The state of health of Italian automotive components companies. Report

Positive data from over 2200 companies in the sector, but the present is full of pitfalls. For this reason, automotive components are asking the new government to significantly reduce energy costs, digitization and innovation projects, but also incentives for registrations and more infrastructures for recharging electric cars.

When it comes to automotive, the big brands come to mind: Alfa Romeo, Fiat, Lancia … almost no one dwells on the importance of third parties, of the entire supply chain that produces more or less small components, all equally important, which will then end up in the car that we find at the dealership. There are 2,202 companies that make up the universe of Italian automotive components, the majority of which, as we shall see, collaborate with Stellantis because they are still part of that industrial 'web' that has sprung up around the Fiat factories. The latest report from Anfia, the association that represents the supply chain, tells us what their health condition is.

ITALIAN AUTOMOTIVE COMPONENTS IN NUMBERS

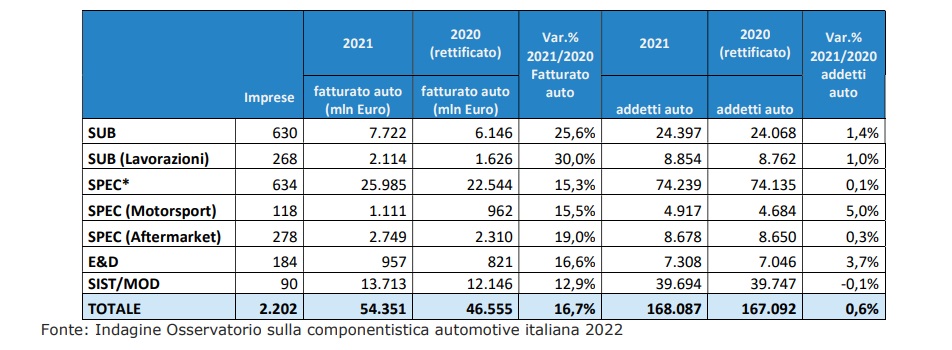

During 2021, the two thousand two hundred and two companies in the sector employed over 168,000 employees and generated an estimated turnover of 54.3 billion euros in the same year. Compared to 2020, which closed with a significant decrease in turnover and a more modest reduction in employment terms on the previous year, 2021 shows a recovery, with a variation of + 16.7% in turnover and a substantial stability in the number of employees (+ 0.6%).

In total, the entire industrial production of the Italian automotive sector (including the production of bodywork and components) records a tendential growth of 18.7% in 2021 compared to 2020 (-8.5% compared to January-December 2019) and closes the final balance of January-June 2022 at -3% on an annual basis. For 2022 it is estimated that the volumes of Italian production can amount to around 730 thousand units (-8.2% compared to 2021); worldwide, vehicle production is expected to close at the end of 2022 at -2.1% (Fitch Solutions forecasts).

Piedmont maintains the national record for the number of companies (33.3%), immediately followed by Lombardy (27%), Emilia-Romagna (10.4%) and Veneto (8.8%). In Piedmont, the turnover generated by components in 2021 was equal to 17.6 billion euros (32.5% of the national total), with over 58,600 employees (34.9%). Compared to the previous year, turnover showed signs of recovery (+ 16.8%), while the number of employees tended to be stable.

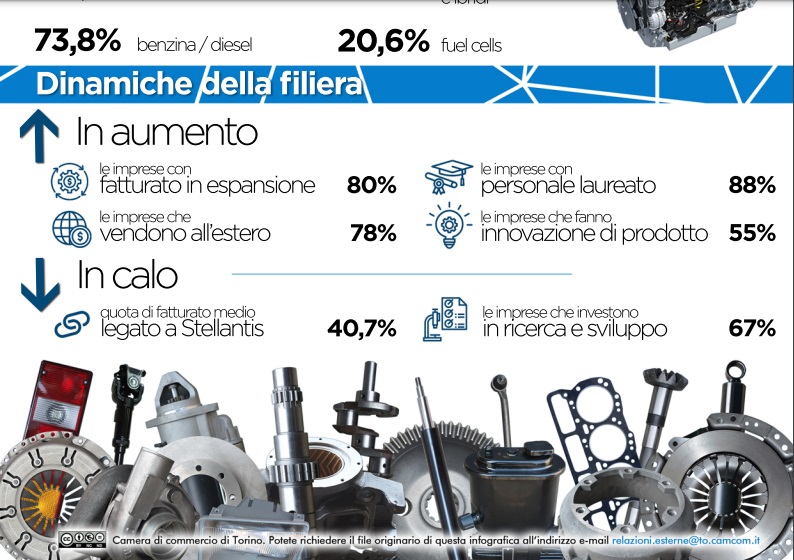

In 2021 there was a strong recovery in international trade (78.3% of companies sell their products on foreign markets. The percentage of turnover deriving from exports also increased, which in 2021 averaged 41.8 % while it was 37.8% in 2017), but the economic-political events of 2022, such as the rise in the prices of raw materials, the costs of logistics, the prolongation of the semiconductor crisis and the Russia / Ukraine conflict, do not hopefully, analysts write. For Marco Stella , President of the National Automobile Industry Association: “In 2022, the effects of instability linked to the conflict in Ukraine could lead to a slowdown”.

