This is how Leonardo, Rheinmetall, Bae Systems and others benefit from the arms race in Europe

Two years after Russia's aggression in Ukraine, Europe's defense industry is booming. Here are the companies that are benefiting from the increase in military budgets according to the Financial Times

The path of rearmament in Europe has turbocharged defense companies.

Global military spending in 2023 increased by 9% compared to the previous year, reaching a value of 2.2 trillion dollars, a new record in an already growing trend, according to data published by the International Institute for Strategic Studies last week.

If the trend is global, it is particularly evident in Europe, due to the Russian war in Ukraine and the prospects of Donald Trump's return to power in the United States in the wake of his comments on Washington's NATO allies; in the Asia-Pacific region, with the rise of China and the aggressive rhetoric of North Korea and the Middle East, in the midst of the conflict between Hamas and Israel, highlights El Pais .

So rising demand for military equipment has transformed the fortunes of European defense contractors, with the combined order books of the region's top seven companies in the sector – including Bae Systems, Leonardo and Saab – reaching near-record levels of more than 300 billion dollars, underlines the Financial Times .

All the details.

BOOM IN GLOBAL DEFENSE SPENDING…

According to “The Military Balance”, the annual report on military capabilities and the defense sector on a global scale prepared by the International Institute for Strategic Studies (IISS), global defense spending “will increase again in 2024 as the world enters in a period of greatest danger."

… BUT ALSO EUROPEAN

In particular, in 2023 defense spending grew by 4.5% to $388 billion in Europe, to reach an average of 1.6% of GDP, levels not seen since the Cold War.

During 2014, the European NATO allies spent 235 billion dollars, 1.47% of GDP. In 2023, this figure has risen to $347 billion (both calculated in constant 2015 prices), equal to 1.85% of GDP. In 2024 the forecast is respectively 380 billion dollars and 2%, according to data published by the Atlantic Alliance.

THE PUSH TO REARMATION FROM THE WAR IN UKRAINE

The increase in defense spending accelerated after the full-scale invasion of Ukraine.

Kiev has forced politicians to face something governments never planned for, even during the Cold War, according to Trevor Taylor of the Royal United Services Institute: “A prolonged, conventional land war,” reports the Ft .

FOCUS ON AMMUNITION

Furthermore, as the British financial newspaper recalls, the EU has committed to delivering 1 million artillery shells to Ukraine by the end of March, a target it has admitted it will fail to hit. Much of the defense sector has struggled to ramp up production quickly enough after decades of underinvestment.

SPOTLIGHT ON RHEINMETALL, BAE SYSTEMS, NEXTER AND NAMMO

The huge increase in demand has put the spotlight on Europe's four main munitions manufacturers: Germany's Rheinmetall, Britain's BAE Systems, France's Nexter and Nammo, owned by the Finnish and Norwegian governments.

The German tank and ammunition manufacturer recently announced that it will invest 300 million euros in a new artillery shell factory. Last February 12, accompanied by German Defense Minister Boris Pistorius, Scholz participated in the inauguration ceremony of the Rheinmetall group's new weapons factory. The site will produce 155mm artillery ammunition, standard NATO ammunition used in many guns and howitzers, from 2025, gradually aiming for a capacity of 200,000 shells per year.

In total, Rheinmetall wants to produce, at all its sites in Europe, up to 700,000 artillery shells per year in 2025, up from 400-500,000 this year. Before the Russian invasion of Ukraine, it produced only 70,000.

“A COMPLETELY DIFFERENT WORLD”

For the Financial Times , Rheinmetall itself has enjoyed the biggest change in its business in the sector, going from being sidelined by many investors for ethical considerations to the star of the new era of the country's defense.

“A few months ago, people wanted to ban us, to say that this industry is a bad industry, it's a harmful industry,” CEO Armin Papperger told the Financial Times shortly after Chancellor Scholz's 2022 announcement that he would inject €100 billion in defense in response to Russia's invasion of Ukraine. “It's a completely different world now.”

Rheinmetall shares quadrupled over the period, catapulting the company into the German blue-chip Dax index, the FT points out.

