Stellantis, Prysmian, Luxottica and more. Here are the big companies that invest their capital badly. Coltorti’s analysis

How do large companies in Italy invest their capital? What emerges from a study by Fulvio Coltorti, economist and professor at the Catholic University of Milan, former head of Mediobanca's research area.

How was the capital used by Italian companies in the past? How do they use it today? Do public and private companies differ in this?

Quite a trivial question to which Fulvio Coltorti (in the photo), economist and professor at the Catholic University of Milan, attempted to answer during a recent seminar at the university dedicated to "Competition, policies and capitalism in Italy".

FIGURES AND ROLE OF THE STATE IN ITALIAN INDUSTRY

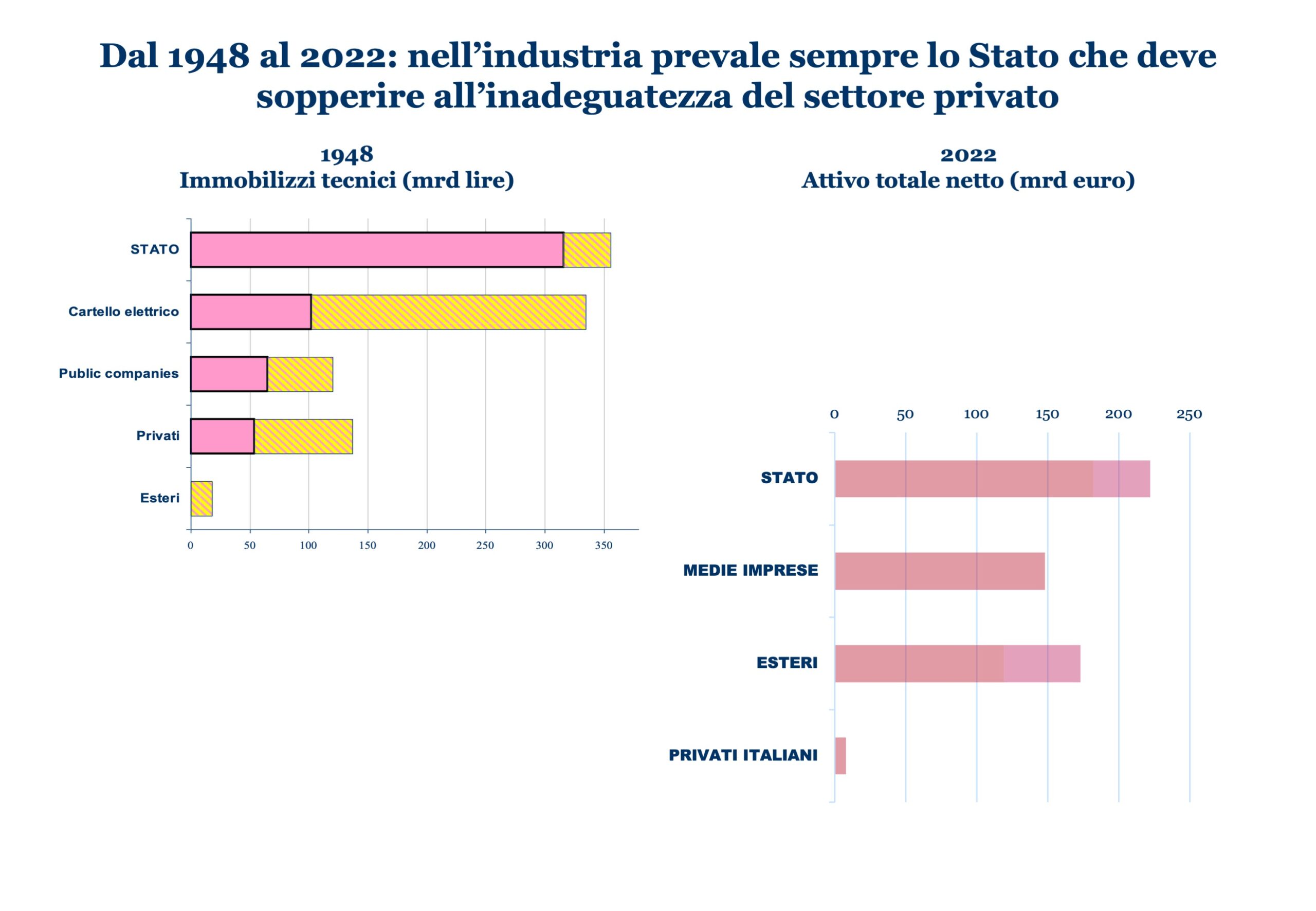

From 1948 to 2022, the former head of the Mediobanca research office points out, the state prevailed in industry and found itself having to make up for the inadequacy of the private sector. Just look at the numbers: in 1948 the technical fixed assets of state-controlled companies exceeded 300 billion lire while in public companies it amounted to around 60 billion and among private individuals 50 billion.

In 2022, the same count on total net assets was equal to around 210 billion euros in the State and instead the levels were lower among medium-sized enterprises (just under 150 billion) and among foreign investors (around 170 billion ).