THE INDUCED IMMENSE OF STELLANTIS

In 2021, 72.9% of companies have Stellantis in their customer portfolio (80.6% in Piedmont). In decline, the share of turnover generated by sales to Stellantis, equal to 40.7% in Italy (it was 41.7% in 2020), while it recorded an increase at the Piedmontese level (from 47.4% in 2020 to 49, 6%). On the other hand, the incidence of turnover from other manufacturers, above all German, French (excluding Stellantis) and American OEMs, is worth 59.3%.

WHAT ACTIVATES LIMPRESE AND PIEDMONTESI

The relationship with Asian manufacturers is of lesser importance. 66% of companies see an opportunity in the establishment of the new industrial giant (only 59% in Piedmont); among the concerns, especially in Piedmont, the possible changes with respect to the decision-making center of gravity and the decrease in supply volumes. For the second consecutive year, the number of companies that declared that they did not know how to express an opinion on the impact of the merger remained high (58%), a tangible sign of the continuing uncertainty of an operation with synergies in development course.

THE ECOLOGICAL TRANSITION

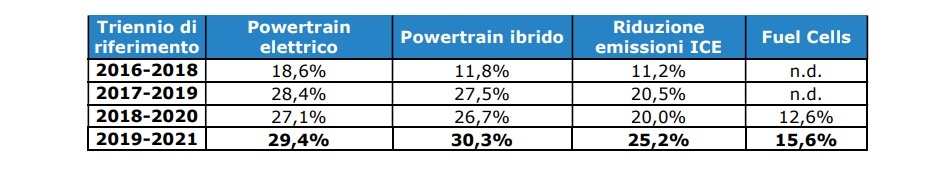

The acceleration of demand and production of electric and hybrid vehicles in 2021 and the positive prospects for a progressive spread of electrified powertrains "force all the players in the supply chain to deal with the transition underway". The percentage of suppliers who define themselves as having a good positioning in the petrol and diesel engine sector remains high (73.8% of respondents), as is the share for methane and / or LPG fueling (40.1%). ). For Marco Stella , number 1 of the National Automobile Industry Industry Association: "To address the challenges of the energy transition, from this year our companies can also count on the measures of the automotive fund, in particular industrial policy interventions such as development contracts and innovation agreements, which facilitate business investment programs ".

The positioning on electric and hybrid powertrains is significant for 37.6% of the companies while 20.6% of the respondents have a significant positioning on fuel cells. After the slight decrease seen in 2020, the supply chain's participation in new powertrain development projects is once again expanding: considering the three-year period 2019-2021, the involvement both for the electric powertrain (29.4%) and for the hybrid one increases ( 30.3%), but above all it increases the share of companies that took part in projects to reduce emissions on internal combustion engines, through new materials and lightening the weight of vehicles (25.2%). Underlining the growing interest in fuel cells, the portion of companies that have joined projects that develop this technology reaches 15.6%.

THE CHALLENGES AWAITING AUTOMOTIVE COMPONENTS

"2021 closed in recovery, with a national turnover up by 16.7%, but today the challenges are multiplying for companies in the automotive supply chain: high energy and raw material costs, international crisis and above all accelerated ecological transition, despite the prevailing positioning still remains on traditional engines (73.8%) – commented the President of the Turin Chamber of Commerce, Dario Gallina. – This is why our companies are looking for solutions, selling more abroad, investing in product innovations and looking for new skills on the job market, often difficult to find: caution and prudence characterize the prospects for the current year in any case ".

INVESTMENTS IN RESEARCH AND DEVELOPMENT

The companies that invested in R&D in 2021 are 67%, gradually decreasing over the three-year period; the decline affected all supply categories, with the exception of some segments, such as E&D, which return to the levels of 2019. The share of R&D employees has also dropped in the last year, although there is a greater projection towards innovation of product (55% compared to 40% of the previous year) and a stronger openness to forms of collaboration in research activities, especially with other companies. In the last three years, the main reasons that have hindered innovation are too high costs (for 25.3% of companies with a high degree of importance), the instability of demand (for 24%) and the lack of qualified personnel (for 22.5%).

Read also: Will the cars of the future be on tap or hydrogen?

The number of companies with internal graduates increased from 84% in 2017 to 88% in 2021, but this did not lead to an increase in the workforce specifically employed in research and development. For the next five years, companies report a widespread need for new professional figures, to be allocated in particular to production processes (62% of companies), automation and mechatronic systems (53%), products and materials (48%). %), as well as environmental sustainability (47%).

THE ITALIAN SCENARIO

The demand for cars in Italy in 2021 at + 6.7%, "but if we compare the figure with 2019, the drop is equal to 21.8%: 463 thousand vehicles less than pre-Covid volumes", they explain from the Anfia . In the first months of 2022, economic activity showed a “widespread deceleration among the main countries. The Russia / Ukraine crisis has amplified already existing criticalities: inflation, obstacles to the functioning of value chains, increase in financial volatility, further increases in the 2 prices of energy raw materials ”. The International Monetary Fund has thus revised downward the growth estimates of world GDP for the two-year period 2022-2023. In 2022, world demand could amount to around 80 million vehicles (-2.8% on 2021); in Italy, car sales are expected to decline by 10.3% to 1.3 million units (Fitch Solutions forecasts).

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/smartcity/lo-stato-di-salute-delle-imprese-della-componentistica-automotive-italiana-report/ on Tue, 25 Oct 2022 12:15:27 +0000.