REFLECTIONS IN THE STOCK MARKET

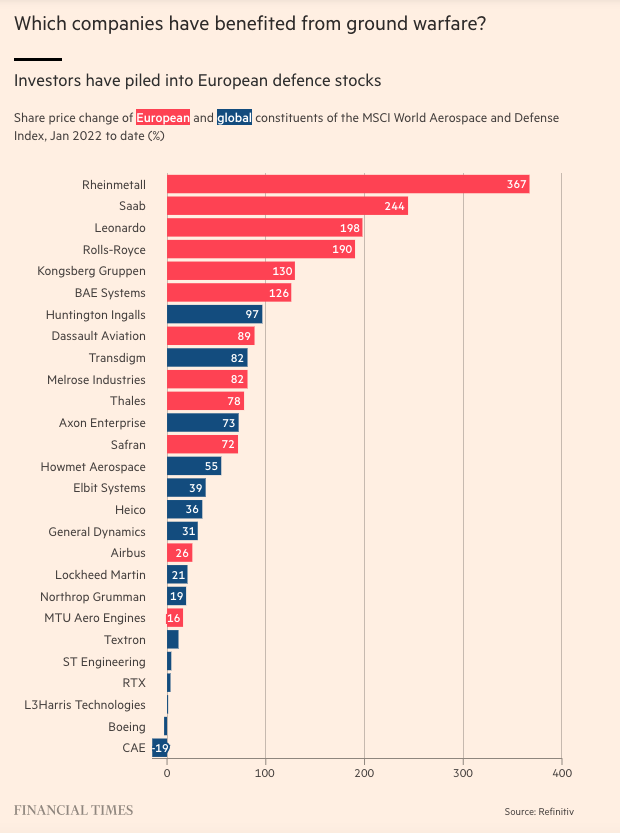

Military spending commitments by European governments have sparked renewed interest in the sector, which had previously been shunned by many investors, with shares of the region's contractors outperforming those of their US rivals.

From the ranking drawn up by the Financial Times on the percentage change in the share price of the European and global components of the MSCI World Aerospace and Defense index, from January 2022 to today it emerges that Rheinmetall, Saab and Leonardo are on the podium.

LEONARDO'S TITLE PERFORMANCE

As Alliance News reported on February 19 , “Leonardo continues his run in Piazza Affari, where he is at five-year highs. The forecasts of an increase in military spending in Europe and the good positioning in advanced electronics are also relaunching the defense giant, controlled by the Italian state with 30%, on the stock market. Today the Leonardo stock rises by 1.6% to EUR19 for a market capitalization of 11 billion euros. In the last month, Leonardo has grown by 13% and in the last six months it has achieved a leap of 49%, which over 12 months reaches an increase of 82%.”

NOT JUST WEAPONS, AIR DEFENSE SYSTEMS ALSO REQUIRED

While the munitions crisis has thrust domestic arms manufacturers into the spotlight, renewed interest among European nations in air and missile defense capabilities has proven to be a boon for the region's manufacturers, the Financial Times further notes.

The case of the Swedish defense giant Saab, known as the manufacturer of the Gripen fighter-bomber, is emblematic. According to Sash Tusa of research firm Agency Partners in London, its other weapons “have become really in high demand because of Ukraine.”

Among Saab's products, the flagship is the NLAW anti-tank missile, sent to Ukraine from the United Kingdom, Tusa noted to the Ft , describing the company's air defense radars as "another Cinderella product for the first two decades of the century" when “literally no one cared about ground-based air defense, because 'we' had air superiority, and none of the wars we chose to fight (Iraq, Afghanistan) had an enemy air force.”

SPRINT MBDA

Finally, MBDA, Europe's largest missile manufacturer owned by BAE Systems, Airbus and Leonardo, also saw growth.

After securing orders worth €9 billion in 2022, MBDA secured £6 billion worth of air defense equipment contracts with Poland last year, as well as contracts with Germany and France to increase missile production, it said. the Financial Times . “We are seeing a rapidly evolving battlefield threat that the industry must adapt to address. Air defense equipment is in high demand,” said Éric Béranger, CEO of MBDA.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ecco-come-leonardo-rheinmetall-bae-systems-e-non-solo-beneficiano-della-corsa-al-riarmo-in-europa/ on Mon, 26 Feb 2024 06:40:49 +0000.