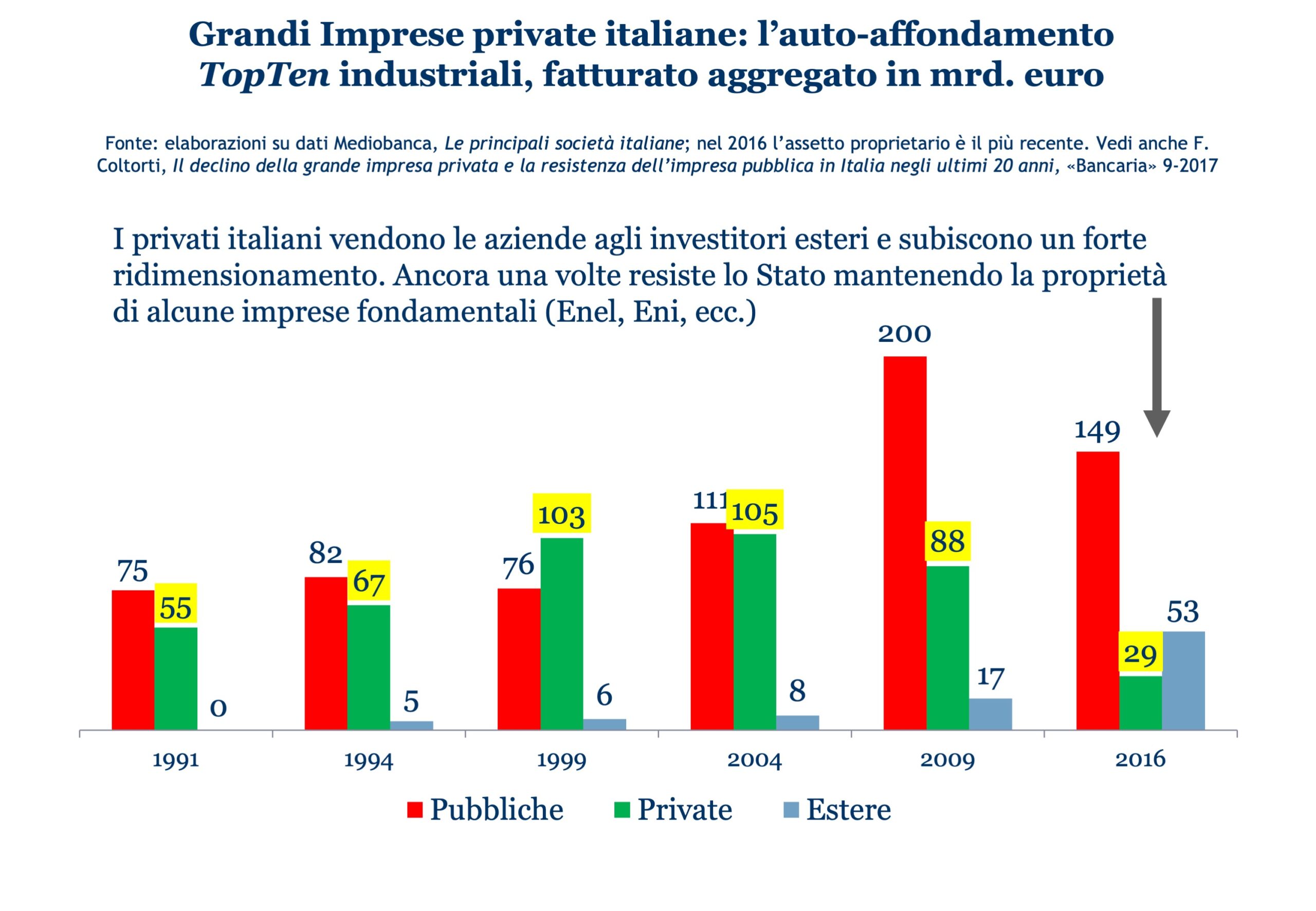

Then when it happened that private Italians sold the companies to foreign investors they suffered a strong downsizing; on the contrary, the State has demonstrated its resistance where it maintains ownership, as in the case of some fundamental companies (Enel and Eni). For example – as can be seen from processing of Mediobanca data – in 1991 public companies boasted a turnover of 75 billion and private ones 55 billion, three years later the comparison was 82-67 while in 1999 there had been overtaking with companies public at 76 billion and private at 103 billion.

In 2004, however, there was a counter-overtaking with public companies that exceeded the turnover of private ones (111 to 105), a difference that increased five years later (200 billion compared to 88 billion) and then decreased in 2016 (149 to 29). The contribution of foreign companies, with the exception of 2016 with a turnover of 53 billion, is of little decisive importance in this discourse.

