What will happen to oil and BTP

"Short-term cancellations but buy opportunity in quarter / semester perspective", by Antonio Cesarano, chief global strategist of Intermonte

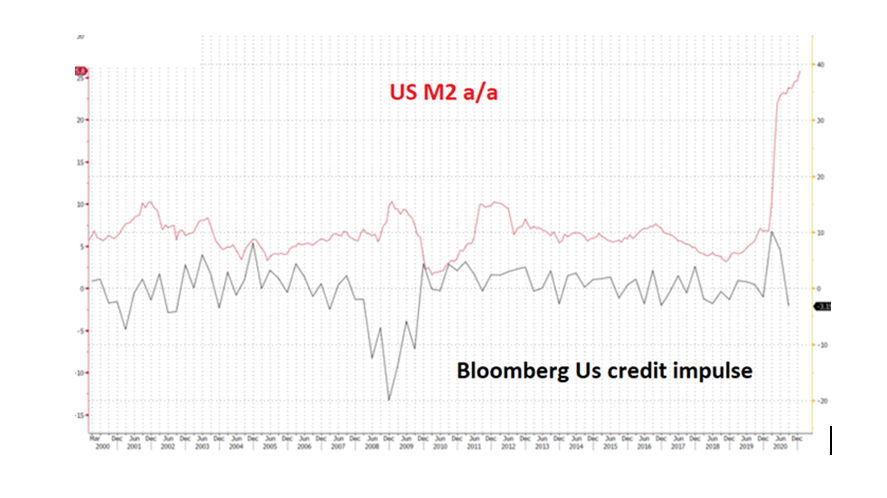

The first part of February was affected by the recovery (in several cases with interest as in the case of the US and Chinese lists) of the profit-taking that emerged in the second part of January. Using the liquidity theme as the main explanatory variable of market dynamics, in the second half of January the implicit request for a “new supply” emerged regardless of the source of origin.

And here came the response from the main four sources promptly:

- Fiscal policy: in the US the discussion of the Biden plan of $ 1900 billion, which, to a substantial extent, is made up of "helicopter money" to consumers as well as aid to states in difficulty, has gotten off to a great start. Pelosi's intention is to obtain approval by the end of February;

- Monetary policy: both the Fed and the ECB have stressed that, at the moment, there is no need to worry about any signs of a return of inflation as the priority is to aim for a rapid recovery in employment;

- Buyback: between the end of January and February, US companies made large issues that will in part be diverted to buy backs and dividends, as in the most striking case of the $ 14 billion bonds (with a maturity of up to 40 years) issued by Apple

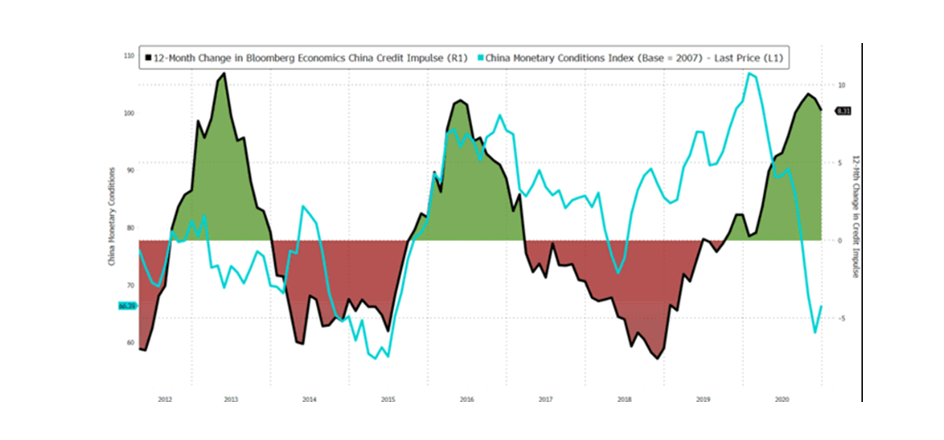

- Credit: this is China's preferred form of liquidity injection which, unlike the US, also tries to avoid excesses by rationing the liquidity in circulation. It is a bit like having a full refrigerator, but with a person in front of you who rationes the daily consumption of food. The reason for this attitude is probably linked to the need to avoid the flourishing of speculative bubbles. In other words, the US is leveraging more on the increase in liquidity in circulation in the broad sense, while China is mainly working on leveraging credit to the economy.

For the markets, optimism quickly returned in view of incoming liquidity, regardless of the source of origin. The favor towards US assets has strongly increased (also witnessed by the recent data on flows vs US equities source EPFR) in view of the enormous spending plans coming up: in addition to the one mentioned by 1900 billion $, a second plan will arrive presumably in the month of March, focused on infrastructure and support for small businesses that produce goods, services and jobs in the US.

