Risks and opportunities of Chinese loans to Bolivia

Why is China supporting Bolivia's economy? Riccardo Venturi's analysis

A previous article dealt with Bolivia's external indebtedness during the presidency of Evo Morales and the predominance of the transport sector in the allocation of resources obtained through those loans; with the present, instead, we go to deepen more specifically the role of China.

The data, expressed in millions of US dollars, the currency most used in borrowing abroad, come from the Informes de deuda externa pública found on the website of the Bolivian Central Bank.

EVO MORALES, "THE CHINESE"

Bolivia's relationship with China has been consolidated in a deep and structured way under the mandates of former president Evo Morales, who has led the South American country to increasingly borrow from Beijing, attracting many Chinese companies.

In recent decades, China has become the largest lender for developing countries, also given the economic disengagement of the richer Western countries, and has confirmed this role also with Bolivia.

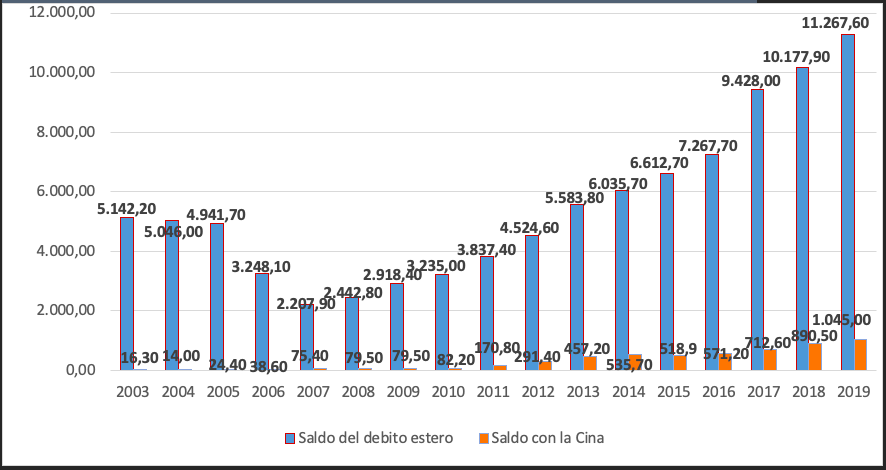

Returning to the role played by Morales in the indebtedness to China, it is possible to observe in the graph below how the annual balance of loans contracted with that country has increased considerably since 2006, the year of his inauguration after the first victory in the presidential elections. for 2005: the balance of the debt with China which amounted to 24.4 million US dollars in 2005 increased to 75.4 in 2006, finally reaching 1,045.0 in 2019, with an average balance of 396.32 million for the period from 2006 to 2019.

It is possible to divide this debt with Beijing into two phases: from 2006 to 2010, a phase in which compared to previous periods there was an increased recourse to Beijing's loans without however this becoming particularly high, with an average balance of 71, 04 million; from 2011 to 2019, in which there is a considerable increase in the average balance compared to before, reaching 577.03 million.

The link created by Morales with China is destined to be lasting, given its confirmation by the current president Luis Arce, former minister of the economy during the Morales presidency.

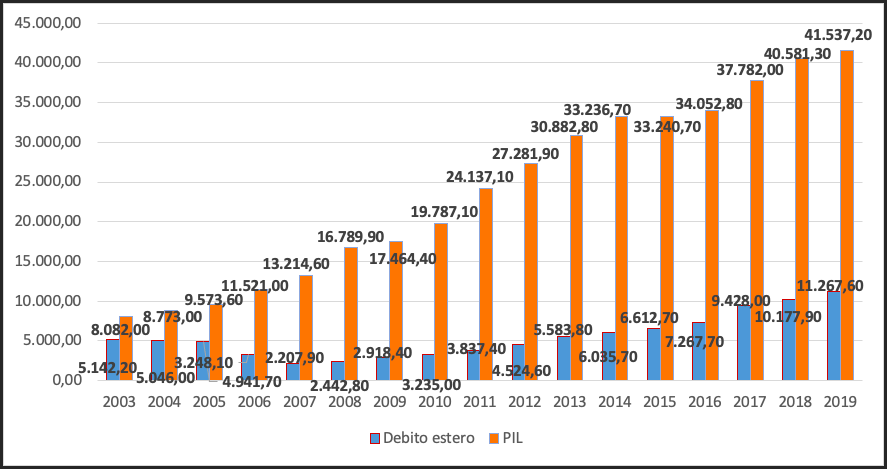

The following graph is also shown to allow an overview of the foreign debt of Morales' Bolivia.

TRANSPORT: A KEY SECTOR AND ITS RISKS

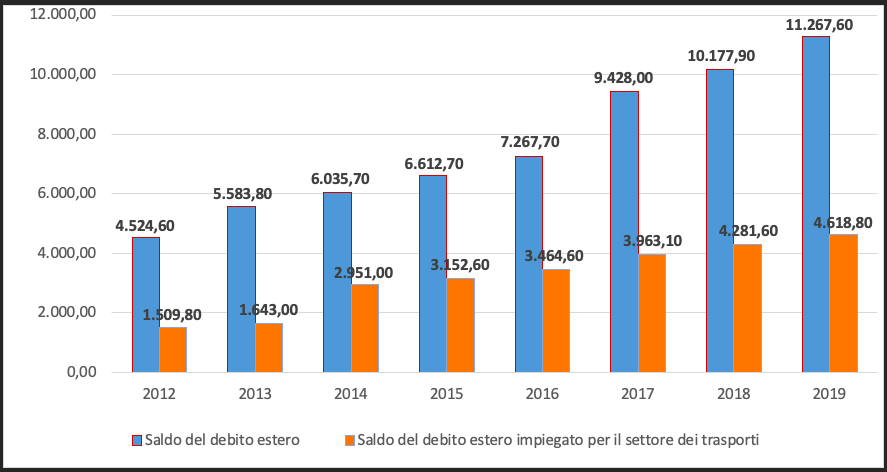

The sector that most intercepted the sums borrowed through foreign debt from 2012 to 2019 was that of transport, with an average percentage of 42.63% and an average balance of 3,198.06 million dollars.

There is a close correlation between infrastructural development and the increase in indebtedness with China, given that with the construction of infrastructures the Asian giant derives multiple benefits: guaranteeing the income from interest, obtaining through contractual clauses that the works are carried out from Chinese companies and laborers, and, once the works have been completed, to achieve faster and cheaper access to natural resources – mainly hydrocarbons and minerals, including lithium (https://www.startmag.it/energia/catl-millennial- lithium-lithium-batteries /), indispensable for the manufacture of rechargeable batteries – which your industry needs. These resources are often extracted by Chinese companies, making them reach companies on their national territory from the extraction sites, reaching the ports of the Pacific coast of South America.

It is clear that while Chinese loans and investments are supporting Bolivia's growth, they could jeopardize its effective sovereignty. In fact, if the world demand for raw materials, of which Bolivia is a producer, should suffer a decrease, with a consequent drop in their price, Bolivia may not be able to honor the interest on the loans contracted without resorting to further debt, perhaps precisely towards the China.

However, the recovery of the world economy, after the most acute phase of the recession induced by the Covid-19 pandemic, is keeping the prices of these resources high, at least in the short term, and this risk is not looming.

On the other hand, it remains to be seen whether the infrastructural development financed with this foreign debt will be justified with an economic growth capable of honoring the debts incurred and their interests.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/rischi-e-opportunita-dei-prestiti-cinesi-in-bolivia/ on Sat, 30 Oct 2021 06:52:45 +0000.