HOW COMPANIES INVEST, DIFFERENCES BETWEEN PUBLIC AND PRIVATE

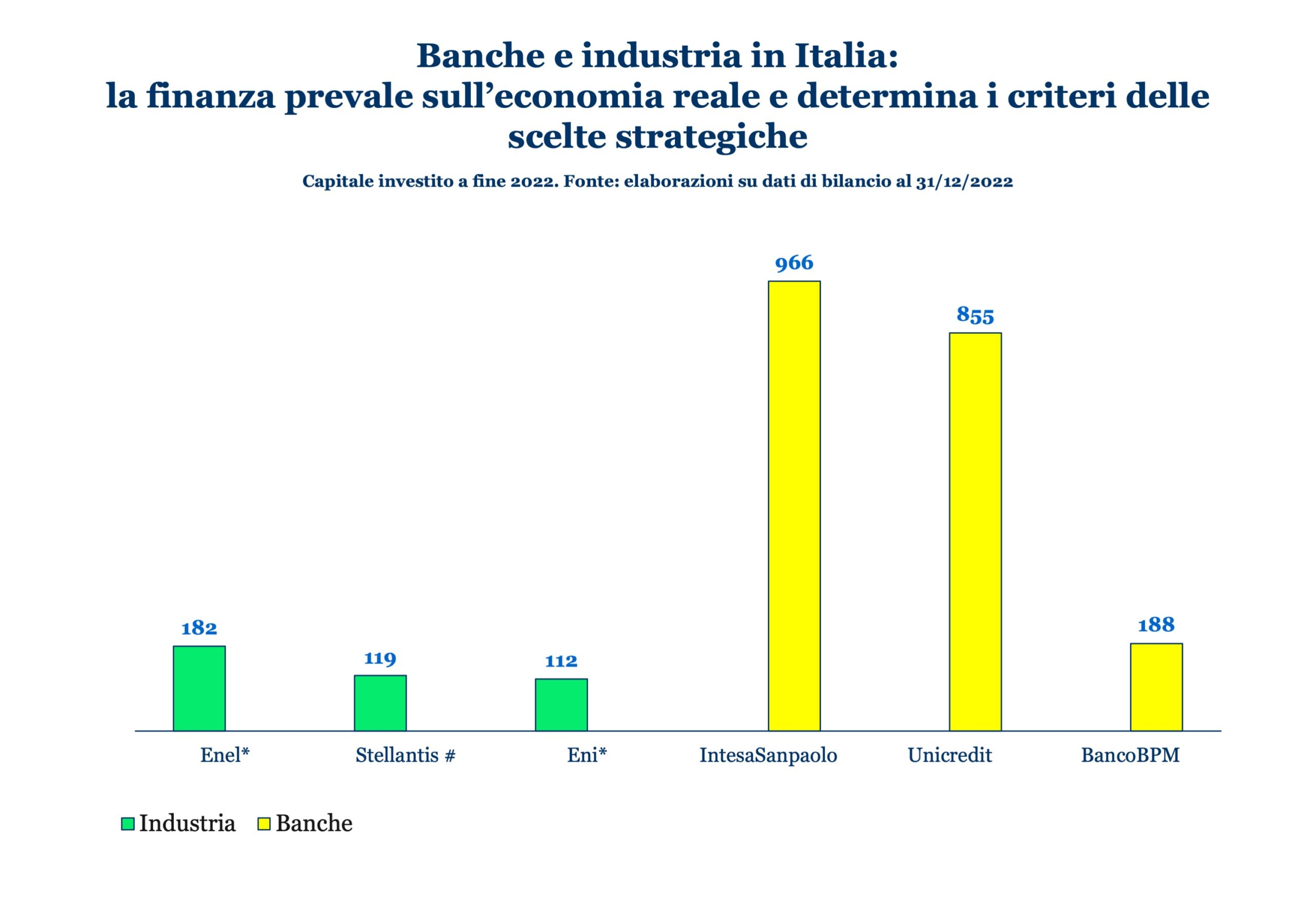

In Italy, Coltorti argues, finance prevails over the real economy and determines the criteria for strategic choices. As can be seen by examining the financial statements as at 31 December last year, Intesa Sanpaolo and Unicredit invested large sums of their own capital, respectively 966 billion and 855 billion; the case of public companies such as Enel (182 billion) and Eni (112 billion) or Stellantis (110 billion) is quite different.

