Trafigura, all about the trader behind the Cypriot fund Goi who wants Isab di Priolo

Figures, business and aims of Trafigura, the large raw materials trading company involved in the restructuring of Isab in Priolo

Trafigura is also involved in the transfer of ownership of ISAB in Priolo Gargallo , one of the largest refineries in Italy and Europe, from the Russians of Lukoil to the Cypriot private equity fund (but mostly made up of Israeli investors) GOI Energy : is one of the world's largest commodity trading companies and is posting substantial profits thanks to the energy crisis and market volatility exacerbated by the war in Ukraine.

WHAT MAKES THROUGH

Trafigura is a Swiss-Singaporean commodity trading company, i.e. the exchange of raw materials: crude oil and condensates, petrol, fuel oil, biodiesel, minerals, refined metals, coal and iron.

It is the world's largest private (i.e., unlisted) trader of metals and second largest of oil. It owns ownership stakes in mining sites, manufacturing plants, transportation facilities and storage terminals spread across 150 different countries. In Italy, for example, it has a 3.01 percent stake in Saras, the refining company chaired by Massimo Moratti and owner of the large Sarroch refinery.

HIS ROLE IN THE ISAB

Trafigura did not obtain a share of ISAB, but still plays an important role in the reorganization of the company after the transition from Lukoil to GOI Energy. The fund has in fact formed a partnership with the Singaporean group, which will supply capital and crude oil to the refinery and will handle the marketing of refined products through offtake agreements.

FOUNDATION, INTERNATIONAL PRESENCE AND SHAREHOLDERS

Trafigura was founded in 1993, and initially focused on just three markets: Africa (for oil), Eastern Europe (for metals) and South America (for both). Since then it has branched out all over the world, operating through a dense network of subsidiaries. Its headquarters are in Singapore, but it has eighty-eight offices in forty-eight countries.

Trafigura is not listed on the stock exchange and therefore is not obliged to disclose its shareholders or provide data on the performance of its activities, but in any case publishes reports every two years. The 2021 annual report states that it is owned by about a thousand of its employees (in 2020 there were 850).

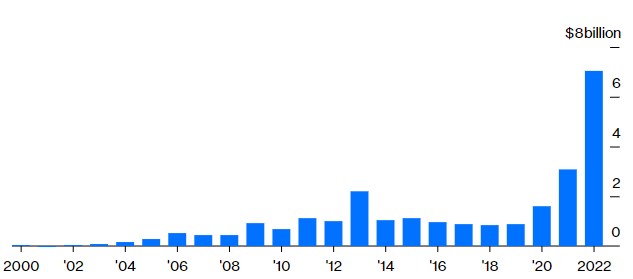

RECORD PROFITS IN 2022

In 2022, the company reported record net income of $7 billion, nearly equal to the profits of the previous five financial years combined. In 2019, before the coronavirus pandemic rocked markets, Trafigura's net income was less than $900 million.

The merit of the 2022 numbers, in a certain sense, is due to the Russian invasion of Ukraine, which aggravated – together with the consequent Western sanctions – the international energy crisis and the volatility on the markets, allowing Trafigura to reach a level of profitability very high.

Between last April and September – reconstructed Javier Blas, journalist expert on commodities, on Bloomberg – Trafigura made a net profit of 4.4 billion dollars: that is to say almost 1 million dollars per hour, every day ( including weekends), for six consecutive months. And all this “just to buy and sell stuff”.

The company has distributed $1.7 billion in dividends among its shareholders.

VERY LOW TAXES

Trafigura's profitability is favored by the very low taxes it is obliged to pay, a condition that affects practically all commodity traders . In 2021, its tax rate was just 12 percent, nearly half that of Wall Street banks (around 20-25 percent) and well below that of big oil companies (close to 30 percent).

Trafigura manages to pay few taxes because it operates in very favorable jurisdictions from this point of view: its high-level executives are located in Switzerland, while the company is based in Singapore: it is a typical structure among companies in the sector, whose districts generals are often found in places like the Bahamas, Luxembourg or the British Virgin Islands.

THE DETACHMENT FROM RUSSIA

Prior to the invasion of Ukraine, Trafigura was a lead trader of crude and refined products for Russia's state oil company Rosneft.

With the onset of war, however, the company quickly distanced itself from Moscow, for example by selling its stake in the Vostok oil project in the Russian Arctic after buying it just a year and a half earlier. The buyer was an unknown trading company called Nord Axis, based in Hong Kong.

THE DEAL WITH THE ROMAN FUND HARA CAPITAL SARL

On January 11, Trafigura sold its 24.5 percent stake in the Indian (but Rosneft-backed) refiner Nayara Energy to investment group Hara Capital Sarl. It is a wholly owned subsidiary of the Roman holding Mareterra Group, formerly known as Genera Group: it invests mainly in Italy, Luxembourg, Spain and France, but is also expanding outside Europe.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/energia/trafigura-goi-isab/ on Mon, 16 Jan 2023 06:16:42 +0000.