What will happen to the American economy

No-landing is increasingly likely for the US market. Analysis by Andrea Delitala, Head of Investment Advisory, and Marco Piersimoni, Senior Investment Manager of Pictet Asset Management

This first quarter of the year saw higher-than-expected inflation , but also stronger economic growth in the United States. This led the Federal Reserve to change its growth estimates for the current year from the +1.4% it estimated in December 2023 to +2.1% (with a consensus expectation of up to 2.2 %). What is new in this scenario is that today, rather than a soft-landing, there could be a no-landing: that is, inflation that falls more slowly than expected accompanied by resilient economic growth, and which stands above the potential (approximately 1.8% for the USA). The data shows how the disinflationary process in America has lost its linearity, with a "last mile" (actually % point: from 3% to 2%) which is proving to be more tortuous than expected.

The most accepted theory is that the post-pandemic inflationary flare-up of 2022-23 is linked to supply dynamics, or the "supply side". Moreover, the president of the Fed, Jerome Powell, also validated this reading: his monetary policy acted to slow down demand, in order to give supply time to normalize, thanks to the restoration of normal conditions on supply chains . A different approach from that of a central bank intent on curbing demand-driven inflation, characteristic of traditional cycles.

Since the beginning of the year, however, inflation has ceased to have a clear downward path. In America, at the moment, we mainly see service inflation. And it is a fact that originates from the dynamism of the labor market and the relationship between supply and demand of workers. In the USA, in fact, there has been a peak of two jobs available for every unemployed person (Vacancies/Unemployment), while today this ratio has fallen to 1.35 thanks also to a greater influx of workforce partly due to new immigrants (equal to 3.3 million more people last year). One figure (the V/U), however, is not yet low enough, since in ideal conditions it should drop to around one.

Although the process of rebalancing the "job market" is still incomplete, at the moment, the upward adjustment of wages is compatible with other economic quantities. In fact, by comparing the growth of wages (latest trend data 4.1%, for 6 months it has been around 4%), net of inflation which on goods is around 3%, we note a growth in real wages of around at 1%. This would be a problem for companies if labor productivity grew at a slower rate, but this is increasing at 2.6%, a pace well above the increase in real wages. An aspect, the latter, in clear divergence with the European situation where real wages grow at around 2% and productivity at around 1%. This means that, to restore purchasing power to disadvantaged employees during Covid, without fueling the price-wage spiral, a sacrifice of profit margins is necessary – something to which the ECB openly relies. This at least partially justifies the valuation differential between American and European shares.

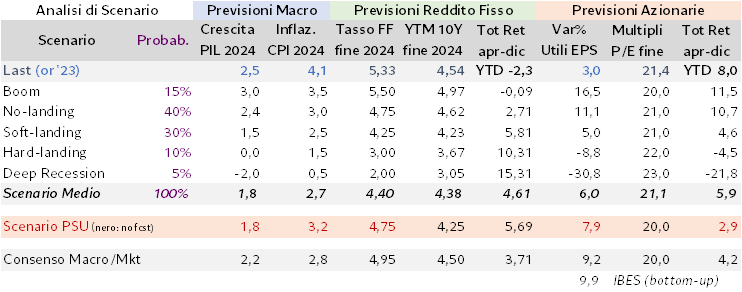

In light of the above, we have developed a series of possible scenarios based on consensus estimates. The most probable ones appear to be 50% that of a no-landing, with macro forecasts pointing to a growth of 2.4% and a CPI inflation of 3%, and that of a soft-landing at 30%, with growth of GDP at 1.5% and CPI inflation at 2.5%. The analysts of our research center converge on an intermediate scenario which sees growth of 1.8% and inflation which should remain higher at 3.2%, above all due to the prices of services which are compressing at a lower than expectations.

The Fed plans two or three rate cuts by the end of the year

The Federal Reserve reiterated that growth was stronger and estimated core PCE inflation rose a couple of decimals to 2.6%. Furthermore, there was an upward revision of one decimal point in the expected long-term interest rate, from 2.5 to 2.6%. At the moment, regarding short-term expectations, the market is in line with the Fed's forecast of three cuts during 2024. Regardless of the doubts within the Fed board, Powell remains convinced that in a market of this type, with tensions on supply, it is necessary to make at least three cuts. The market, in the meantime, has undergone a correction and now expects rates in the United States of 4.47% in 1 year (they are now at 5.5%) and 3.84% in two years. While, as regards the European Central Bank, a drop in the deposit rate is expected to 2.85% in one year and to 2.35% in two years.

Powell is determined to cut because he is convinced that he has been sufficiently restrictive in his monetary policy and that remaining firm on rates until June will allow him to slow down the economy in the right way. Moreover, monetary policy fully unfolds its effects in a period of time between 12 and 18 months, and perhaps this interval (the so-called "lag") has been further lengthened considering that we are coming from a period in which fiscal policy of governments has protected from the effects of the tightening of rates, although this shield has now run out. The intention, therefore, is to proceed with the first two or three cuts and then possibly take a break. The latest inflation data argues in favor of greater circumspection, therefore, in the absence of a weakening of the data in May, a postponement of the first reduction to July and two cuts in total in '24 is likely.

