No boom in layoffs, the catastrophists proved wrong. Report

The trend of the economy in Italy and a look at the labor market with an emphasis on the issue of layoffs. Extract from the report of the Confindustria study center

The Italian restart is characterized in 2021, and will be so also in 2022, by two important passages of the baton. First, consumption is gradually taking over from exports as a driving force for the rise, placing itself alongside investments. Second, services are becoming more dynamic than industry, which had already broken down between the second half of 2020 and early 2021.

These two developments are closely connected: in the second half of 2021 and then in 2022, as already in the spring, a recovery in household spending is expected, especially in services. In particular for spending outside the home and for travel, penalized until April by the limitations for the pandemic. Private consumption, partly blocked and diverted to durable goods during the lockdown, from May-June 2021 could also be divided into services such as restaurants, accommodation, entertainment, as well as non-durable goods. The partial recovery so far of tourist flows, of foreigners to Italy and also of Italians to abroad, provides growth margins to be exploited for services in the second half of 2021 and then in 2022.

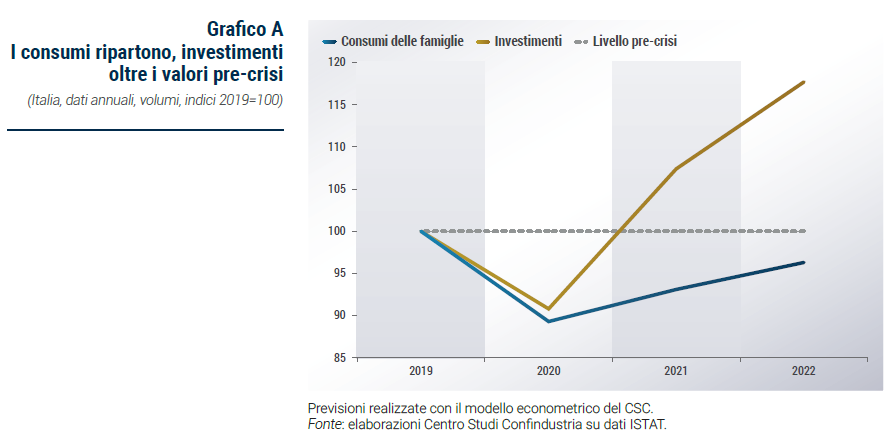

The greater propensity to save, largely "forced" until the first quarter of 2021, due to the anti-Covid restrictions, should continue to diminish in the coming quarters, freeing up resources for spending. On the other hand, it is conceivable that it will remain higher than in the past, beyond the forecast horizon. Furthermore, it is unlikely that all the extra savings of 2020 will flow back into consumption in 2021 and 2022. Therefore, the CSC scenario predicts private consumption still well below pre-crisis levels also in 2022 (-3.7% compared to 2019 ).

Conversely, investments, which remain the main engine of the Italian recovery, in 2022 will rise to a much higher level than the pre-crisis (+ 17.7% compared to 2019; Chart A). So far, the main contribution has come from investments in construction, both non-residential buildings and homes, already beyond the pre-crisis values, driven by incentives on renovations and public investments. Investments in plant, machinery and means of transport, on the other hand, are still below pre-pandemic levels. Their recovery will continue in the coming quarters, thanks to the still high confidence of entrepreneurs and the driving force determined by new public investments. This drive is partly held back by negative supply factors, such as the increase in the prices of raw materials and the difficulty in finding some materials.

In industry, production rose gradually in the first half of 2021, at a gradually decreasing pace, returning in June to above the pre-pandemic level. More recently, industrial production and the confidence of manufacturing firms have signaled a slight attenuation in activity dynamics. In fact, in recent months, the lack of materials has become a factor of growing obstacle to production. According to the PMI indicator, interruptions in the distribution chain have weighed on the recent slowdown, leading to a further lengthening of average delivery times and an increase in unpaid deliveries. In addition, the negative dynamics of industrial activity in our main trading partners (Germany and France) will also have unfavorable effects in the coming months.

Italian exports of goods and services, after a fall of 14.0% in 2020, in the CSC scenario will rise by 12.4% in 2021 and by a further 7.7% in 2022. This is a dynamic revised upwards for this year, by one point. On the one hand, the export of goods is confirmed to return already in 2021 on the path of pre-crisis expansion, also thanks to a world trade that will record a growth of 10.5% in 2021 (despite the slowdown in mid-year) and 4 , 5% next. On the other hand, the export of services is no longer expected to restart this year, but only in 2022, remaining well below the pre-crisis levels: the persistent weakness of some types of travel, such as long-distance tourism, weighs heavily. and commuting for work. Furthermore, reflecting the high growth of investments, strong triggers of purchases from abroad, imports are restarting even stronger than sales, so that net exports do not make a significant contribution to the rise in GDP in the two-year period.

AND ALSO WORK

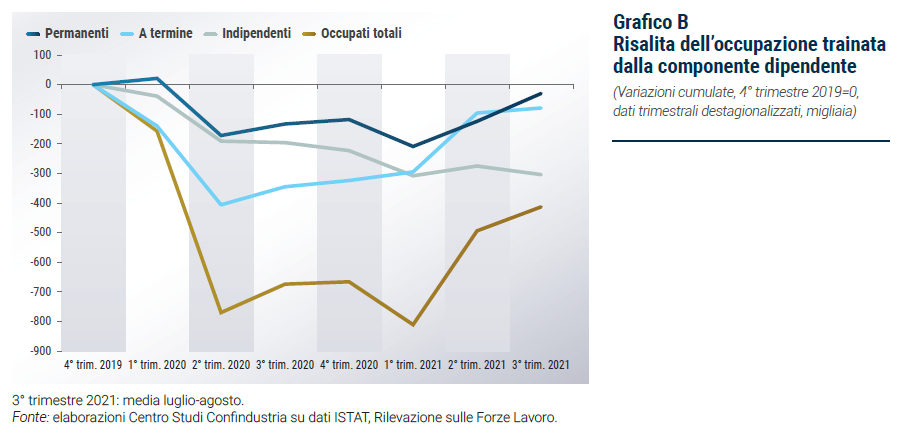

The trend of economic activity during the crisis was reflected in the labor input employed with substantial immediacy, almost one by one in terms of amplitude, both in the phases of contraction and in the recovery. Thus the number of people employed, after hitting a minimum in the 1st quarter 2021 (-811 thousand units compared to the 4th 2019), recovered almost half of the fall (+ 398 thousand units in the two months July-August on the beginning of 2021, -413 thousand compared to the end of 2019). As in the past, the reactivity to the economic cycle was more marked for the temporary employee component, but in this crisis it was also large for the permanent one (Graph B).

With the removal, from last July, of the suspension of dismissal procedures in the construction and industrial sectors (with the exception of textiles, clothing and leather goods), the feared haemorrhage of workers was not recorded. According to the analysis of the Bank of Italy and the Ministry of Labor on Mandatory Communications, in July there were about 10 thousand layoffs, a number in line with the average levels of 2019. Already in August the layoffs returned to extremely low values. In the autumn there will probably be a higher turnover, both incoming and outgoing, due to both sectoral recomposition processes, historically more intense following the crisis, and inevitable corporate restructuring, but the total number of people employed is expected to grow 0.3%, on average for the year.

In 2022, both the number of people employed and the hours worked per capita are expected to recover to pre-pandemic levels. But if per capita hours were to decrease structurally, as happened with the double recession of 2008-2009 and 2012-2013, the growth in the number of people employed would be more sustained than expected.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/economia-licenziamenti-confindustria/ on Sun, 17 Oct 2021 07:33:20 +0000.