What will happen to the banks in Intesa Sanpaolo, Unicredit, Banco Bpm and more

Accounts, analyzes and scenarios on Intesa Sanpaolo, Unicredit, Banco Bpm, Mps and more

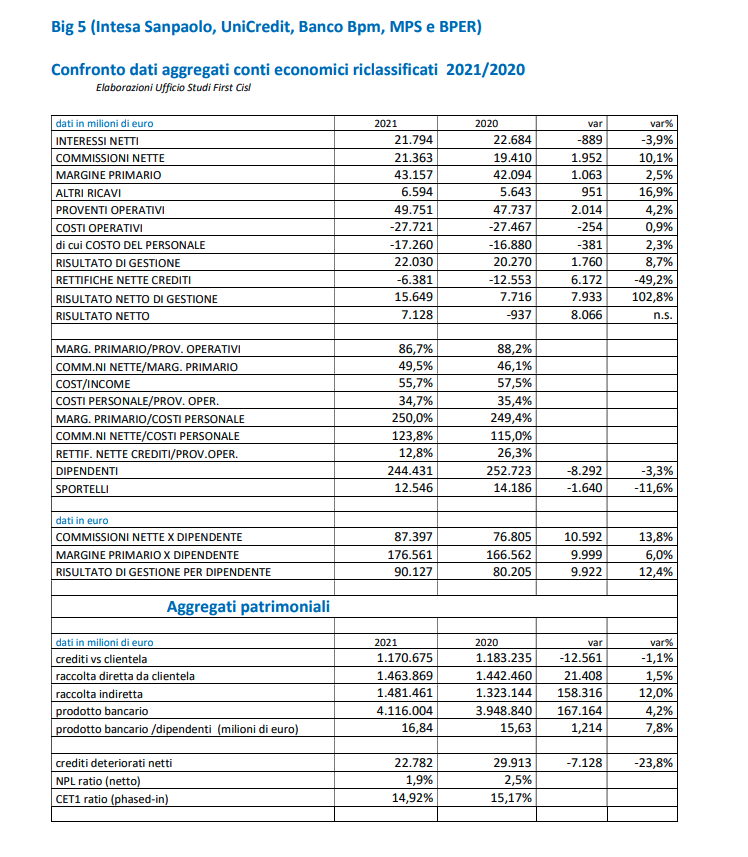

Collections and operating income continue to grow and impaired loans as well as costs, branches and employees continue to decrease, but they are increasingly productive. This is the summary of the analysis carried out by the First Cisl research office on the results of the 2021 financial year of the top five Italian banking groups (Intesa Sanpaolo, Unicredit, Banco Bpm, Mps and Bper). According to the general secretary of the union, Riccardo Colombani, “such a strong increase in productivity makes it necessary to address the issue of redistribution to workers: their contribution was decisive despite the criticalities caused by the sharp contraction of the branch network”. Colombani also offers its recipe for the banking business which must aim for a model "that does not sacrifice the relationship with the territories, includes savers with fewer digital skills and avoids the obsessive search for economic results".

Looking beyond the border, then, the ECB promotes European credit institutions which, despite the two years of pandemic, are showing growth in capital and liquidity and a decline in NPLs. However, the Eurotower invites EU banks to pay attention to possible shocks on the markets, climate and cyber risks and weakness of governance.

MORE REVENUES, LESS NPLs

From the analysis of the research office it emerges that – in comparison with the 2020 financial year – in 2021 operating income increased – which touched 50 billion – by 4.2% thanks to the growth in net commissions (+ 10.1%) and the net operating income (+ 102.8%), which exceeds 15 billion. A plus sign also for direct deposits from customers (+ 1.5%) to almost 1,464 billion and for indirect deposits (+ 12%) to 4116 billion.

The economic situation of credit institutions also improves thanks to the confirmation of the decreasing trend of NPLs which in one year fell by 23.8% to 22.7 billion compared to 29.9 billion in the previous year. The Npl ratio, i.e. the incidence of net impaired income on loans, falls to 1.9% from 2.5% and adjustments to loans halve (-49.2%) which – in relation to operating income – they decrease from 26.3% to 12.8%.

EMPLOYEES: LESS COSTS, MORE PRODUCTIVITY

Compared to 2020, the decline in the number of employees and branches continues and – at the same time – the increase in company productivity. Suffice it to mention a few numbers: if in fact the branches go from 14,186 to 12,546 (-11.6%) and workers from 252,723 to 244,431 (-3.3%) net commissions per employee grow by 13.8%, the primary margin for employee by 6% and the operating result per employee by 12.4%. A negative sign also for the cost / income ratio, or the cost / income ratio, of 1.8% and for the ratio between personnel costs and operating income, of 0.7%. And if the banking product rises by 4.2%, compared to employees it increases even more, by 7.8%.

FOR THE ECB BANKS STRONGER DESPITE THE PANDEMIC

In the meantime, the European Central Bank presented the prudential review and evaluation process for 2021 which shows a rather comforting picture. In particular – as Il Sole 24 Ore points out – to reassure the Eurotower, despite the period marred by the pandemic, the decrease in bad loans with the Npl ratio dropped to an absolute minimum of 2.2%, the improvement of the ratios on capital with CET1 rose to 15.5% and liquidity increased to 173.3%.

Of course, some indications to follow have arrived anyway. For example, the ECB said "that credit risk control systems need to be improved, especially for loans with very high leverage that are increasing". In this sense, "the 'latent' credit risk on unlikely to pay loans hidden under public aid must be brought to light as soon as possible". Frankfurt then asks to pay attention to new pitfalls such as cyber attacks. Furthermore, both the increase in interest rates – which can give rise to sudden shocks – and the climate risk must be kept in mind: for the stress test on the environment and climate, the request for quantitative requirements will also come in the future. Finally, governance must be improved, which still has too many deficiencies, and structural gaps must be filled because profitability remains low and ROE – even though it has risen – remains below the cost of equity.

However, he is satisfied "with how the banks have operated so far during the pandemic" Andrea Enria, chairman of the Supervisory Board. Lenders, he said, "have contributed to the resilience of the euro area economy by continuing to lend to households and businesses." According to Enria, "the peak of NPls is behind us" and with the continuation of the reduction in bad debts, "better than expected" has been done in cleaning the balance sheets of banks.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/cosa-succedera-alle-banche-a-intesa-sanpaolo-unicredit-banco-bpm-e-non-solo/ on Sun, 27 Feb 2022 12:33:36 +0000.