Because the showdown in the ECB between hawks and doves is coming

What could happen soon in the ECB. Giuseppe Liturri's analysis

Delicate weeks await us on the front of the purchases of public securities by the ECB.

Since Christine Lagarde stated on 9 September that "on the basis of a joint assessment of financing conditions and inflation prospects, the Governing Council believes that favorable financing conditions can be maintained with a pace of net asset purchases. in the framework of the moderately lower Pepp compared to the two previous quarters ”, various things have happened on the markets, albeit of a not so significant entity.

The yield of the ten-year BTP rose by 15 basis points (from 0.66% to 0.81%) in parallel with the similar German bond (from -0.34% to -0.18%), thus leaving the spread between the two stocks essentially unchanged around 100/105. The US 10-year yield, on the other hand, moved more strongly upwards, rising from 1.30% to 1.55%, before falling back to 1.45% at the end of the week. The US dollar strengthened on the highs of the year, also falling below 1.16 from its previous level of 1.18.

During the hearing at the European Parliament on Thursday , Lagarde confirmed the accommodative stance of monetary policy, already shown on the 9th, adding that she continues to consider the recent signs of rising inflation to be entirely transitory. The dollar reacted quickly and strengthened.

A Lagarde that continues to show itself as a “dove” as opposed to the “hawks” (Germany and its allies) is also confirmed in the facts. After the 9th tip, we would have expected some sign in the buying pace to reflect that “moderately lower” declared that day. Instead nothing, or almost.

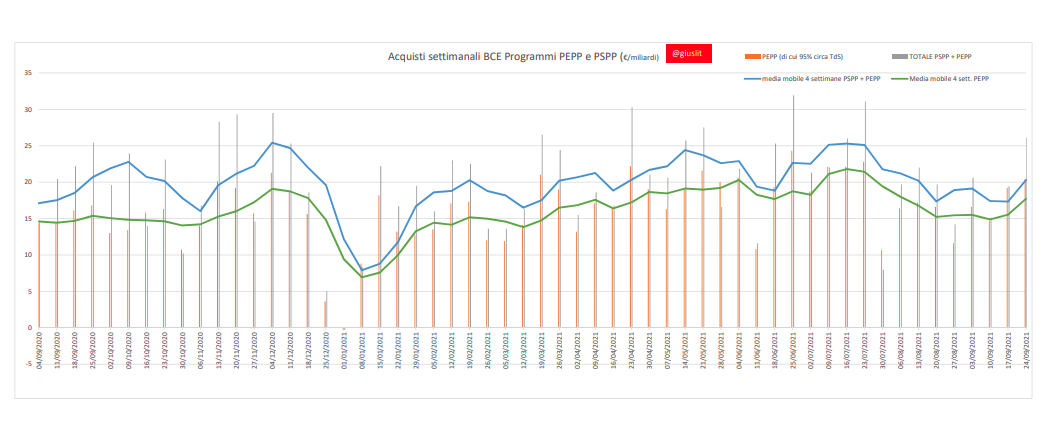

As can be seen from the graph, the following two weeks also saw a slight increase in purchases compared to the previous weeks, which brought the 4-week moving average of weekly purchases with the Pepp program to about 18 billion which, adding purchases with the PSPP program , rise to around 20 billion. Exactly the same data from the same period of 2020, with the only difference being a greater weight of the Pepp extraordinary program.

All right, then? Will the ECB, albeit on the edge of violating the Treaties, continue to do its job, like all central banks in the world? Not exactly. The pressure within the Council is mounting and, especially in Germany, public opinion openly accuses the ECB of destroying savings and welfare. As Giulio Tremonti explained well, Germany – if this level of zero or negative rates persisted – would see the social security system in great difficulty, which thrives on returns on savings, with which benefits are paid. With inflation at 4.1 % (transient or not) widely negative real rates are no longer a bugbear but a fearful reality.

For the moment Lagarde (and our BTPs with her) resist. But December is approaching and that could be the moment of reckoning between hawks and doves.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/perche-sta-arrivando-la-resa-dei-conti-nella-bce-tra-falchi-e-colombe/ on Sun, 03 Oct 2021 08:04:42 +0000.