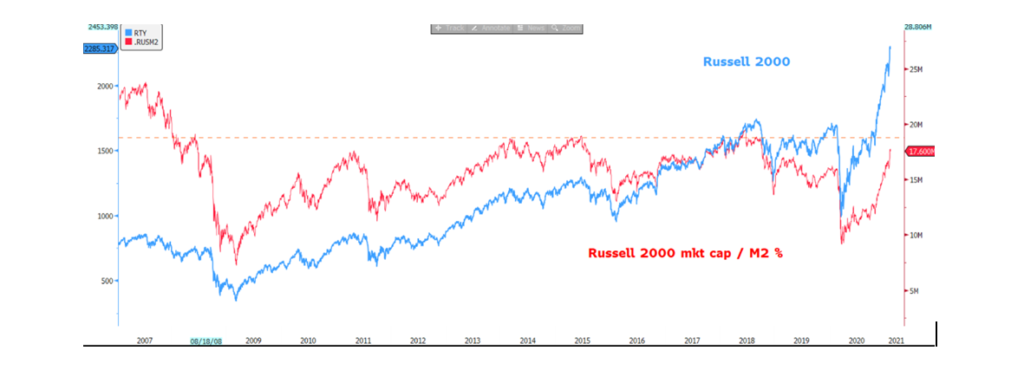

It is no coincidence that the Russell 2000 index has achieved almost double performance since the beginning of the year compared to the Nasdaq (+ 16% vs + 9%).

Pending the arrival of liquidity, the capitalization of the US indices vs the M2 monetary aggregate has moved towards historically very high levels.

The impatience for the concrete arrival of liquidity has therefore become high. Next week the US Senate will be busy voting on Trump's impeachment while on the commodity front we will begin to assess what Arabia's attitude will be ahead of the OPec + meeting on March 4. Arabia has agreed to take on a huge cut in production in the face of an increase especially in Russia, probably in the face of a geopolitical exchange that may have followed the following pattern: Arabia cuts production, therefore argues the price of crude oil and therefore US shale oil, the US thanks by offering the NATO umbrella to Arabia.

We are therefore entering a very short phase of transition waiting for the Biden plan to be approved and for the reassurance that OPEC + continues to tame oil prices, thanks also to the positive expectation of recovery conveyed by the vaccination campaign. Added to this is the potential growing attention to the fearful greater spread of Covid variants, which has already led Germany to extend the confinement until 7 March.

All factors that could trigger possible short-term profit taking.

However, the underlying climate remains positive, in view of the double support for fiscal policies (US in primis) and monetary policies referred to above, so the attitude of taking advantage of transfers to accumulate on the stock markets continues to be valid. The greater preference for US assets (also in view of the second US infrastructure plan) could tend to favor an average appreciation of the dollar up to 1.18 / 1.19 by the end of March and 1.16 by the end of June. The debt increase theme could be taken into consideration at a later time, once the post Covid euphoria that could affect the second quarter has been eliminated. Therefore, the temporary depreciation phases towards the 1.22 / 1.23 area are still to be considered dollar buying opportunities, at least until March / June.

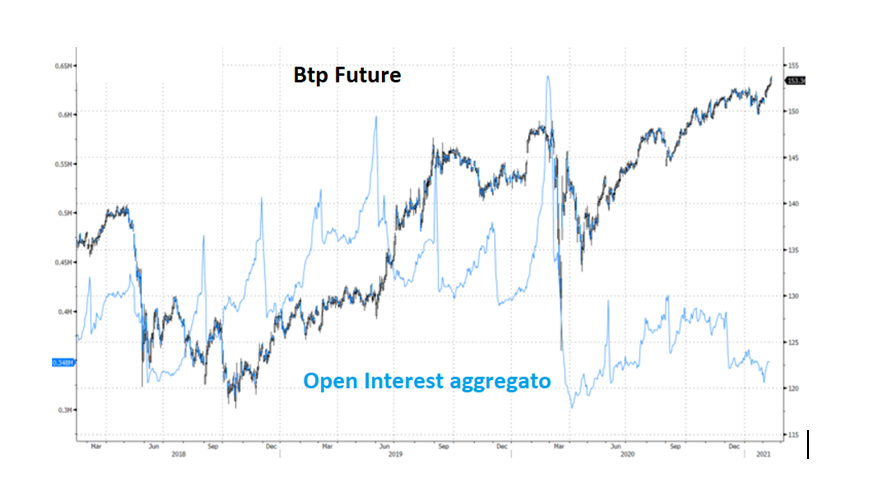

Finally, a focus on BTPs, awaiting the arrival of the Draghi government. The movement that emerged up to the spread tightening agios / BTP rate drop appears to be part of the movement that could then continue by March / April, i.e. until a new version of the recovery plan is presented with the attached timing of the reform plans which could implemented by the rating agencies that will express their opinion between the end of April and the beginning of June. Furthermore, part of the liquidity that Italian banks could withdraw in view of the next Tltro operation in mid-March could flow into BTP, also in light of the more optimistic outlook fueled by the arrival of Draghi. In addition, in technical terms, the BTP future has a historically very low level of aggregate open interest, thus leaving room for a broader directional stance by operators, probably in terms of bullish prices.

In this context, it is possible to hypothesize the substantial zeroing of the spread vs Spain by March / April, which is currently in the 30 bp area, with the Italy / Germany spread targeting the 60/70 bp area.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/che-cosa-succedera-a-petrolio-e-btp/ on Sun, 14 Feb 2021 05:46:24 +0000.