the plan is for the US and international partners to supply around 50 billion cubic meters of gas annually to the EU – in addition to the 22 billion cubic meters currently supplied and the 37 that are expected to be secured by the end. from the year by the USA.

This is all part of an initiative (REPowerEU) which aims to reduce European imports of Russian gas by around two thirds by the end of 2022 (equal to around 100 billion cubic meters per year). This is a very ambitious plan, of which we have analyzed five main targets and the challenges to be faced.

Target 1: importing an extra 50 billion cubic meters of LNG from alternative sources

Even before the Russian invasion of Ukraine, Europe had begun to gradually reduce Russian gas and import more LNG. The problem is that the US cannot do much in terms of supply and Europe is competing with other countries for the import of LNG. Another obstacle is that LNG – as the name suggests – is liquid and has to be transformed back into gas through a process which is called 'regasification', and for which Europe does not have the necessary reserve capacity. The good news is that Europe is planning to expand its capacity in this area; even if the process has not started yet.

Target 2: Increase non-Russian imports by 10 billion cubic meters via pipelines

If getting more LNG is not a simple solution, increasing supply through existing pipelines will also be very difficult without further development of production. At the moment the main suppliers are Algeria – with expansion plans for the operator Sonatrach – Norway and the United Kingdom but any development of new plants has been very limited in recent years.

Target 3: reduce the demand for natural gas by increasing the production of renewable energy

In our opinion, focusing on renewables is the most logical and sustainable solution. However, it is a long-term process. In terms of costs, even with the recent increases in the prices of raw materials, the generation of renewable energy through wind and solar is already much cheaper than thermoelectric and coal systems.

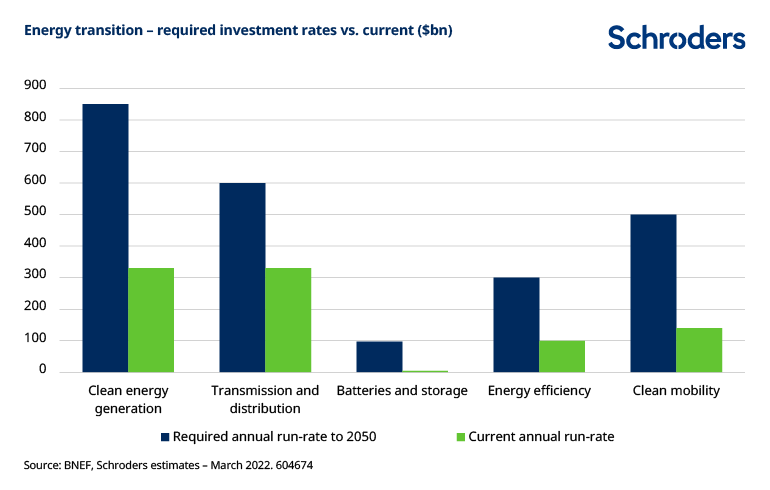

However, the capital expenditures for renewable energy production are much lower than what is needed to meet existing targets for 2030/2050. The same is true for investments in transmission and distribution networks.

The main obstacle today is not political will or investments, but logistics, due to the disruption related to Covid-19. The hope is that in 2023 we will start to see a relaxation of those limitations, but even then there is no simple solution.

Target 4: Take measures to improve energy efficiency and reduce demand

Looking at the demand side, gas is used to heat around 35% of commercial and residential buildings in the EU. There is no doubt that current gas and electricity prices are leading to a temporary and permanent reduction in demand. Many industries, such as fertilizer and cement producers, are announcing temporary closures of some plants due to high gas prices.

Meanwhile, a recent Bloomberg analysis indicates that a 1.75 ° Fahrenheit reduction in thermostats could reduce European residential and commercial demand by 10%.

Whenever possible, heat pumps are an efficient way to reduce gas consumption. The EU aims to accelerate their adoption at the residential level, with the aim of seeing growth of 10 million units in the EU market over the next 5 years.

Target 5: restore storage to 80% of capacity by November

Finally, the REPowerEU plan aims to increase gas storage, bringing it back to 80% of capacity by 1 November 2022, and to 90% in the coming years. It's a strange goal, as it essentially implies that operators buy gas on the market at any cost during the summer to avoid another surge next winter. Currently, gas storage levels in Europe are around 25% lower than normal, but above the 2018 lows.

Conclusions

In conclusion, there are no simple answers to the problem of replacing natural gas in Europe. The Old Continent is now heavily dependent on LNG imports and the REPowerEU plan will act as an accelerator for the transition to new, less risky suppliers.

The United States will be at the forefront of this. The US companies best positioned to benefit from this increased demand and resulting price increases will be those that can take advantage of low-cost resources and easier access to LNG export facilities.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/energia/piano-ue-dipendenza-gas-russia/ on Sun, 17 Apr 2022 06:38:11 +0000.