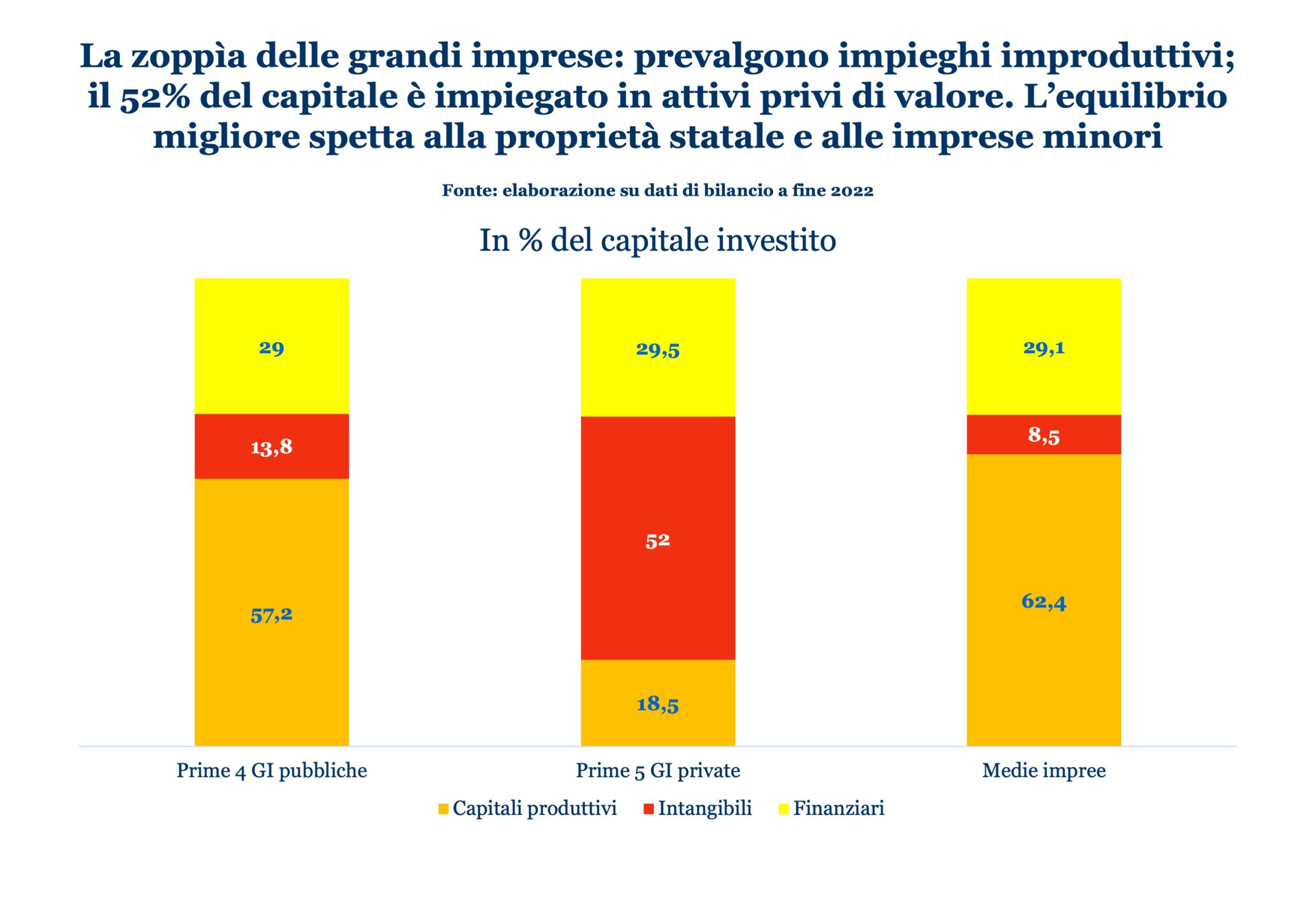

These data are interesting because, as is well known, the firm is efficient when it uses efficiently the capital that the community allows it to use. There are uses that create value, such as factories, machinery, licences, patents, while cash, as long as it remains cash, does not produce anything other than an annuity (which, moreover, is subject to risk).

Then there are the intangible assets which do not correspond to anything directly productive and which arise above all on the occasion of acquisitions and mergers, for example in the case in which companies are acquired which are then consolidated and it is discovered that the balance between the acquired assets and liabilities with these operations it is much lower than the price paid.

Well, again through an elaboration of financial statement data as at 31 December 2022, one realizes – it emerges from the Coltorti survey – that unproductive uses prevail among large private companies: in fact among the first five (Stellantis, Tim, Essilor Luxottica , Prysmian, Pirelli)) intangibles are equal to 52% of invested capital and financials are 29.5%; only 18.5% is productive capital. The discourse in the first four large public companies (Enel, Eni, Leonardo, ST) is practically the opposite, where productive capital is 57.2% of the total, intangible assets 13.8% and financial assets 29%. Finally, looking at medium-sized enterprises, we note that productive capital rises to 62.4% of the total, with intangible assets stopping at 8.5% and financial assets in line with large enterprises at 29.1%.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/stellantis-prysmian-luxottica/ on Mon, 31 Jul 2023 05:34:16 +0000.