Is this the beginning of the end for Gazprom?

How is the Russian giant Gazprom doing? Facts, numbers and insights. The article from Energia Oltre

Gazprom is having a bad time in Europe and the mood of its managers shows it.

Here are facts, numbers and insights-

THE ROLE OF GAZPROM IN EUROPE

Europe has dashed the predictions of many analysts, breaking its dependence on Russian gas and Gazprom, the state gas monopolist that has become a major corporate casualty of the conflict in Ukraine. “Gazprom has understood that it will never again have as big a slice of the pie in Europe as before, and it will have to accept it. Now the only way forward is to look for smaller sources of revenue and develop them gradually, collecting the crumbs,” commented Marcel Salikhov, head of the Russian think tank Institute for Energy and Finance.

WHAT PUTIN SAID

As the Financial Times reports, Putin admitted that Russia had previously profited more from energy exports, but denied that the loss of business was causing problems. “Maybe it was better before – declared the Russian president – but, after all, the less we depend on energy, the better, because the non-energy part of our economy is growing”.

Although Moscow decided to cut gas supplies to Europe early in the war, raising prices enough to offset the collapse in exports, the effect was short-lived. In the first six months of 2022, pre-tax profits reached a record 4.5 trillion rubles ($49.7 billion), but a year later they plummeted by 40% to 2.7 trillion rubles, while net profits fell from almost 1 trillion to 255 billion rubles.

GAZPROM'S PROFITS

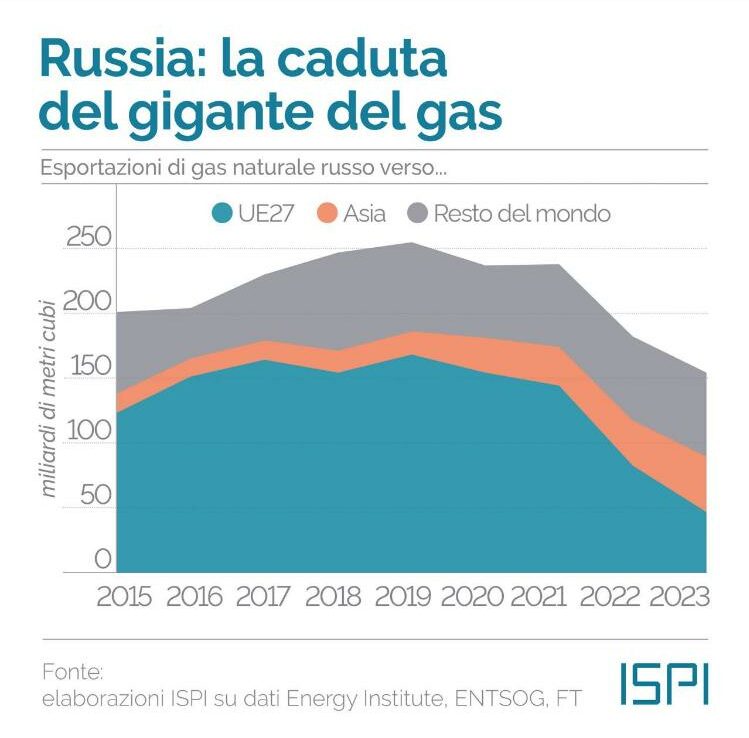

Researchers at the state-controlled Russian Academy of Sciences predicted that Gazprom's full-year 2023 results would show that it has ceased to be profitable and that by 2025 net losses could reach 1 trillion rubles. The European Union has proven more adept at sourcing alternative gas than many thought: Russia's share of EU gas imports fell from more than 40% in 2021 to 8% in 2023, while prices plummeted compared to to the peaks of the first days of the war. The EU aims to eliminate all imports of Russian fossil fuels by 2027.

Putin said Russia responded well after Europe stopped buying its gas, "exploring alternative routes and focusing on its own gasification efforts", but in reality these do not replace EU export activities. With its main export business in dire straits, Gazprom has been trying to find new buyers but, according to Salikhov, its deals in Central Asia and small increases in supply to China and Turkey will only make up 5% to 10% of the European market lost. In this scenario, achieving any substantive change will require huge investments in pipelines and other infrastructure to serve new markets, as well as the involvement of external partners, who are in less of a hurry to engage.

HOW THE WAR CHANGED GAZPROM'S OUTLOOK

When the war in Ukraine began, Gazprom seemed to be in a much better position than other Russian energy exporters, considering that Russian gas, unlike oil, was not subject to any Western sanctions.

Its prospects changed, however, in September 2022, when underwater explosions damaged Nord Stream pipelines, which carried 40% of Russian gas exports to Europe, dramatically reducing Moscow's ability to use the fuel as leverage. Moscow and the West accuse each other of sabotage, and Gazprom did not respond to a request for comment.

THE RUSSIAN MARKET SUPPORTS GAZPROM, BUT…

The Russian market – which has always accounted for a much larger share of Gazprom's production than Europe – has helped the company stay afloat, but with gas sold at a much lower price domestically, local sales are not can compensate for the collapse of the community market. Gazprom must sell gas domestically at regulated prices, while competitors such as privately run Rosneft and Novatek can offer discounts to attract large buyers.

The main recipient of Gazprom's profits is now the Russian state, which immediately after the invasion imposed an additional monthly tax of 50 billion rupees on the company until 2025. Although exports to China have increased, gas volumes they remain relatively small: last year Russia sent about 22 billion cubic meters to Beijing via pipeline, a fraction of the annual average of 230 billion cubic meters exported to Europe in the decade before the war in Ukraine.

LNG EXPORTS

Meanwhile, although Russian LNG exports are gradually increasing, they remain a fraction of pre-war deliveries. Novatek accounts for the bulk of Russia's LNG exports, with Gazprom lacking the specialized infrastructure to convert and transport it, having bet on pipelines rather than liquefaction technologies at the dawn of the Putin era.

Gazprom Neft – Gazprom's oil business – has become the company's main lifeline, contributing 36% of revenues and 92% of net profit in the first half of 2023. Last year's market value of the division even surpassed that of the parent company. “Gazprom will never again be a huge cash cow for those in power,” said Vladimir Milov, former deputy energy minister and architect of Gazprom's reforms in the early 2000s. “Instead of making excessive profits, there is risk that the company becomes a beneficiary of state subsidies”.

(Article published in Energia Oltre )

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/energia/gazprom-crisi-risultati-2023/ on Mon, 26 Feb 2024 06:05:29 +0000.