What will happen in the markets by the end of 2020

The comment "End of year scenario between viruses, central banks and China on the run" by Antonio Cesarano, chief global strategist of Intermonte

We are approaching the last two months of the year with some main factors that could guide the performance of the markets in November and December.

In the order:

- US elections

- Spread of the virus – especially in Europe

- China in sharp contrast to the rest of the world

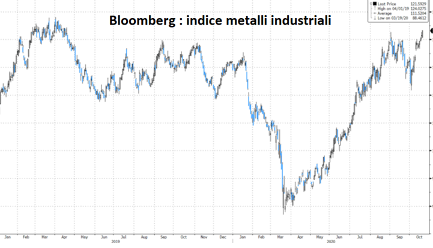

On the last point (China in countertrend), the most recent data supporting this thesis are different. Among those from Chinese sources, the dynamics of imports and retail sales in September, among those least affected by any "manual adjustments" the level reached by industrial metals (of which China is, in several cases, by far the leading consumer in the world, copper in the first place), at its highest since 2019.

On the issue of US elections , negotiations for a tax plan are now underway just before the electoral deadline. Regardless of the outcome (a same-day agreement possible), both candidates present expansive fiscal maneuvers, albeit modulated in different forms (more redistributive Biden, more focused on the Trump tax cut). In both cases, the pivot is represented by a mega investment plan in infrastructure, over $ 2000bn for Trump, around $ 1300bn for Biden.

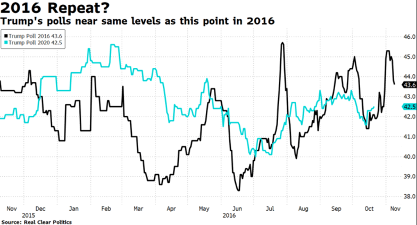

In the last few days, Trump is showing signs of recovery, for now emulating what happened in the last 15 days of the 2016 election campaign.

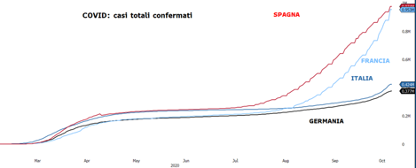

On the virus front, the expansion is exponential especially in France and Spain:

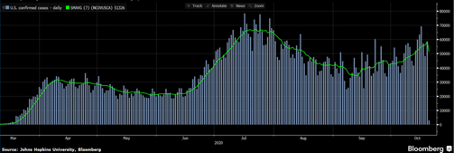

Even in the US there is a resumption of daily infections:

In this context, central banks declare themselves willing to do more but at the same time remaining on standby for now. The Fed is waiting for a fiscal plan to unstuck the accusation of having contributed to increasing inequalities and having made the interests of Wall Street and not of Main Street. The ECB, for its part, is discounting the uncompromising attitude of central bankers in Northern Europe who prefer to wait to verify the impact of the measures already implemented.

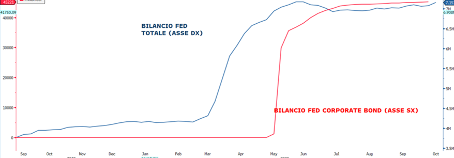

The result is therefore a stand-by situation in which governments cannot yet act (US in the throes of elections and euro area struggling with the approval of the Recovery Fund) and the same applies for the reasons mentioned above for central banks. From this emblematic point of view, the trend of the Fed balance sheet, which has in fact stood at around $ 7000bn for three months, with the corporate line in particular at $ 45bn, out of a potential maximum of $ 750bn.

On the other side of the world, however, China is in full acceleration, managing to control the second wave with a mix of very strict controls without too many scruples on the privacy front and, according to press rumors, even with first tests tests of a vaccine on a part of the population. At the end of the month, China, among other things, will announce the 14th five-year plan, based in part on the concept of technological autarchy with China increasingly at the center of the world within the line dictated by President Xi under the name of dual circulation strategy.

By the end of the year, central banks are expected to heavily return to the field, to make up for the temporary absence of governments as well as to prevent the growth gap with China from becoming too marked.

As a result, the Fed could resume implementing the lines already decided (in particular the corporate one and the Main Street Lending Program). On the ECB side, the quantitative and temporal expansion of the current lines is expected, including the PEPP, the QE in addition to the TLTROs which could be extended beyond March 2021 with the addition of more favorable conditions (for example an even more favorable rate). negative due to a change in the Tiering mechanism).

All this could again prove favorable for the equity sector, also giving rise to a steepening of the curves, necessary to restore inflation expectations and eliminate the negative expectations associated with excessively flat rate curves. All this, for example, with the appropriate dosage of the QE maneuvers on the intermediate curve segment and less unbalanced on the long-term parts.

Consequently, the scenario for the last two months of the year could be the following:

- Risk on on equity markets due to the return of central banks

- Steeper curve (US and higher German long-term rates) and therefore possible sector rotation, as also happened in the two months following the 2016 US lessons

- Favorable trend in the US corporate bond world thanks to the Fed intervention and potentially also the euro high yield component in view of inclusion in the ECB's QE plan

- Stronger dollar (1.13 / 1.15 vs eur area) in view of even more negative euro rates on the Tltro (not in terms of reference rates) and coverage of the huge short euro positions

- Gold temporarily down (towards 1800/1850 $ / ounce) in view of a stronger dollar but always in a primary growing trend with first recovery in view of the Chinese Lunar New Year of February 12, 2021 (year of the ox)

- Spread 10y Italy on a downward trend towards 100 / 120bps area, after a temporary widening towards 140 / 150bps in view of the rating agencies S&P (23 October) and Moody's (6 November)

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/che-cosa-succedera-nei-mercati-entro-la-fine-del-2020/ on Sun, 25 Oct 2020 05:59:01 +0000.