Looking at the long part of the estimates on real rates, both in Europe and America they are above neutrality (i.e. when monetary policy is neither restrictive nor expansionary). At the moment, there is an ongoing debate within central banks on what balances should be maintained in the long term, i.e. the natural rate to be reached once the cyclical events of the economy have concluded. In this sense, the Williams model estimates state that for the Fed the natural rate should stand at 0.73% over 5 years. The market, also in light of the ongoing debate, is positioned slightly higher, at 1.13%, thus creating a sort of guarantee margin. A final important aspect of the Fed's monetary policy concerns quantitative tightening, i.e. the withdrawal of liquidity through the non-renewal of maturing government bonds. The Fed has recently signaled its intention to slow down the pace of this quantitative tightening as the compensatory phenomenon represented by the Reverse Repos of the MM Funds approaches the end (which would cease once the stock, which today amounts to around $400 billion, is exhausted, from over $2trn in mid-2022 – as highlighted by us in the January Outlook). Therefore, we expect the US central bank to slow the pace of decreasing Treasuries on its balance sheet from 60 to 30 billion per month starting in May.

No bubble on IT stocks, eyes on short-term European bonds

For this year it seems that the stock market cannot run much further than it has already done so far. Economists at the Pictet research center, in fact, see a total return between April and December of 5-10% (compared to 8% from the beginning of the year). Similarly, on the bond front, the yield on 10-year US Treasuries should stand at 4.25% with an estimated total return from April to the end of the year of over 5%. Therefore, the exceptional situation of 2022 should not recur, when the decorrelation between stock and bond returns disappeared, resulting in a particularly negative result, even in the context of a 70-30% multi-asset strategy.

On the European bond front, we currently find the short end of the curve more interesting given that interest rate cuts by the European Central Bank are, if not certain, at least very likely.

On the equity side, there has been a recovery in earnings and there has been a big surprise after the war, where European stocks are not underperforming US stocks. Then observing the price/earnings ratio, in the last 10 years there has been a significant increase in the valuations of US shares (+24%) and, on the contrary, a decrease in those of emerging countries (Hong Kong recorded a -25% ). In particular, at a relative price/earnings level compared to the US index, China saw a de-rating of 70%, in line with the earnings trend which in turn underperformed by 70%. Extending the same analysis to individual stock sectors, over the last ten years we can see a major re-rating of the IT sector (+50% of the price-earnings ratio) and a de-rating of the energy sector (-27%). The revaluation of technology companies has been supported by earnings outperformance; a circumstance which excludes an ongoing bubble in the sector or, in any case, an excess of euphoria.

Since the end of the pandemic, the correlation between earnings growth and macroeconomic growth has been lost. Hence the idea of thinking in terms of subsector, i.e. selecting the securities on which to bet wisely. We analyzed the most highly capitalized companies on the Nasdaq, selecting those that can aspire to higher earnings growth than the index itself, without running into credit risks if real rates were to rise in such a way as to damage highly indebted companies. Another possible investment idea concerns the pharmaceutical sector and, in particular, the so-called magnificent two: Eli Lilly and Novo Nordisk. The sector has had complex histories, but these two companies are posting earnings growth that is much higher than the sector. Furthermore, there has been a recent strong appreciation in Japanese equities, mainly attributable to corporate governance reform accompanied by a weakening of the yen which contributed significantly. Still in Asia, South Korea could potentially replicate what Japan has done. The Korean government, in fact, is thinking of a package to revive its stock market which includes the reduction of inheritance taxes and tax incentives for the distribution of dividends. In fact, historically 40% of companies on the Korean list trade at a discount compared to book value; this depends on the Korean corporate structure that is built around large family-controlled companies that have no interest in protecting the interests of minorities. The government, in particular, would aim to build an index in which to include only companies that trade at a 40% discount on the price to book, thus forcing pension funds to invest only in these companies. In this regard, however, the outcome of the elections makes the implementation of these reforms less likely in the near future.

Work and tax policies at the center of the US elections

Finally, the approach of the US elections in November 2024 could also impact macroeconomic dynamics. Among the issues to be considered electorally sensitive is the labor market. In fact, the strong influx of foreign labor has helped fill the gap between labor supply and demand, alleviating wage tensions and supporting the economy. The fact is that, although the number of employed people has increased compared to before the pandemic, the workforce of immigrant citizens is increasing more rapidly than that of resident workers. According to some findings by Goldman Sachs, in fact, the number of visas denied is increasing to put a brake on entries. President Joe Biden himself, moreover, realizes how much this issue can weigh on the electoral challenge with Donald Trump.

In general, whoever wins will have to take into consideration the sustainability of American accounts. The Congressional Budget Office, in fact, recently published its annual report on the dynamics of long-term American fiscal quantities, drawn up in light of current legislation but which may not materialize if a President other than Biden is elected. Despite this, American debt is expected to reach 166% of GDP by 2054. If, in fact, the real interest rate were to increase as indicated by long-term forecasts, interest spending would also increase significantly and the current levels of deficits would not be sustainable.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/economia-mercato-usa-no-landing/ on Sun, 28 Apr 2024 06:07:02 +0000.