What the Japanese markets say about the post Suga

The Topix marks a 30-year high after the announcement of the resignation of Prime Minister Suga. The analysis by Daisuke Nomoto, global head of Japanese equities at Columbia Threadneedle Investments

After months of declining approval ratings, Japanese Prime Minister Yoshihide Suga has announced that he will not run for the election as LDP leader, thus resigning from office. In addition to mounting public criticism for its response to the Covid-19 pandemic and the decision to proceed with the Tokyo Olympic Games despite objections from health experts, a series of regional election defeats highlighted public discontent with the government. .

Given the collapse of the approval rating of the Suga executive, many party members feared that without a change of prime minister the LDP would lose the lower house elections. News of his resignation helped a rally in Japanese equities, which took the Topix index to a 30-year high.

AND NOW?

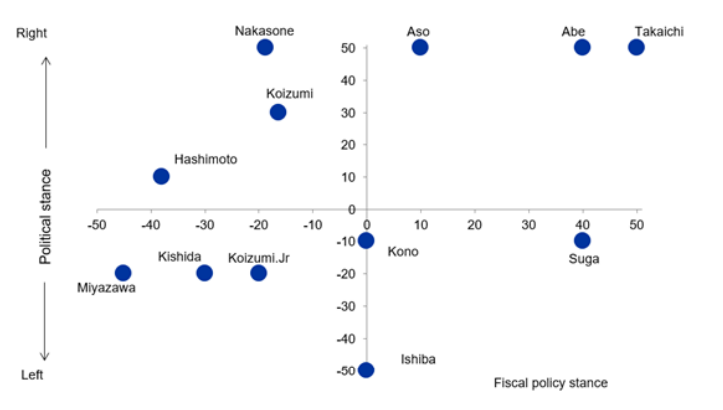

There are currently three candidates openly lined up: Fumio Kishida, the former foreign minister who finished second behind Suga in last year's ballot; Sanae Takaichi, the former interior and communications minister; and current vaccine minister Taro Kono. Former defense minister Shigeru Ishiba indicated that he is considering running for office.

From a market perspective, many investors and business executives see Kono as a more favorable candidate because of its reformist views. He speaks English fluently, has a strong appeal to the public and is generally in favor of increased tax spending. Political analysts expect his candidacy to be supported by Suga. Kono is currently Minister for Administrative Reforms and Regulatory Reforms and has been instrumental in changing the national pension system. He also called for cuts in health and safety spending, which has grown with the aging population, and proposed accepting more foreign workers to address the labor shortage. In the past, it has insisted that the Bank of Japan (BoJ) provide clearer communications regarding an exit strategy from its extremely accommodative policy.

Fumio Kishida is a former banker who was beaten by Suga in last year's elections for leadership. Kishida pledged to maintain expansionary fiscal and monetary policies, although he previously expressed doubts about the BoJ's overly accommodative stance. We can expect the market to prefer its stance on economic policy, as Kishida has called for more support for businesses in technology and innovation, with the aim of creating a "digitization society". In addition, he proposed a stimulus plan worth over 30 trillion yen to overcome the challenges posed by Covid.

Former interior minister Sanae Takaichi supports an economic policy very similar to that of "Abenomics", which involves a combination of aggressive monetary easing, use of fiscal resources in emergencies and spending on crisis management and growth. In an interview, Takaichi said that Japan should freeze the goal of bringing the budget to balance until inflation reaches the BoJ's 2% target, and that it should not hesitate to issue government bonds if necessary to manage the crisis more effectively. If he became the new prime minister, the fiscal stimulus would be greater than that of the other contenders.

Shigeru Ishiba, former defense minister, can be considered one of the worst outcomes for the market. A supporter of more populist economic policies, instead of relying on foreign trade, he recommended reviving domestic demand (particularly in the regions) in order to fuel growth. He also criticized the BoJ's extremely low interest rates and defended the need to cut the consumption tax in the past.

IMPLICATIONS FOR THE JAPANESE MARKET

Despite the change of prime minister, investors should consider the prospects for the Japanese political landscape in a favorable light, as the majority of seats are likely to remain in the hands of a ruling coalition (LDP + Komeito Party). The backbone of economic, foreign and fiscal policy is expected to remain intact, providing a significant driver for continued economic recovery.

In the past, the Japanese stock market has been sensitive to the election of the House of Representatives, which defines the future stability of the administration. In the event that the LDP alone holds the majority, we can expect a marked market reaction. Provided the coalition party does not lose more than 72 seats – a scenario we consider unlikely given the imminent departure of the increasingly unpopular Suga – Japanese equities are expected to perform reasonably strong in the face of global economic recovery, low valuations. and increased vaccination rates. In light of the good historical performances highlighted by the lists during the last 14 general elections since 1979, we believe that this could prove to be a catalyst capable of bringing the Japanese index potentially in line with the US and Europe, given the delay accumulated in the course of the year.

We also remain optimistic about the imminent announcement of the fiscal corrective action, which is expected to amount to around 30 trillion yen and offer further support to the economy. We can also rest assured that, regardless of the next prime minister, the BoJ's monetary policy will remain accommodative in the short term, at least until the end of the current governor's term in April 2023. At the same time, the government is considering easing policy. anti-Covid restrictions in the catering and entertainment sectors. With the further relaxation of social distancing measures, it is reasonable to foresee an acceleration of reopening which will support the recovery of the service sector.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/mercati-giappone-dimissioni-suga/ on Sun, 03 Oct 2021 06:00:02 +0000.